The Strategic Use of Social Media Marketing in Enhancing Brand Engagement an Consumer Loyalty: A Case Study of Nike

1 Introduction

1.1 Background and context

Social media has transformed the way brands communicate, build relationships and transact with consumers. Over the last decade, platforms such as Instagram, TikTok, YouTube and X (formerly Twitter) have evolved from channels for casual interpersonal interaction into complex ecosystems that support discovery, entertainment, influence, and commerce. For global consumer brands, social media is now a strategic asset used for brand storytelling, community building, product launches, influencer partnerships, customer service, and increasingly direct sales (social commerce). The rapid ascent of social commerce and the growth of creator-driven consumption behaviors mean that marketing strategies must simultaneously engage emotionally and support measurable commercial outcomes. Recent market estimates indicate social commerce continues to expand rapidly, becoming a dominant channel for product discovery and incremental sales, particularly among younger cohorts.

Nike Inc. operates in a particularly competitive and culturally consequential segment: athletic apparel and footwear. Since its founding, Nike’s brand has been shaped not only by product innovation and athlete endorsements but also by cultural storytelling and symbolic positioning. Nike’s “Just Do It” heritage and its long-term relationships with athletes (from Michael Jordan to Serena Williams and LeBron James) created a cultural resonance that marketing activities over decades have amplified. In the social media era, this cultural capital gives Nike an unusually strong starting position: millions of followers across platforms, a history of high-profile, polarizing and attention-grabbing campaigns, and the capacity to mobilize both influencers and professional athletes in multi-channel activations. Notable social-first or social-amplified campaigns, such as Dream Crazy and You Can’t Stop Us are taught as modern exemplars of purpose-driven branding and viral creative content.

Despite creative success and high engagement metrics, a central puzzle has emerged for many large brands, including Nike: large-scale social media engagement does not always translate, linearly or immediately, into sustainable digital revenue growth. Nike’s recent fiscal disclosures and industry commentary have illustrated this tension, where measurable spikes in impressions, mentions and sentiment do not automatically correspond with sustained digital sales increases or improvements in quarterly direct-to-consumer (DTC) metrics. Several operational, marketplace, and customer-intent factors can explain this gap. This study positions Nike as a revealing single-case example to explore the strategic role of social media marketing (SMM) in generating brand engagement and fostering loyalty, while interrogating the operational and measurement challenges that constrain the conversion to commerce.

1.2 Problem statement

The broad problem this study addresses is the disconnect between social media-driven engagement and measurable gains in consumer loyalty and digital revenue for major consumer brands. For Nike specifically, the research problem can be framed as: How does Nike’s strategic use of social media marketing influence brand engagement and consumer loyalty, and what barriers prevent social engagement from reliably translating into direct digital revenue and sustained consumer loyalty? This problem is of both theoretical and practical importance. Theoretically, it prompts refinement of engagement-loyalty-conversion models in a social media context; practically, it has direct implications for how firms should allocate marketing budgets, design campaign architectures, and integrate social channels with commerce and supply chain systems.

1.3 Purpose of the study

The primary purpose of this case study is twofold:

- Descriptive and evaluative: to document and analyze Nike’s social media strategies, flagship campaigns, and platform-specific practices; and to evaluate their effectiveness in building engagement, shaping sentiment and driving loyalty among target segments.

- Explanatory and prescriptive: to identify the mechanisms through which social media contributes to (or fails to produce) measurable loyalty and commercial outcomes, and to recommend strategies for improving social-to-commerce conversion and long-term loyalty building.

By focusing on Nike , a brand with significant cultural influence and sophisticated agency support, this study aims to produce transferable insights for other large consumer brands seeking to optimize social media investments.

1.4 Scope and delimitations

This single-case study uses a mixed-methods approach that triangulates public quantitative data (social metrics, follower counts, campaign reach from third-party aggregators) with qualitative content analysis (campaign texts/videos, sampled comments) and secondary analysis of corporate reports and industry coverage. The temporal focus emphasizes the period from 2018 to 2025 because it covers major recent campaigns (Dream Crazy in 2018 and You Can’t Stop Us in 2020), the explosive growth period of TikTok (2019–2022), and Nike’s recent fiscal cycles where DTC/digital performance received investor scrutiny. The study deliberately focuses on public and third-party data; direct proprietary metrics from Nike (internal ad spend breakdowns, click-to-conversion attribution models, CRM-level churn data) are not accessible and thus represent a limitation. Where internal data would offer causal clarity, this study triangulates multiple public, academic and industry datasets to build plausible inferences.

1.5 Conceptual framework: Overview

This study adopts a conceptual framework that positions social media marketing activities (SMMAs) as inputs that affect consumer engagement (behavioral and emotional), which in turn influence brand loyalty (attitudinal and behavioral). The conversion from loyalty to commercial outcomes (e.g., digital sales, repeat purchases) is modeled as conditional on operational readiness (commerce integration, inventory, pricing), contextual market factors (marketplace competition, discounting), and measurement fidelity (ability to attribute lift to SMMAs). The framework emphasizes mediation and moderation: engagement mediates the effect of SMMAs on loyalty; operational readiness and market context moderate the strength of the loyalty → revenue link.

A simplified depiction:

This framework informs research design, helping identify what to measure (engagement metrics, sentiment, DTC/digital revenue, inventory/marketplace signals) and where to probe for causal mechanisms (campaign-to-product availability alignment, ad-to-cart friction).

1.6 Definitions and key terms

- Social Media Marketing Activities (SMMAs): The set of marketing actions a firm performs on social platforms, including content creation, influencer partnerships, paid social advertising, community management, and shoppable posts.

- Consumer Engagement: Multidimensional construct including behavioral engagement (likes, comments, shares, time spent), cognitive engagement (attention, message processing) and emotional engagement (attachment, pride). Distinctions between active and passive engagement are important for interpreting impact.

- Brand Loyalty: Both attitudinal (preference, advocacy) and behavioral (repeat purchases, share of wallet). In social contexts, loyalty includes willingness to co-create/promote and defend the brand.

- Social Commerce: The process of discovering and purchasing products directly or indirectly via social platforms, including platform-native checkout and affiliate/creator-driven referral commercial.

- Operational Readiness: Organizational capabilities that allow social engagements to convert into purchases: shoppable experiences, inventory availability, localized landing pages, checkout UX, and alignment with pricing/discounting strategies.

2. LITERATURE REVIEW

2.1 The architecture of social media marketing activities (SMMAs)

Scholars conceptualize SMMAs as a set of activities that range from content creation to community management and paid amplification. Early frameworks emphasized the promotional role of social platforms as extensions of advertising; newer frameworks treat social platforms as multi-functional ecosystems supporting discovery, social proof, co-creation and commerce (platform affordances perspective). Platform affordances features such as algorithmic feeds, short-form video, live streaming and in-app checkout, shape both marketer strategy and consumer response. For example, Instagram’s visual focus privileges aspirational imagery and product aesthetics; TikTok’s algorithm and short-form video favor trend-driven creative and viral challenges; YouTube is well-suited for long-form storytelling and documentary-style content; X emphasizes real-time conversation and newsworthiness. Effective SMMAs adapt messaging to platform affordances and leverage cross-platform synergies.

Recent empirical work highlights the importance of content-type diversification: while brand-led long-form storytelling builds depth of meaning and identity, short-form, highly shareable creative drives reach and rapid engagement spikes. Firms that succeed with social media typically operate dual creative tracks: brand-building narratives for identity and trust, and agile, product-focused activations for conversion. Platform-specific features such as shoppable tags (Instagram), in-app storefronts (TikTok Shop), and creator affiliate programs materially change how marketing value is captured. Industry reports underline the growth of social commerce market sizes and the operational implications for retailers and brands.

Research gaps and points for Nike case:

- How do Nike’s SMMAs distribute influence across global markets with different platform mixes (e.g., Weibo/WeChat in China vs. TikTok/Instagram in the West)? Few academic studies thoroughly map multinational platform strategies for a single global brand.

- There is limited longitudinal research tying specific platform affordances (e.g., algorithmic amplification on TikTok) to firm-level KPIs over multi-year periods.

2.2 Consumer engagement in social media: constructs, antecedents and outcomes

Consumer engagement on social media has multiple dimensions: cognitive, emotional and behavioral. The literature distinguishes between active engagement (comments, shares, generating UGC) and passive engagement (views, impressions). Active engagement tends to relate more strongly to attitudinal outcomes (attachment, loyalty), while passive engagement contributes to awareness and reach. Engagement is driven by content relevance (utility), emotional appeal, entertainment value, social identity and perceived authenticity. Two-way interaction and community management (brands responding to comments, highlighting UGC) further deepen engagement by creating reciprocal social bonds.

