Leading a Cultural Renaissance: Satya Nadella's Transformation of Microsoft's Organizational Behavior

Born on the 19th of August 1967; the media shy – Satya Narayana Nadella better known as Satya Nadella is the India-born newly appointed CEO of the Microsoft. With a salary package of $17.5 million currently has been creating buzz in the tech world, the Silicon Valley and the Indian media, since a year before Sundar Pichai become the CEO of Google. Satya has succeeded Steve Ballmer to become the CEO of Microsoft on 4th of February 2014. He is known to be one of the very few in the company who have seen a range of promotions and that too since his joining. Apart from being married to his high school love Anupama, he has also been married to Microsoft since 22+ years. Satya lives with his wife and three children (a son and two daughters) in Bellevue, Washington. He simply loves reading and cricket. His preference includes American and Indian poetry. On the other hand, cricket has been his interest since his school days and was also a part of his school team. He often says that the game has thought him leadership and teamwork skills. Lastly, just like every successful person on this planet, he too is passionate about knowledge, and signing up something or the other to learn something new.

1.Introduction

In the annals of modern business history, few corporate turnarounds are as compelling as Microsoft’s renaissance under the leadership of Satya Nadella. When he was appointed Chief Executive Officer on February 4, 2014, Microsoft was a company at a profound crossroads—an institution with unrivaled legacy and formidable resources, yet increasingly perceived as a lumbering giant unable to adapt to the seismic shifts transforming the technology landscape.

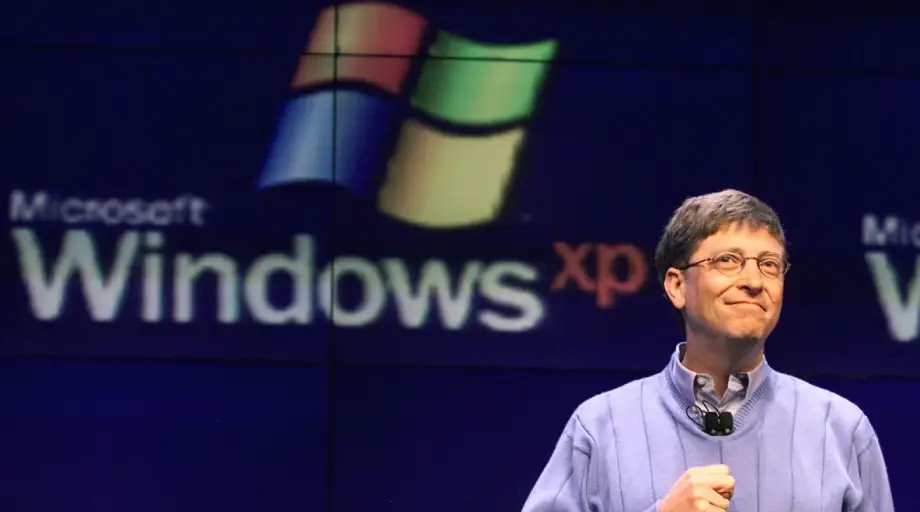

At the time, Microsoft’s dominance of the PC era was no longer sufficient to secure its future. Windows, once the unchallenged operating system for the world’s computing needs, was rapidly losing its centrality in an age of mobile-first and cloud-first applications. Apple’s iOS and Google’s Android had redrawn the battlefield, capturing consumer mindshare and developer attention. Amazon Web Services was reshaping the economics of enterprise IT with its pay-as-you-go cloud model, a revolution Microsoft had been late to embrace.Internally, the company had become synonymous with intense rivalries between divisions, often described as a culture of “stack ranking,” infighting, and guarded silos. While this competitive ethos had spurred breakthroughs in the 1990s, it was now undermining collaboration and stifling innovation. Employee morale had suffered under the weight of bureaucracy and risk aversion. Investors questioned whether Microsoft could regain the dynamism that had made it a category-defining pioneer.It was into this complex environment—defined by external disruption and internal stagnation—that Satya Nadella stepped as only the third CEO in Microsoft’s history.

Unlike his predecessors, who had been known for combative brilliance and relentless operational drive, Nadella embodied a quiet, reflective style. Yet beneath his understated presence was a clear conviction: for Microsoft to remain relevant, it had to fundamentally rewire how it thought, behaved, and defined its purpose.