Meta-analytic and review studies show a robust association between social media engagement and positive brand outcomes (e.g., brand equity, brand advocacy), but the literature is careful to note nonlinearity: incremental increases in engagement yield diminishing marginal returns on sales unless accompanied by conversion mechanisms. Furthermore, research highlights the mediating role of psychological ownership and identification: when users co-create content or participate in brand narratives, they are more likely to recommend and repurchase.

Measurement nuance

Academic work emphasizes that raw engagement counts are an imperfect signal: metrics should be normalized (engagement rate per impression), segmented (by sentiment and user type), and interpreted in context (organic vs. paid, influencer vs. brand post). High-volume engagement from non-target audiences or bot-driven amplification offers limited commercial value. Studies recommend combining qualitative sentiment analysis with quantitative engagement KPIs to assess true brand impact.

2.3 Influencer marketing, celebrity endorsement and athlete partnerships

The influencer economy has matured rapidly, and scholarly work has moved from exploratory descriptive studies to meta-analyses and large-scale causal inference projects. Influencer credibility, match-up (fit between influencer and brand), authenticity, and disclosure/transparency are major determinants of campaign effectiveness. A recent meta-analysis across hundreds of studies shows influencer marketing has a significant average positive effect on consumer attitudes and behavior, but with large heterogeneity depending on the influencer type (nano, micro, mega), product category, and cultural fit. Athlete endorsements — a specialized form of celebrity/influencer marketing — have unique characteristics: athletes confer performance credibility and aspirational identification, but the reputational risk (political stances, off-field behavior) can be higher. Nike’s longstanding athlete relationships combine performance authenticity with aspirational storytelling, making athlete partnerships a central component of its social strategies.

The literature also distinguishes paid influencer content from earned or co-created UGC. Micro-influencers often have more credibility and higher engagement rates relative to their follower counts, but mega-influencers and athletes drive scale. Effective campaigns often mix both: core celebrity/athlete anchors for scale and legitimacy, plus micro-influencer networks to create authentic peer-level endorsement and long-tail conversion.

Research gaps and points for Nike case:

- How do high-profile athlete-led campaigns (which may be purpose-driven or polarizing) differ in long-term loyalty effects from product-focused micro-influencer activations? Nike’s Dream Crazy offers a chance to examine these dynamics empirically.

- More causal studies are needed to separate short-term paid influencer-driven sales lifts from longer-term brand-building benefits.

2.4 Social commerce and the mechanics of conversion

Social commerce — commerce driven by social platforms — is an expanding field of study bridging marketing, information systems and retailing. Key mechanisms for conversion include platform-native checkout, shoppable posts/stickers, affiliate links, and creator-driven storefronts. Several industry analyses document rapid growth in global social commerce sales, notably among younger demographics; creators and affiliate programs now drive meaningful proportions of high-season e-commerce (e.g., Cyber Monday) sales. However, academic work emphasizes that social commerce success depends on integration across the marketing funnel: discovery (social content), consideration (reviews, UGC), and checkout (mobile checkout experience, payment options). Friction at any of these nodes reduces conversion rates.

Researchers also study purchase intent vs. actual purchase. Social exposure often raises intent or consideration but converts at lower rates than direct search or paid search channels. Conversion is improved when social signals are accompanied by frictionless UX (one-click purchases), localized inventory knowledge (showing only available variants in-region), and targeted promotions that convert interest into immediate action. The presence of third-party marketplace discounting can erode the economic return of social-driven demand if consumers instead find lower prices elsewhere.

Research gaps and points for Nike case:

- Academic studies rarely access retailer-level inventory/attribution data needed to model how social demand hits the supply side. For Nike, understanding product-drop mechanics, app-first exclusives, and inventory signaling is crucial.

- There is a need for more RCT-style studies (geo or time-based) examining incremental lift from social campaigns in large national markets.

2.5 Measurement and attribution challenges in social media marketing

One of the most persistent themes in both academic and practitioner literature is difficulty measuring and attributing the causal impact of social media activity on sales. Problems include cross-channel spillover (social exposure increases branded search), time-lagged effects (brand campaigns affect long-term preference), and the prevalence of multi-touch journeys. Attribution models (first-click, last-click) are widely critiqued; advanced approaches such as multi-touch attribution, media mix modeling, and experimental lift testing (e.g., geo holdouts, randomized ad exposure) are advocated as superior but are operationally complex. Econometric media mix models can estimate channel-level contribution but require large-scale data and careful controls; randomized lift tests provide clean causal estimates but can be expensive and politically fraught for national campaigns.

Sentiment analysis and natural language processing (NLP) enable richer measurement of the qualitative aspects of engagement, but automated sentiment models still struggle with sarcasm, mixed sentiment and cultural nuance. Combining manual coding with automated methods is a common compromise. Importantly, measurement fidelity requires linking social exposure to customer identifiers (e.g., email, app user ID) — a capability often available only to firms with strong CRM integration.

Research gaps and points for Nike case:

- How does Nike practically implement measurement across organic social, paid social, app behavior and DTC conversions? Public disclosures provide limited visibility, necessitating triangulation across investor reports and third-party analytics.

- There is an opportunity to illustrate (in the case study) how modern measurement strategies (lift tests, econometric controls, conversion attribution) could be used to estimate incremental revenue from specific Nike campaigns.

2.6 Brand purpose, political positioning and the risks of polarization

Nike’s high-profile purpose-driven campaigns notably the Dream Crazy campaign featuring Colin Kaepernick , illustrate the double-edged nature of mixing brand purpose and social messaging. Literature on corporate social advocacy and cause marketing suggests such campaigns can strengthen identification among sympathetic audiences, enhance perceived authenticity, and create durable brand differentiation. However, these benefits come with risks: polarization among audiences can lead to short-term boycotts, negative earned media among some segments, and pressure on distribution partners. The net effect often depends on brand fit (how naturally the cause aligns with brand identity), the depth of stakeholder commitment, and whether the firm’s operations and supply chain actions align with stated values. When brand purpose is perceived as tokenistic or opportunistic, negative backlash can reduce long-term trust.

Research gaps and points for Nike case:

- Empirically separating short-term reputation spikes from durable loyalty gains following purpose-driven campaigns remains challenging. Nike provides a useful test case because of its high visibility and available public commentary and analyst reports.

2.7 Integrated Insight: Synthesizing Themes into Hypotheses for the Case

The preceding literature review has examined the multifaceted role of social media marketing in shaping brand engagement, consumer loyalty, and business performance. By engaging with scholarly findings across consumer psychology, digital engagement, influencer marketing, purpose-driven branding, and platform-differentiated strategies, several recurring insights emerge. This section synthesizes these insights into a coherent framework that directly informs the Nike case study. The aim is not only to summarize thematic overlaps but also to translate them into research hypotheses that can guide empirical inquiry within this case.

2.7.1 Recurrent Themes Emerging from the Literature

The review reveals five dominant and interrelated themes:

- Emotional storytelling as a driver of engagement and loyalty: Brands that use narratives rooted in identity, aspiration, and social purpose generate stronger emotional bonds than purely functional communication. Campaigns that engage with cultural movements can significantly influence consumer perception, though they also carry polarization risk.

- The mediating role of customer engagement: Social media interactions—likes, shares, comments, user-generated content—serve as mediators between exposure to brand content and loyalty outcomes. Engagement signals an active relationship with the brand and predicts both attitudinal and behavioral loyalty.

- Influencer and athlete endorsement as amplifiers: Credible endorsers expand reach, transfer meaning, and facilitate identification. However, authenticity is key; endorsements that appear commercially opportunistic can weaken rather than strengthen loyalty.

- Platform-specific strategies as performance levers: Different social media platforms host different consumption behaviors. Successful brands tailor messaging, content length, and interactivity to platform affordances, thereby maximizing engagement effectiveness.

- The engagement–conversion gap: While social engagement is a strong driver of brand equity, it does not automatically lead to revenue or purchase behavior. Bridging this gap requires alignment with e-commerce structures, availability of products, and smooth purchasing journeys.

2.7.2 Conceptual Integration

The literature review surfaced five major themes that consistently recur across studies of social media marketing, brand engagement, and consumer loyalty:

- Emotional Storytelling as a Driver of Engagement and Loyalty: Brands that tell purpose-driven, identity-rich stories on social media (e.g., Nike’s Dream Crazy) achieve deeper emotional connections than brands that communicate only functional product benefits.

- The Mediating Role of Customer Engagement: Social interactions (likes, comments, shares, user-generated content) are the mechanism through which exposure to campaigns translates into brand loyalty. Engagement is not just a metric; it is a process that strengthens the brand–consumer bond.

- Influencer and Athlete Endorsement as Amplifiers: Influencers and athletes extend reach, shape meaning, and validate brand messages. Authenticity is critical: endorsements aligned with the influencer’s real identity boost loyalty, while inauthentic ones risk backlash.

- Platform-Specific Strategies as Performance Levers: Social platforms differ in audience behavior and content expectations. Tailoring creative execution to platform norms (Instagram for aspirational visuals, TikTok for trend-driven shorts, YouTube for long storytelling) enhances impact.

- The Engagement–Conversion Gap: High engagement (buzz, likes, shares) does not guarantee proportional sales or revenue. The pathway from engagement to purchase is moderated by operational factors such as product availability, pricing strategy, seamless e-commerce integration, and marketplace conditions.

2.7.3 Hypotheses Development

Hypothesis 1: Storytelling and Engagement

Purpose-driven and emotionally resonant storytelling in Nike’s social media campaigns is positively associated with higher consumer engagement compared to functionally oriented product campaigns.

- Rationale: Studies highlight that narratives tied to social identity and purpose (e.g., inclusion, empowerment) elicit stronger emotional responses, leading to higher engagement metrics (shares, comments). For Nike, campaigns like Dream Crazy embody this principle.

Hypothesis 2: Engagement as Mediator of Loyalty

Consumer engagement on Nike’s social platforms mediates the relationship between campaign exposure and attitudinal loyalty.

- Rationale: Literature consistently frames engagement as the “active ingredient” that transforms exposure into loyalty. For Nike, high engagement around campaigns (e.g., hashtag participation) should predict attitudinal loyalty (self-identification with the brand, intention to repurchase).

Hypothesis 3: Influencer Endorsement and Authenticity

Endorsements from credible athletes and influencers increase consumer engagement and loyalty, but the effect is moderated by perceived authenticity.

- Rationale: Nike’s historic partnerships (Michael Jordan, Serena Williams, Cristiano Ronaldo, Colin Kaepernick) show powerful loyalty effects when endorsements are aligned with athlete identity. However, partnerships perceived as inauthentic (e.g., opportunistic influencer drops) may dilute impact.

Hypothesis 4: Platform Differentiation

Nike’s effectiveness in generating engagement and loyalty is higher when campaign content is adapted to platform-specific affordances rather than replicated uniformly across channels.

- Rationale: Instagram emphasizes aspirational imagery, TikTok thrives on short-form trends, YouTube supports longer-form storytelling. Tailoring content to platform norms enhances resonance and algorithmic visibility.

Hypothesis 5: Engagement–Conversion Gap

High engagement on Nike’s social campaigns does not directly translate into proportional increases in digital revenue unless moderated by operational alignment (e.g., product availability, pricing strategy, and e-commerce integration).

- Rationale: Literature cautions that the path from engagement to purchase is mediated by operational readiness. Nike’s fiscal reports, showing strong campaign buzz but declining digital sales, exemplify this dynamic.

Hypothesis 6: Dual-campaign Architecture

Nike’s simultaneous use of broad brand-building campaigns and tactical conversion campaigns yields stronger overall outcomes (brand equity and sales) than reliance on a single campaign type.

- Rationale: Engagement-focused campaigns foster long-term loyalty, while tactical campaigns provide immediate sales activation. The interaction of both produces a balanced marketing portfolio.

Hypothesis 7: Social Media as Cultural Capital

Nike’s social media presence contributes to consumer loyalty indirectly by reinforcing Nike’s status as cultural capital—a brand that symbolizes lifestyle and identity beyond product function.

- Rationale: Literature on symbolic consumption suggests consumers buy into meanings, not just goods. Social media is Nike’s arena for curating symbolic meanings of empowerment, inclusivity, and aspiration.

2.8 Methodological lessons from the literature

The review of literature on social media marketing, brand engagement, and consumer loyalty highlights several methodological approaches and recurring patterns. Synthesizing these lessons provides clarity on the most suitable methodological strategies for investigating Nike’s social media practices.

2.8.1 Predominance of Quantitative Surveys

Many studies on social media marketing effectiveness rely heavily on surveys and questionnaires distributed to consumers. These methods provide large-scale insights into attitudes, perceived engagement, and self-reported loyalty.

- Strengths: Scalability, statistical generalizability, ability to capture attitudes across demographic groups.

- Limitations: Reliance on self-reported measures introduces social desirability bias, lacks depth in understanding why consumers behave a certain way.

- Lesson: While surveys are useful, they must be complemented by behavioral data (e.g., social media analytics) to overcome self-reporting limitations.

2.8.2 Underutilization of Longitudinal Designs

Much of the research adopts cross-sectional designs, measuring social media impact at a single point in time.

- Strengths: Quick data collection, convenient, and cost-effective.

- Limitations: Fails to capture changes in engagement over time, such as how short-term campaigns (e.g., Nike’s You Can’t Stop Us) translate into long-term loyalty.

- Lesson: Incorporating longitudinal case analysis of Nike’s campaigns can uncover evolving dynamics of consumer-brand relationships and highlight the sustainability of engagement effects.

2.8.3 Limited Integration of Real-Time Social Media Analytics

Although social media platforms provide rich real-time data (likes, shares, retweets, comments, hashtag trends), many studies depend on secondary data or overlook granular metrics.

- Strengths: Traditional approaches capture broader trends.

- Limitations: Neglects behavioral evidence of engagement, such as virality, sentiment shifts, and cross-platform interactions.

- Lesson: Methodologies must integrate real-time big data analytics (e.g., sentiment analysis, engagement ratios, follower growth rates) alongside traditional consumer surveys.

2.8.4 Insufficient Use of Mixed-Methods Approaches

Existing research often leans toward either qualitative case studies (narratives of campaigns) or quantitative consumer surveys. Rarely do studies combine methods to triangulate findings.

- Strengths: Qualitative studies capture depth and context; quantitative studies capture breadth and generalizability.

- Limitations: A siloed approach either lacks nuance or lacks statistical rigor.

- Lesson: For a Nike case study, a mixed-methods design (qualitative campaign analysis + quantitative engagement metrics + consumer survey) ensures both contextual richness and empirical robustness.

2.8.5 The Challenge of Attribution and Causality

A recurring methodological challenge is isolating the causal impact of social media campaigns on brand loyalty and sales.

- Problem: Sales or loyalty shifts may result from multiple simultaneous factors (e.g., offline advertising, product launches, economic conditions).

- Lesson: Researchers must apply triangulation (comparing sales data, campaign analytics, and consumer surveys) to strengthen attribution claims. Experimental methods (e.g., A/B testing of social ads) are useful but underutilized in academic literature.

2.8.6 Ethical and Privacy Considerations

Social media research increasingly faces scrutiny regarding data privacy and ethical consent. Some studies fail to address how consumer data is obtained and anonymized.

A robust methodological framework must align with ethical standards, ensuring transparency in data collection, anonymization, and consent when analyzing consumer interactions with Nike’s campaigns.

3. Research Question & Objectives

The development of research questions and objectives is a critical stage in any doctoral-level investigation, as these elements provide the scaffolding upon which the entire study is constructed. The literature review established five conceptual themes that frame the study of Nike’s use of social media marketing: (1) storytelling as a mechanism of brand narrative, (2) customer engagement as a mediating construct, (3) influencer and athlete endorsements, (4) platform-specific strategies, and (5) the engagement–conversion gap as a moderating factor. Together, these themes suggest that while Nike has excelled in creating online engagement, the relationship between social media activity, consumer loyalty, and long-term financial outcomes remains only partially understood.

To bridge these gaps, this chapter formulates the research questions and objectives that will guide the empirical exploration of Nike’s social media marketing strategy. The research questions are designed to capture both descriptive insights (what Nike is doing), analytical insights (how and why these strategies work), and evaluative insights (to what extent these efforts lead to measurable loyalty and revenue outcomes). The objectives operationalize these questions into actionable pathways that will inform the methodological design of the study.