Nadella believed that the greatest threat to Microsoft was not a competitor’s technology or an adverse market trend—it was the company’s own mindset. In his view, the insularity that had once been a strength now prevented teams from seeing possibilities beyond their silos. A culture that prized knowing over learning discouraged experimentation and collaboration. And a narrow focus on protecting legacy franchises limited the courage to embrace new business models.His diagnosis was radical in its simplicity: Microsoft had to rediscover a growth mindset, a philosophy inspired by psychologist Carol Dweck’s work on the power of continuous learning and resilience. This was more than a motivational slogan. Nadella envisioned a systemic transformation—one that would touch every process, every team, and every leader.To make this transformation real, he set out to define a clear mission for Microsoft that transcended products:

“To empower every person and every organization on the planet to achieve more.”

This purpose statement became the north star that would unify a sprawling enterprise of more than 100,000 employees across geographies and business units. It provided a rallying cry to focus less on defending territory and more on creating value for customers.

Simultaneously, Nadella initiated a strategic pivot to the cloud, boldly accelerating investment in Azure, reimagining Office as a subscription service, and embracing open-source ecosystems that Microsoft had once treated as adversaries. Underpinning these business model shifts was a sweeping cultural overhaul—moving from a “know-it-all” to a “learn-it-all” organization.This case study examines how Satya Nadella led Microsoft through this cultural renaissance. It explores the interplay between leadership behaviours, organizational culture, and strategic execution. By tracing how Nadella articulated a compelling vision, modeled empathetic leadership, and systematically embedded new norms, we gain insights into what it takes to transform an enterprise that had lost its way.

Ultimately, this is a story not only of corporate revival but of the transformative potential of leadership rooted in purpose, humility, and an unrelenting commitment to learning. For business leaders navigating disruption and inertia in their own organizations, Nadella’s example offers both inspiration and a blueprint for renewal.

2. THE CHALLENGES BEFORE NADELLA

To fully appreciate the magnitude of Satya Nadella’s leadership transformation, one must first understand the formidable challenges he inherited. In 2014, Microsoft was a company with immense technological pedigree— but one that had, in many ways, lost its footing in a rapidly evolving digital landscape. The company was highly profitable and still dominant in areas like enterprise software and personal computing, yet it was increasingly seen as stagnant, defensive, and out of sync with emerging trends.

2.1 The Decline of Windows-Centric Dominance

For decades, Microsoft’s success had been tethered to the twin pillars of Windows and Office. This Wintel model (Windows operating system plus Intel processors) had powered billions of personal computers worldwide and generated massive, predictable revenue streams. But by the early 2010s, the world was shifting from a desktop-centric paradigm to one dominated by mobile, cloud, and open platforms.

Smartphones and tablets—led by Apple’s iOS and Google’s Android—had become the new computing hubs. Consumers no longer needed a Windows PC to be productive or connected. Instead, they relied on cloud-based apps and services that ran across devices. Microsoft’s mobile operating system, Windows Phone, had failed to gain traction despite multiple attempts and substantial investment.

As a result, Windows’ strategic relevance was rapidly diminishing. Even as the company maintained market share in enterprise software and licensing, its influence over the direction of the tech industry was waning.

2.2 The Late Arrival to Cloud Computing

One of Microsoft’s most glaring strategic vulnerabilities was its slow response to the cloud revolution. Amazon Web Services (AWS), launched in 2006, had quickly become the dominant player in infrastructure-as- a-service, setting new standards for agility, scalability, and pricing. While Microsoft had recognized the potential of cloud computing, its efforts to scale Azure lagged behind.

Internally, there were conflicting priorities. On one hand, the company wanted to protect its lucrative on- premises software licenses. On the other, it knew that future growth depended on transitioning customers to cloud-based delivery models. This tension created inertia and delayed full commitment to cloud-first strategies.

By 2013, AWS was not only the undisputed leader in cloud infrastructure—it had redefined how businesses thought about IT. Microsoft, by contrast, was still navigating the politics of legacy businesses, uncertain about how aggressively to disrupt its own models.

2.3 A Toxic and Siloed Internal Culture

Perhaps the most dangerous issue wasn’t external at all—it was Microsoft’s internal culture. Over time, the organization had developed a reputation for being bureaucratic, territorial, and resistant to change. Business units operated like competing empires. Teams hoarded information, prioritized internal competition over customer needs, and resisted collaboration across silos.A key symbol of this culture was the controversial “stack ranking” system, which forced managers to rank employees against one another and limit how many could receive top performance ratings. This led to toxic dynamics, as employees were incentivized to compete with colleagues rather than work as teams.Former employees and media reports described a workplace culture that stifled innovation, punished risk-taking, and rewarded political maneuvering. For a company that depended on creativity, learning, and speed, this internal environment was a major liability.