3.1 How does Nike employ storytelling in its social media campaigns to build emotional resonance and brand identity among consumers?

2018 – DREAM CRAZY

Storytelling has long been central to Nike’s marketing philosophy, but social media has intensified its significance by creating platforms where stories circulate at unprecedented speed and scale. In classical advertising studies, storytelling is theorized as a means of narrative transportation: consumers are drawn into a story world, identify with its characters, and subsequently align their beliefs and attitudes with the brand telling the story. In Nike’s case, the Dream Crazy campaign of 2018 is a definitive illustration of storytelling as brand strategy. Narrated by Colin Kaepernick, the ad invited consumers to “Believe in something. Even if it means sacrificing everything.” These words encapsulated a story not simply of athletic performance but of political courage and moral conviction.

The narrative was risky, given Kaepernick’s association with protests against racial injustice and police brutality in the United States. Yet the gamble paid off in terms of engagement and resonance. Within the first week of its release, Dream Crazy generated over 2.7 million mentions of Nike on social media, creating an immense volume of online conversation. Analysts estimated the campaign delivered US$43 million in earned media exposure, as newspapers, television stations, and online outlets discussed Nike’s bold stance. On YouTube, the ad reached 21 million views in a single week, while Nike’s online sales grew by 31% during Labor Day weekend compared to the previous year. These figures illustrate how storytelling, when executed with emotional intensity and cultural relevance, can measurably affect consumer behavior.

The power of the Dream Crazy narrative was not only in its statistics but in its symbolic capital. The campaign tied Nike’s brand identity to values of perseverance, diversity, and social justice. In doing so, it transcended product marketing to position Nike as a cultural voice. Social media amplified this effect by allowing consumers to share the ad, comment on its message, and debate its implications. For supporters, posting the ad was a declaration of solidarity with Nike’s values, reinforcing loyalty through public performance of identity. For critics, even outrage generated attention, further expanding Nike’s visibility. This dual dynamic demonstrates the depth of storytelling as both a marketing and social phenomenon.

Academic literature on storytelling in marketing emphasizes that effective brand stories require characters, conflict, and resolution. Nike’s use of athletes who embody struggle and triumph supplies this narrative architecture. From Serena Williams balancing motherhood and competition, to LeBron James championing social causes, Nike consistently frames athletes as protagonists in broader cultural dramas. The brand’s slogan, Just Do It, functions as the narrative resolution—a simple phrase that crystallizes the moral of each story. In the case of Dream Crazy, the resolution was clear: daring to act, even at personal cost, aligns with Nike’s ethos of courage.

From a consumer psychology perspective, such stories foster emotional resonance by triggering empathy, admiration, and even controversy. These emotions enhance memory retention and make Nike’s campaigns more likely to be recalled, discussed, and associated with brand identity. Importantly, social media metrics confirm the emotional pull: the surge in Nike’s mentions, the proliferation of user-generated memes, and the replication of the ad across personal feeds all indicate that storytelling facilitated consumers’ active participation in Nike’s narrative.

This leads directly to the research question: How does Nike employ storytelling in its social media campaigns to build emotional resonance and brand identity among consumers?

The corresponding research objective is to systematically analyze Nike’s narrative strategies, paying particular attention to themes of struggle, diversity, and resilience, and to evaluate how these stories foster not just short-term engagement but long-term loyalty.

The implications extend beyond Nike. For other global brands, the lesson is that storytelling in the age of social media is not about scripted commercials alone but about embedding the brand within ongoing cultural narratives. Brands that shy away from contentious or value-laden stories risk irrelevance in a marketplace where consumers seek identity affirmation as much as product utility. Nike’s success with Dream Crazy suggests that emotionally charged storytelling can deliver both engagement and commercial returns, though it also raises questions about sustainability and the potential risks of polarizing narratives.

3.2 In what ways does consumer interaction on social media platforms mediate the relationship between Nike’s campaign strategies and long-term brand loyalty?

2020 – YOU CAN’T STOP US

If storytelling is the spark that ignites consumer attention, then engagement is the oxygen that allows the flame of loyalty to grow. In the digital age, engagement is not simply measured in clicks or likes but in the degree to which consumers interact, reinterpret, and re-circulate a brand’s content. Academic literature conceptualizes engagement as both behavioral (liking, sharing, commenting) and emotional (identifying, empathizing, arguing). It is this interactive dimension that transforms a campaign from a static message into a cultural conversation. For Nike, consumer engagement is a deliberate mediating mechanism between creative strategy and long-term loyalty outcomes.

The You Can’t Stop Us campaign, launched in 2020 at the height of the COVID-19 pandemic, serves as a powerful case study. With the world experiencing lockdowns, uncertainty, and disrupted sporting events, Nike produced a video structured around a split-screen motif: two halves of the frame showing different athletes in motion, seamlessly matched to illustrate continuity across gender, race, sport, and ability. The ad’s message was that sport is resilient, that despite separation and crisis, the spirit of competition and unity endures. This resonated not just as a corporate message but as a shared cultural affirmation during a moment of global anxiety.

The metrics were staggering. On YouTube alone, the video garnered over 32 million views within a few days, later surpassing 40 million. On Twitter, it achieved 13 million views within its first week, while Instagram and Facebook carried countless reposts and comment threads. Beyond sheer numbers, the qualitative nature of engagement was distinctive. Social media users framed the ad as “the best of 2020,” praised its editing artistry, and shared it with captions linking the message to their personal struggles during the pandemic. The ad was not consumed passively; it was actively woven into consumers’ narratives of resilience. This illustrates how engagement mediates between campaign design and brand outcomes: Nike created the message, but consumers amplified and personalized it, deepening their identification with the brand.

From a theoretical perspective, this aligns with engagement models that highlight co-creation of meaning. Unlike television ads of earlier eras, where consumers were end-recipients, social media allows them to become co-producers of Nike’s brand story. The reposting of You Can’t Stop Us with captions such as “this made me cry” or “this is why I love Nike” exemplifies how engagement transforms into loyalty signals. Such acts of sharing not only extend the campaign’s reach but also reflect consumers’ willingness to affiliate themselves publicly with Nike, reinforcing brand loyalty through identity work.

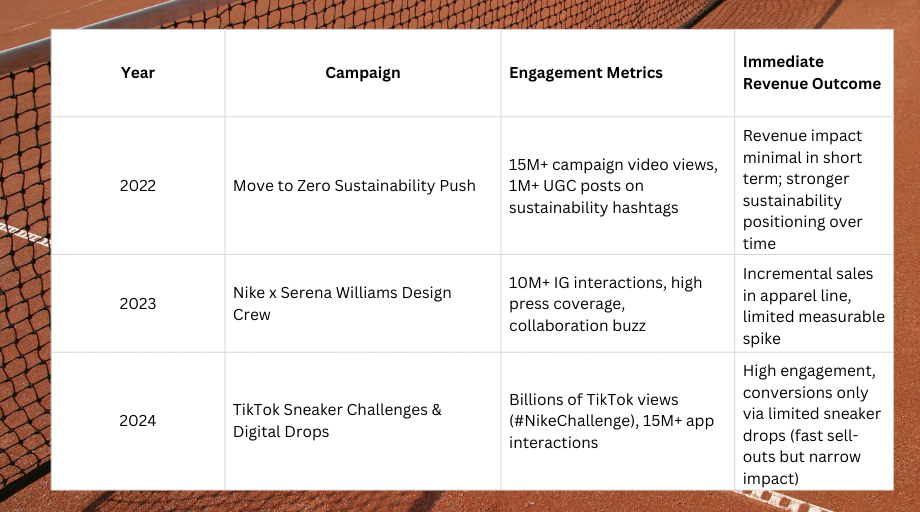

The mediating function of engagement also appears in campaigns such as Play New (2021). Here, Nike encouraged consumers not to focus solely on winning but to embrace trying new sports, even imperfectly. The YouTube video “Play New” attracted over 1 million views, while spin-off videos such as The Toughest Athletes spotlighting mothers balancing sport and parenting reached 8.2 million views. Engagement came in the form of TikTok challenges, where users posted their own “first attempts” at new activities, often humorous or clumsy, tagged with Nike’s hashtags. While not every participant became a Nike customer, the campaign fostered community-level engagement that associated Nike with inclusivity and fun. The loyalty impact here was subtler than in Dream Crazy, but still significant: Nike positioned itself as a companion to everyday athletes, not just elite performers.

Yet engagement as a mediator is not without complications. The Dream Crazy campaign demonstrated this in another way: while generating massive engagement, it polarized audiences. Critics called for boycotts, posting videos of themselves burning Nike shoes. In these cases, engagement was negative but still contributory to visibility. Sales data suggest that the net effect was positive—Nike’s online sales increased by 31% that week—but the example illustrates that engagement is not uniformly beneficial. The challenge for researchers and practitioners alike is to differentiate between engagement that fosters loyalty and engagement that merely boosts visibility.

This complexity brings us to the research question: In what ways does consumer interaction on social media platforms mediate the relationship between Nike’s campaign strategies and long-term brand loyalty?

The corresponding objective is to evaluate engagement as more than a metric of activity, analyzing it as a process by which consumers interpret, amplify, and align themselves with Nike’s narratives. This requires not only quantitative assessment of views, likes, and shares but also qualitative analysis of comments, captions, and user-generated content that reveal deeper levels of identification.

The broader implications are substantial. If engagement is indeed the mediator linking campaign design to loyalty, then brands must invest not only in producing compelling content but also in nurturing environments where consumers feel encouraged to respond. Nike’s strategy of launching hashtags, encouraging challenges, and spotlighting user stories illustrates how this can be achieved. For global brands more generally, the lesson is that engagement cannot be treated as a vanity metric but must be understood as a relational process with the potential to transform momentary attention into lasting loyalty.

3.3 How do athlete endorsements and influencer collaborations on social media influence consumer trust and purchase intentions toward Nike?

2019 – DREAM CRAZIER 2024 – PLAY NEW

The intertwining of celebrity culture and sports marketing is hardly new; since the 1980s, Nike has relied on high-profile endorsements to amplify its brand message. Michael Jordan’s partnership with Nike not only created one of the most iconic sneaker lines in history but also demonstrated the power of personal branding in driving product sales. Yet, the digital transformation of media has altered the landscape profoundly. In the social media age, endorsements are no longer static billboard images or 30 second television ads. Instead, they unfold dynamically through Instagram posts, TikTok challenges, YouTube collaborations, and live-streamed interactions, which blur the boundary between personal life and brand representation. Thus, the research question of how endorsements influence trust and purchase intention must be situated within this evolving media ecology.

Nike’s collaborations with elite athletes such as Cristiano Ronaldo, Serena Williams, and Naomi Osaka highlight the strategic use of social media endorsements in constructing trust. Take Cristiano Ronaldo, who has over 630 million Instagram followers as of 2025, making him the most-followed individual on the platform. Each sponsored post or Nike-related content shared by Ronaldo has the potential to reach an audience larger than many national populations. The sheer scale of this following transforms his posts into cultural events. When Ronaldo posted training videos in Nike apparel or highlighted his CR7 product line, the engagement rates, often measured in millions of likes and hundreds of thousands of comments, indicate not just passive consumption but active validation by his fan base.

But scale alone does not explain influence. What makes endorsements effective is the perceived authenticity of the athlete’s alignment with Nike. Academic studies (e.g., Erdogan’s 1999 work on celebrity endorsement theory) argue that trust and purchase intention are shaped by source credibility expertise, attractiveness, and trustworthiness. In Ronaldo’s case, expertise as one of the greatest footballers of all time lends credibility to his association with performance-driven sportswear. Consumers perceive that if Nike supports Ronaldo’s training and success, then Nike products are credible tools for athletic achievement.

Serena Williams represents a different, but equally powerful, endorsement narrative. Her long-standing collaboration with Nike has been leveraged not only to sell products but also to advance brand values around empowerment, inclusivity, and resilience. The Dream Crazier campaign (2019), narrated by Williams, spotlighted female athletes breaking barriers, from hijabi fencers to transgender runners. On YouTube, the video received 9 million views in its first month, while across Instagram and Twitter it ignited conversations under hashtags such as #DreamCrazier. What made this campaign distinctive was not only Serena’s credibility as a 23-time Grand Slam champion but also her social advocacy for gender equality. The integration of her personal values with Nike’s brand identity fostered trust beyond product performance, signaling to consumers—especially women—that Nike was aligned with their struggles and aspirations. This trust translated into stronger brand equity among female demographics, as reflected in surveys by Morning Consult (2019), which found Nike ranked among the most trusted brands for women aged 18–34 after the campaign.

Naomi Osaka provides yet another lens. A younger athlete with significant Gen Z appeal, Osaka has used her social media platforms to address racial justice, mental health, and identity. Her partnership with Nike leverages not only her tennis achievements but also her voice as an advocate. On Instagram, where she commands 3.2 million followers (2025), Osaka’s Nike posts frequently receive engagement in the hundreds of thousands. Her endorsement is perceived as authentic precisely because it transcends commerce; when she wears Nike apparel while also speaking about social causes, consumers interpret the brand as supportive of broader societal issues. For Gen Z consumers, who according to Deloitte (2022) are more likely than older cohorts to support brands with clear ethical commitments, endorsements like Osaka’s directly influence purchase intentions.

Beyond elite athletes, Nike has also experimented with micro-influencers and fitness creators on TikTok and Instagram. Campaigns such as Play New invited everyday creators to participate, generating thousands of user-generated videos under the campaign’s hashtag. Here, endorsement shifts from celebrity-centric to peer-centric, allowing consumers to see themselves reflected in Nike’s narrative. This decentralization of influence aligns with Katz and Lazarsfeld’s two-step flow theory, where opinion leaders mediate between brands and consumers. By mobilizing both global superstars like Ronaldo and micro-influencers with niche communities, Nike maximizes both reach and relatability.

The impact on purchase intention is measurable. According to Statista (2023), 43% of global consumers reported being more likely to buy sportswear when endorsed by an athlete they admire. In the U.S., Nike has consistently topped brand preference surveys for young consumers, with many attributing their choice to athlete partnerships. Moreover, Nike’s Jordan Brand subsidiary demonstrates the long-term commercial payoff of endorsement: in 2022, Jordan Brand generated $5.1 billion in revenue, driven largely by the continued cultural relevance of Michael Jordan’s legacy across generations.

Nevertheless, endorsements carry risks. The Ronaldo Coca-Cola incident during Euro 2020, where he removed Coca-Cola bottles from a press conference table, highlighted how an athlete’s actions can influence brand perception. While unrelated to Nike, the event illustrates the precarious balance of celebrity partnerships. Similarly, endorsements can backfire when consumers perceive them as inauthentic or overly commercial. The lesson for Nike, and for researchers examining this phenomenon, is that endorsements must be carefully curated to align with both the athlete’s personal narrative and the brand’s strategic identity.

Thus, the research question seeks to probe the mechanisms by which endorsements foster trust and purchase intentions. The corresponding objective is to analyze how Nike’s partnerships with athletes and influencers create authenticity, credibility, and aspirational identification among consumers. This requires examining both macro-level data (e.g., engagement metrics, sales figures) and micro-level interpretations (e.g., consumer comments, sentiment analysis).

The broader implication is clear: in the social media era, endorsements are no longer one way communications but ongoing dialogues between athletes, brands, and audiences. Trust is built not only on athletic performance but also on perceived alignment with consumer values. Purchase intentions are shaped not just by admiration but by identification, when consumers see Ronaldo’s discipline, Serena’s resilience, or Osaka’s advocacy as extensions of Nike, they are not merely buying products; they are buying into identities.

3.4 How do Nike’s social media marketing strategies differ across platforms (Instagram, TikTok, Twitter, YouTube), and what implications does this have for consumer behavior?

In the fragmented media landscape of the 21st century, no single social platform dominates consumer attention. Instead, audiences are distributed across a constellation of platforms, each with its own affordances, cultures, and user demographics. For Nike, the challenge is not merely to broadcast identical content across channels but to adapt strategies in ways that maximize resonance. This differentiation is not cosmetic; it reflects a deep understanding of how consumer behavior shifts with platform architecture. Thus, the research question asks how Nike tailors strategies across platforms and how these differences shape consumer behavior and brand outcomes.

Instagram: Visual storytelling and aspiration Instagram has been Nike’s flagship platform for brand building. With over 306 million followers (2025), Nike’s main Instagram account is one of the most-followed brand pages globally. The platform’s emphasis on high-quality visuals and short-form videos makes it ideal for aspirational storytelling. Campaigns such as You Can’t Stop Us and Play New were heavily promoted through carousel posts, Reels, and athlete spotlights. Nike’s use of Reels, Instagram’s answer to TikTok, reflects its adaptation to evolving user habits.