2.4 Strained Developer and Partner Relationships

In its quest to dominate platforms and control ecosystems, Microsoft had often alienated the developers and partners it once championed. Its tight control over APIs, restrictive licensing, and dismissive stance toward open-source communities had eroded goodwill.By the time Nadella took over, many developers had migrated toward more open, accessible platforms—Google’s Android, Apple’s App Store, and GitHub. Microsoft’s developer tools and services, once considered best-in-class, were now regarded as clunky and insular.

2.5 Lack of a Compelling Vision

Perhaps most critically, Microsoft seemed to lack a clear and inspiring sense of purpose. While the company was still a dominant player in many segments, it was no longer seen as a leader or innovator. It had become known more for preserving legacy businesses than for pushing the boundaries of possibility.Without a unifying mission or values that resonated with employees and customers alike, Microsoft risked becoming a tech behemoth adrift—a company rich in resources but poor in relevance.

2.6 The Leadership Vacuum

Steve Ballmer, Nadella’s predecessor, was known for his sales acumen and energetic leadership style. However, his tenure had been marked by missed opportunities (such as mobile), costly missteps (like the Nokia acquisition), and cultural stagnation. While Ballmer maintained profitability, he did not cultivate an environment where new ideas flourished or where talent felt truly empowered.

When the board began its search for a new CEO, Microsoft needed more than an operational manager. It needed a visionary—a cultural architect who could reimagine not just the company’s strategy but its soul.

3.Nadella's Leadership Approach

When Satya Nadella stepped into the CEO role in 2014, he understood that the challenges facing Microsoft were as much cultural and psychological as they were technological or operational. Unlike a conventional turnaround requiring cost-cutting or incremental improvements, Nadella faced the task of rewiring the very beliefs, behaviors, and habits that defined Microsoft’s identity.

Observers sometimes underestimate how deeply culture is embedded in large organizations. By the time a company reaches the scale of Microsoft—more than 120,000 employees spread across continents—culture becomes self-perpetuating. It seeps into hiring decisions, meeting norms, incentive structures, and even how emails are written. Under Ballmer, the culture was marked by an aggressive internal competitiveness, an instinct to protect territory, and a reluctance to embrace outside ideas. While this approach had once fueled rapid growth, it had ossified into an obstacle.

Nadella’s leadership approach was rooted in a conviction that transformation begins with mindset—that before processes and products could change, the way people thought about their work and each other had to be reimagined. His style drew on principles of humility, curiosity, empathy, and clarity—traits not traditionally associated with “hard-charging” tech executives but which proved instrumental in Microsoft’s revival.

3.2 Humility and Self-Awareness:

One of Nadella’s earliest insights was that Microsoft’s collective ego had become a liability. The company’s long track record of success in the PC era had engendered a belief that it knew best—a “know-it-all” mindset that discouraged learning from customers, competitors, and even each other.

In his book Hit Refresh, Nadella wrote candidly about how this arrogance manifested in day-to-day interactions:

“When I would go to meetings, people would present ideas as if they were fully baked, because it was not okay to admit you were still figuring things out.”

This mindset discouraged vulnerability and reflection. Employees felt compelled to defend their positions, rather than ask questions or entertain alternatives.

Nadella knew that modeling humility had to start at the top. He made a deliberate effort to show that he did not have all the answers. In executive meetings, he asked open-ended questions. He encouraged leaders to admit uncertainty and to solicit feedback. In town halls, he spoke about the power of learning, rather than declaring triumphs.

This commitment to humility was not mere rhetoric—it influenced how leaders were evaluated and promoted. Performance reviews began to incorporate not just what leaders accomplished but how they engaged with their teams. Those who clung to old patterns of defensiveness and internal combativeness found themselves increasingly marginalized.Over time, this example created permission for employees to bring curiosity and honesty to their work. As one Microsoft engineer noted in an interview:

“Suddenly, it was okay to say, ‘I don’t know, but let’s find out together.’”