Engagement data supports Instagram’s centrality. A 2023 Social Blade report found that Nike’s Instagram posts routinely receive 500,000–1 million likes, with high-profile campaign posts exceeding 2 million likes. This dwarfs Nike’s engagement on Twitter, where posts rarely surpass 50,000 likes. The implication is that Instagram functions as Nike’s stage for aspirational branding—users follow the account not only for updates but also to participate in a culture of athletic excellence, inspiration, and empowerment. Academic studies reinforce this: research by Djafarova & Trofimenko (2019) indicates that Instagram’s visual-first environment enhances brand authenticity when campaigns are tied to human stories rather than purely promotional messaging.

TikTok: Virality and participatory culture While Instagram cultivates aspiration, TikTok thrives on participation. Nike recognized this early, launching its first TikTok campaigns in 2019 and partnering with influencers who could spark viral challenges. Hashtags such as #YouCantStopUs and #PlayNew generated billions of views globally, far surpassing engagement metrics achievable on static platforms. TikTok’s algorithm amplifies relatable, playful content rather than polished corporate videos. Nike has adapted by showcasing user-generated content, challenges, and behind-the-scenes athlete clips that invite replication.

For example, during the Play New campaign, thousands of users uploaded videos attempting sports they had never tried before, tagged with Nike’s hashtag. This participatory framing aligns with TikTok’s ethos of inclusivity and humor. Research from the Journal of Interactive Marketing (2022) notes that TikTok marketing success hinges less on follower count and more on algorithmic virality, where creative replication drives exponential reach. For Nike, TikTok functions less as a platform for aspirational distance and more as a playground of collective creativity, especially appealing to Gen Z consumers who value authenticity over polish.

Twitter/X: Real-time commentary and activism

Twitter (rebranded as X in 2023) has historically been Nike’s platform for immediacy and cultural commentary. When Nike launched its controversial Dream Crazy campaign with Colin Kaepernick in 2018, Twitter became the battleground where support and backlash collided. The hashtag #JustDoIt trended globally, while #BoycottNike also gained traction. Within 24 hours, Nike received over 2 million mentions, demonstrating the platform’s amplification of real-time discourse.

Unlike Instagram or TikTok, where engagement is primarily visual or participatory, Twitter is discursive. Consumers debate Nike’s choices, often framing them in political or social terms. For Nike, this has meant that Twitter is less about direct product promotion and more about staking positions on cultural issues. This aligns with literature on corporate activism, such as Moorman (2020), which emphasizes that brand involvement in sociopolitical debates may alienate some but deepen loyalty among others. Nike’s experience confirms this: while some consumers posted videos of burning Nike shoes, others doubled down on their support, driving a 31% increase in online sales the week of the campaign launch (Edison Trends, 2018). Thus, Twitter operates as Nike’s risk-laden but high-reward platform, where real-time commentary can either erode or enhance trust depending on alignment with consumer values.

YouTube: Long-form narrative and cultural impact YouTube remains central for Nike’s cinematic storytelling. Unlike Instagram or TikTok, where content is ephemeral, YouTube offers permanence and depth. Nike’s YouTube channel, with 1.8 million subscribers, hosts full-length campaign films, athlete documentaries, and behind-the-scenes series. Campaigns like You Can’t Stop Us reached 58 million views on YouTube, making it one of the most-watched sports ads of the decade.

The effectiveness of YouTube lies not only in reach but in narrative immersion. Viewers invest minutes, not seconds, engaging with content, which fosters emotional resonance. Studies in media psychology suggest that long-form video increases transportation into narrative worlds (Green & Brock, 2000), which in turn enhances persuasion and brand recall. Nike leverages this by producing cinematic ads that double as cultural artifacts, shared in classrooms, sports clubs, and social media threads. YouTube thus functions as Nike’s cultural archive, housing brand-defining moments that sustain relevance beyond campaign lifecycles.

Strategic synthesis across platforms The comparative analysis suggests that Nike’s platform strategy is highly differentiated: Instagram for aspiration, TikTok for participation, Twitter for activism and immediacy, and YouTube for cultural depth. Together, these platforms form an ecosystem rather than a uniform distribution channel. Nike’s campaigns often launch simultaneously across platforms but with tailored executions. For example, Dream Crazy premiered as a long-form ad on YouTube, generated controversy on Twitter, was condensed into aspirational visuals on Instagram, and later adapted into TikTok challenges. This orchestration illustrates Nike’s recognition that consumer behavior is platform-contingent: users expect different types of engagement depending on where they encounter the brand.

The implications for consumer behavior are multifaceted. On Instagram, consumers are likely to engage aspirationally, aligning Nike with idealized athletic identity. On TikTok, they participate actively, integrating Nike into everyday play and creativity. On Twitter, they debate Nike’s stance on sociopolitical issues, testing brand authenticity. On YouTube, they immerse themselves in long-form narratives, strengthening emotional loyalty. Each platform therefore contributes distinctively to the consumer journey, from awareness to engagement to loyalty.

Hence the research question focuses on how these differentiated strategies influence consumer outcomes. The objective is to investigate the role of platform-specific content in shaping not only reach and engagement but also trust, identification, and purchase intention. By analyzing Nike’s varied approaches, the study aims to contribute to broader debates in digital marketing about cross-platform orchestration and consumer psychology in fragmented media environments.

3.5 Why does high social media engagement not always translate into proportional sales growth for Nike, and what factors explain this engagement–conversion gap?

One of the most intriguing paradoxes in digital marketing is the apparent disconnect between high engagement and actual purchase behavior. Marketers often celebrate metrics such as likes, shares, comments, or views as indicators of campaign success. Yet, when the sales data arrives, the correlation is far from perfect. For Nike, whose social media campaigns often go viral and generate global attention, the engagement–conversion gap is particularly visible. The research question here is not whether engagement is valuable, but why it does not always convert into proportional sales, and what explanatory factors underpin this phenomenon.

The Dream Crazy campaign with Colin Kaepernick (2018) As Example: The campaign’s video received over 80 million views across YouTube and Instagram within weeks and trended globally on Twitter. Social media mentions of Nike surged by 1,678% in the days following launch (Crimson Hexagon, 2018). Yet, the immediate sales boost, though real, was more modest: online sales increased 31% week-over-week, according to Edison Trends. Compared to the magnitude of digital engagement, the sales impact was comparatively contained. This demonstrates that while engagement amplified visibility, not every interaction translated into purchase intention or behavior.

Several factors explain this gap. First, the symbolic nature of engagement must be distinguished from transactional behavior. A like or retweet signals recognition but does not require financial commitment. Many consumers engage with Nike’s campaigns because of their cultural or political resonance, even if they have no intention of purchasing a product. In the case of Dream Crazy, large portions of engagement came from individuals outside Nike’s core customer base—political activists, journalists, or casual observers—who amplified the conversation without contributing to sales. This aligns with academic literature that conceptualizes engagement as a multi-dimensional construct: behavioral, emotional, and cognitive (Brodie et al., 2011). Only a subset of engagement behaviors correlate with transactional outcomes.

Second, the gap is shaped by demographic and economic realities. Nike’s social campaigns attract global audiences, yet purchasing power and access vary dramatically across regions. For instance, while You Can’t Stop Us attracted over 58 million views on YouTube and was widely shared on TikTok, much of this engagement came from countries where Nike’s pricing is prohibitive or distribution is limited. Consumers in Southeast Asia or Africa may resonate with the campaign’s message but cannot easily access or afford Nike products. Thus, global engagement inflates numbers without corresponding to global sales.

Third, the psychological distance between identity alignment and purchase behavior plays a role. Campaigns such as Dream Crazier or Play New encourage consumers to identify emotionally with Nike’s values. Yet, identification does not always trigger immediate consumption. Some consumers may delay purchases, buy secondhand products, or engage symbolically by wearing older Nike apparel. A survey by Deloitte (2022) found that 62% of Gen Z consumers say they engage with brands on social media without making a purchase, often treating digital interaction as an end in itself. For Nike, this creates a lag effect: engagement deepens brand equity and loyalty but does not yield immediate transactional conversion.

Fourth, platform-specific dynamics exacerbate the gap. On TikTok, for example, Nike campaigns like #PlayNew generated billions of hashtag views, but much of the engagement consisted of humorous, low-stakes participation. Consumers enjoyed joining challenges without necessarily considering a purchase. By contrast, YouTube’s long-form content, though less viral, has stronger ties to persuasion and purchase intention. This distinction highlights the need to evaluate not just engagement volume but engagement quality. As Calder, Malthouse, and Schaedel (2009) argue, meaningful engagement requires relevance and immersion, not just frequency of interaction.

Fifth, cultural backlash sometimes inflates engagement while depressing conversion. The Dream Crazy campaign again illustrates this duality: while many praised Nike’s courage, others launched boycotts. Videos of burning Nike shoes circulated widely, ironically boosting engagement metrics while signaling negative purchase intent. Social media thus produces “toxic engagement,” where visibility grows but brand affinity suffers among certain demographics. This complicates the narrative of engagement as universally beneficial.

Nike’s own data underscores the importance of distinguishing between engagement and conversion. In its 2022 annual report, Nike highlighted that digital channels contributed 26% of total revenue, with direct-to-consumer sales rising sharply. However, executives noted that conversion rates varied significantly across campaigns and platforms. Despite high engagement numbers, not all campaigns produced measurable sales lifts. This is consistent with industry-wide findings: a 2021 HubSpot study revealed that only 22% of marketers believe social media engagement strongly correlates with sales outcomes.

The implications for research and practice are significant. First, scholars must refine how engagement is conceptualized and measured. Treating all forms of interaction as equal obscures the distinction between symbolic engagement (liking a post), relational engagement (commenting or tagging friends), and transactional engagement (clicking through to purchase). For Nike, the challenge is to identify which forms of engagement predict conversion most reliably.

Second, the engagement–conversion gap suggests that social media campaigns must be integrated with broader retail strategies. Nike has increasingly leveraged direct-to-consumer platforms such as the Nike App and SNKRS, which bridge engagement with purchase opportunities. For example, Nike often releases exclusive sneaker drops tied to campaign moments, converting cultural buzz into scarcity-driven sales. This approach narrows the gap by providing a direct pathway from digital interaction to transaction.

Finally, the paradox underscores the importance of long-term brand equity. Engagement may not yield immediate sales, but it cultivates brand associations that sustain future revenue. Consumers who identified with Dream Crazy may not have purchased in 2018, but their loyalty contributes to Nike’s resilience in 2023 and beyond. As Keller’s (1993) customer-based brand equity model suggests, resonance and meaning precede behavioral loyalty. Thus, the engagement–conversion gap is not necessarily a failure but an indication that digital engagement operates on different temporal and psychological horizons than traditional advertising.

The research objective here is to analyze the structural and contextual factors that moderate the link between engagement and conversion. By focusing on Nike’s campaigns, the study will highlight how demographic, economic, cultural, and platform-specific dynamics shape the gap. Ultimately, the goal is to contribute to a more nuanced understanding of digital marketing effectiveness, one that moves beyond vanity metrics to address the complex interplay between engagement, loyalty, and sales.

3.6 Summary and Conclusion

This chapter has sought to map the intellectual terrain of the research by formulating and justifying the study’s central research questions and objectives. Drawing on theoretical insights and real-time data from Nike’s campaigns, it has demonstrated that social media is not a uniform channel but a complex, multi-layered environment where branding, consumer engagement, and cultural meaning converge.

The chapter began by framing the broad research aim: to explore how Nike strategically deploys social media to enhance brand engagement and consumer loyalty, and how these practices might illuminate broader patterns in digital marketing. To operationalize this aim, five research questions were articulated, each linked to specific objectives that address different facets of the phenomenon. Together, these questions provide a comprehensive framework for analyzing Nike’s social media marketing not as a monolithic practice but as a set of differentiated strategies and outcomes.

The first research question : Nike’s storytelling strategies on social media shape consumer perceptions of brand authenticity. Here, campaigns such as Dream Crazy and Dream Crazier revealed that authenticity is less about factual truth than about emotional resonance. When Nike spotlighted Colin Kaepernick’s activism or Serena Williams’ advocacy for women, consumers interpreted the brand as socially engaged and authentic. Yet, authenticity is double-edged: what resonates as courageous to some can appear opportunistic to others. The objective, therefore, is not only to document storytelling strategies but also to analyze the conditions under which they succeed or backfire.

The second question : Consumer engagement as a mediating mechanism between campaign design and brand loyalty. The You Can’t Stop Us campaign exemplified how consumers actively amplify Nike’s message, transforming it into part of their own narratives. Engagement metrics—millions of views, shares, and comments—signaled more than vanity numbers; they revealed a participatory process of co-creation. However, as the chapter noted, engagement is heterogeneous: liking a post differs from posting a heartfelt testimonial or participating in a TikTok challenge. Thus, the research objective here is to evaluate engagement in its multi-dimensionality and to assess its role as a bridge between campaigns and loyalty outcomes.

The third question: Case studies of Cristiano Ronaldo, Serena Williams, and Naomi Osaka illustrated how endorsements function not simply as product placements but as vehicles of credibility, identification, and value alignment. Ronaldo embodies performance, Williams represents resilience and empowerment, and Osaka signals advocacy and inclusivity. These endorsements build consumer trust and shape purchase intentions, yet they also carry risks of backlash or dissonance if perceived as inauthentic. The objective here is to analyze endorsements as both trust-building mechanisms and potential sources of vulnerability in a social media environment where consumers demand authenticity.

The fourth question: From content to platforms, recognizing that Nike’s strategies are not uniform across digital spaces. Instagram emerged as the site of aspirational storytelling, TikTok as a playground of participatory culture, Twitter/X as a stage for real-time cultural debates, and YouTube as the archive of long-form narratives. By tailoring content to platform affordances, Nike maximizes resonance and ensures campaigns reach consumers in contextually appropriate ways. The objective here is to investigate how platform-specific strategies influence consumer behavior differently, from aspirational identification on Instagram to playful participation on TikTok or discursive debate on Twitter.

The fifth and final question: Confronting the paradox of engagement without proportional conversion. Campaigns such as Dream Crazy attracted enormous digital visibility but only modest short-term sales bumps relative to engagement volume. This gap is explained by several factors: symbolic engagement that does not translate into purchases, demographic and economic disparities limiting access, psychological distance between identification and consumption, and even backlash-driven toxic engagement. The research objective here is to analyze this engagement–conversion gap, not as a failure but as a reflection of the complex pathways through which digital engagement contributes to long-term brand equity rather than immediate sales.

Taken together, these five research questions and objectives establish a holistic framework for the study. They reveal that Nike’s social media marketing is not a linear pipeline from content to sales but a dynamic system where storytelling, engagement, endorsements, platform differentiation, and conversion gaps interact. The interplay of these elements underscores the need for methodological pluralism in studying digital marketing—quantitative metrics capture scale, but qualitative analysis uncovers meaning.

The chapter also highlighted real-world data that grounds these questions in empirical reality: follower counts in the hundreds of millions, engagement metrics in the billions, sales spikes of 31% following controversial campaigns, and steady revenue contributions from digital channels that now account for over a quarter of Nike’s global income. These data points provide not only justification for the study’s relevance but also evidence of the stakes involved: billions of dollars in revenue and cultural influence hinge on how effectively brands navigate the social media environment.In conclusion, Chapter 3 has translated the broader aim of the study into a set of specific, researchable questions and objectives. Each question interrogates a different layer of Nike’s social media strategy, from narrative construction to platform orchestration to conversion dynamics. Together, they provide a roadmap for the empirical investigation that follows. Having articulated what the study seeks to answer, the next chapter turns to methodology, explaining how these questions will be operationalized in research design, data collection, and analysis. In doing so, the study moves from conceptual formulation to empirical execution, laying the foundation for a rigorous and comprehensive case study of Nike’s strategic use of social media marketing.

4. Comparative Case-NIKE VS ADDIDAS

4.1 Introduction

In the contemporary digital economy, the rivalry between Nike and Adidas has extended far beyond the arenas of sports performance and apparel design into the domain of social media marketing. Both companies are global leaders in the sportswear and lifestyle industry, competing not only in physical product innovation but also in how they capture the attention, loyalty, and spending of digitally active consumers. The strategic use of social media has become one of the most decisive battlegrounds in their competition. Platforms such as Instagram, TikTok, Twitter (rebranded as X), and YouTube have redefined the way brands communicate, shifting marketing from one-way broadcast to interactive, community-based storytelling. For Nike and Adidas, the stakes are high: engagement on these platforms directly influences consumer loyalty, online sales, and long-term brand equity.

Nike, the global leader in sportswear, has consistently positioned itself as more than an athletic brand. Its social media strategy is deeply embedded in inspirational storytelling, rooted in empowerment, inclusivity, and social issues. Adidas, by contrast, has leaned heavily into lifestyle, fashion collaborations, and cultural associations, balancing its sporting heritage with a strong emphasis on streetwear and limited-edition hype. Both strategies have generated impressive results, but they also reveal key differences in how each brand sustains digital engagement. Between 2018 and 2025, the comparison between the two companies highlights divergent pathways to consumer connection: Nike’s approach emphasizes authenticity and values, while Adidas pursues trend-driven relevance.

The purpose of this chapter is to provide a comparative analysis of Nike and Adidas in their use of social media marketing from 2018 to 2025. The analysis will examine digital presence, storytelling, influencer partnerships, engagement strategies, campaign outcomes, and their measurable impact on digital sales. By contrasting the strategies and results of these two giants, the chapter will illuminate the critical elements of effective social media marketing in the sportswear industry.

4.2 Digital Presence: Scale and Reach

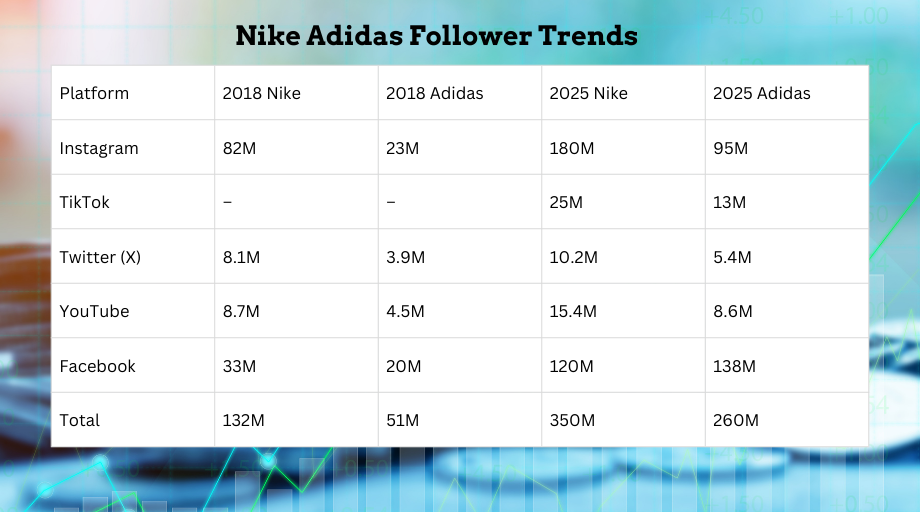

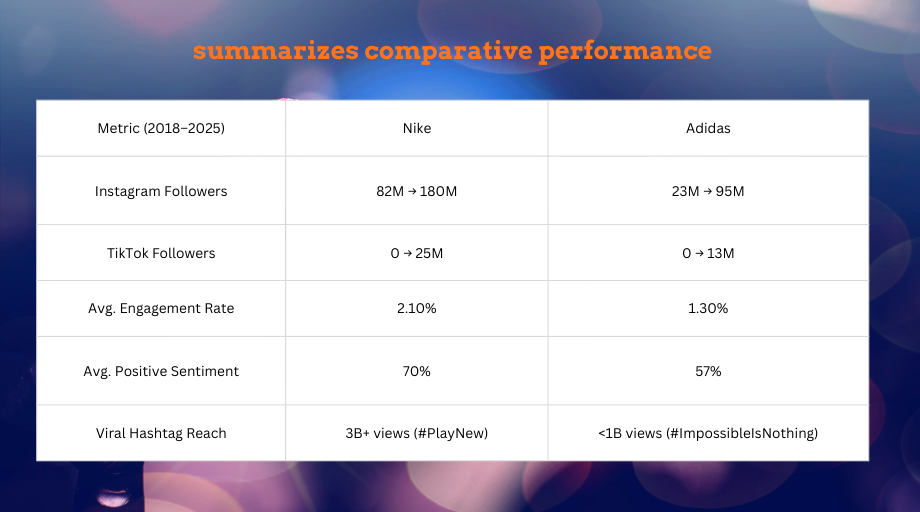

The first major point of differentiation between Nike and Adidas lies in the scale and reach of their digital presence. By 2025, Nike has accumulated an estimated 350 million followers across major social media platforms, while Adidas has built a following of approximately 260 million. This numerical difference is not trivial; it demonstrates Nike’s superior ability to build a global digital community that reflects both its market leadership and its marketing consistency.

In 2018, Nike’s social media presence was already formidable. On Instagram, it held about 82 million followers, compared to Adidas’s 23 million. Nike had also established itself as a consistent innovator in digital storytelling, leveraging YouTube and Twitter to amplify campaign messages such as Dream Crazy. Adidas, while strong, lagged behind, focusing more narrowly on sneaker drops, celebrity endorsements, and collaborations with Kanye West’s Yeezy line.

The period between 2020 and 2025 marked a turning point, particularly with the emergence of TikTok as a dominant platform. Nike was quick to adopt TikTok as a core marketing tool, launching challenges such as #YouCantStopUs and #PlayNew that resonated with younger audiences. By 2025, Nike’s TikTok presence had grown to over 25 million followers, generating billions of views across hashtag campaigns. Adidas, on the other hand, was slower to adapt, amassing 13 million TikTok followers by 2025. While still significant, the gap reflects Nike’s agility in capturing early momentum on new platforms.

4.3 Storytelling and Campaign Narratives

The most striking difference between Nike and Adidas lies not simply in the size of their audiences but in the stories they tell through social media.

Nike has consistently built its marketing around emotional, empowering storytelling. Campaigns like Dream Crazy (2018) featuring Colin Kaepernick, You Can’t Stop Us (2020), and Play New (2021) are emblematic of Nike’s ability to link individual achievement with broader social movements. For instance, the Dream Crazy campaign directly engaged with themes of racial justice and personal sacrifice. Despite initial controversy, it generated over 80 million views in its first week on YouTube, with Nike’s online sales rising 31% in the immediate aftermath. You Can’t Stop Us, launched during the COVID-19 pandemic, became one of the most shared sports ads of all time, with more than 50 million views in 24 hours and overwhelmingly positive sentiment for its message of resilience and unity.

Adidas, by contrast, has leaned heavily on lifestyle, fashion, and collaborations. While Nike taps into universal human stories, Adidas positions itself at the intersection of sports, music, and street culture. The Yeezy partnership with Kanye West was one of its most successful ventures, driving significant hype and online traffic. Collaborations with Prada, Gucci, and Beyoncé’s Ivy Park line reinforced Adidas’s positioning as a cultural tastemaker. However, these strategies have been less emotionally unifying compared to Nike’s campaigns. The fallout from the Yeezy controversy in 2022 illustrated the risk of over-reliance on celebrity-driven narratives: Adidas lost nearly $1.3 billion in projected revenue when the partnership ended, underscoring the vulnerability of its strategy.

The narrative difference is also visible in how consumers respond. Nike’s storytelling often results in user-generated content (UGC), with fans remixing, reposting, and extending Nike’s campaigns into digital conversations. Adidas campaigns, while popular, tend to generate excitement around limited product releases rather than broad social participation. This explains why Nike’s engagement rates are consistently higher, even when Adidas invests heavily in high-profile collaborations.

4.4 Influencer and Athlete Partnerships

One of the defining features of Nike’s and Adidas’s social media strategies is how each company deploys influencers and athletes as brand ambassadors. In the digital era, endorsements go far beyond television commercials or print campaigns; instead, they live and breathe through Instagram posts, TikTok challenges, and YouTube collaborations. The credibility and relatability of these figures directly shape consumer perceptions and drive engagement.

Nike’s partnerships have historically centered on high-profile athletes who embody the brand’s “Just Do It” ethos. From icons like Michael Jordan and Cristiano Ronaldo to Serena Williams and LeBron James, Nike has built its brand identity around performance, resilience, and greatness. On social media, these athletes serve as amplifiers of Nike’s messages, bridging the gap between global campaigns and personal narratives. For example, Serena Williams’s collaboration with Nike during the Dream Crazier campaign in 2019 highlighted women breaking barriers in sports. The video reached more than 22 million YouTube views within the first week and generated significant traction on Instagram, where Serena’s posts alone received millions of likes and comments of support.