3.3 Empathy as a Leadership Principle

If humility was the antidote to arrogance, empathy was the force that could reconnect Microsoft with its customers and employees. Nadella’s focus on empathy was deeply personal. His son, Zain, was born with cerebral palsy and required lifelong care. Nadella has often spoken about how this experience shaped his understanding of human vulnerability and resilience.Rather than seeing empathy as a soft skill, he framed it as a strategic capability. In a rapidly changing world, the ability to understand others’ perspectives—customers’ unmet needs, employees’ frustrations, partners’ aspirations—was essential to innovation. Nadella’s emphasis on empathy showed up in multiple ways:

Customer Obsession: He encouraged teams to spend more time with customers, to listen without preconceived notions, and to design products that solved real problems rather than showcasing technical prowess.

Inclusive Product Development: Under Nadella, Microsoft invested in accessibility features, recognizing that inclusive design benefits everyone. The Xbox Adaptive Controller and Seeing AI app are examples of empathetic innovation.

Internal Relationships: Leaders were expected to build trust with teams, to demonstrate care, and to develop talent holistically.

Empathy also influenced how Microsoft responded to mistakes. Rather than assigning blame, the emphasis shifted to understanding root causes and improving systems.

- Growth Mindset

Nadella’s most enduring cultural contribution may be his embrace of Carol Dweck’s concept of growth mindset—the belief that abilities and intelligence can be developed through effort, feedback, and learning.

Before Nadella, Microsoft operated in a fixed mindset paradigm: employees competed to prove they were the smartest in the room. Success was often defined by positional power and defending one’s domain.

Nadella redefined success as learning faster than the competition. He introduced growth mindset as a unifying concept to describe the kind of culture Microsoft needed: one that prized experimentation, resilience, and curiosity.

This concept was not left abstract. The company operationalized it in several ways:

- In performance reviews, employees were recognized for how they contributed to others’

- Managers were trained to coach, rather than merely

- Leaders were encouraged to share their own learning journeys and

- The language of growth mindset permeated communications, from earnings calls to onboarding

Over time, this shift reframed how teams approached challenges. Failure became data. Questions became opportunities. And success was redefined as progress, not perfection.

The most remarkable aspect of embedding growth mindset was how it gradually changed the tone of Microsoft’s internal dialogue. Teams who once competed for credit began collaborating more openly. Product leaders became more willing to admit when features weren’t working. Senior executives began to praise experimentation over certainty.

One widely cited example was the Azure team’s pivot from an early, cautious approach to a more aggressive pursuit of developer adoption—even if it meant cannibalizing some existing Windows Server revenue. In the old Microsoft, such a move would have been politically impossible. Under Nadella, the emphasis on learning and long-term value created a more supportive environment for bold bets.

Microsoft also partnered directly with Carol Dweck to help leaders understand the nuances of fostering growth mindset. Training programs and leadership off-sites were redesigned to model curiosity, humility, and iterative thinking.

These efforts culminated in a cultural reframing: instead of trying to be a know-it-all organization, Microsoft would aspire to be a “learn-it-all” organization. This phrase, repeated in countless speeches and memos, became a mantra for how employees were expected to show up every day.

3.5 Simplifying Mission and Vision

Another hallmark of Nadella’s leadership was clarity of purpose. Under Ballmer, Microsoft had become a sprawling conglomerate, dabbling in everything from mobile phones to search engines to advertising. Without a clear north star, priorities often shifted with the latest competitive threat.

Nadella’s first major address as CEO distilled Microsoft’s ambition into a single sentence:

“Our mission is to empower every person and every organization on the planet to achieve more.”

This mission resonated because it was both expansive and specific. It conveyed that Microsoft’s job was not to own every technology stack but to build platforms and tools that helped others thrive. This purpose also served as a filter for decisions about where to invest and where to divest.

For example, this clarity underpinned the decision to eventually exit the smartphone hardware business. Nadella recognized that competing directly with Apple and Google in handset manufacturing distracted from Microsoft’s strengths in cloud services, productivity software, and enterprise tools. The same logic guided the company’s renewed focus on developer platforms and subscription models.

The simplicity of the mission made it memorable and actionable. Leaders across divisions could connect their daily work to the broader purpose. Employees who had struggled to articulate why their work mattered now had a unifying framework.

3.6 Reinventing Communication

He began holding regular town halls, where employees could ask questions directly. He published thoughtful, long-form emails that explained not just what decisions were made but why. He shared personal stories, including his experiences raising a son with disabilities, to illustrate empathy and vulnerability.

These practices humanized the CEO role and encouraged a more open dialogue throughout the company. Senior leaders began to model similar transparency in their own communications. The old Microsoft had prized certainty and bravado; the new Microsoft prized authenticity.

One senior executive described the shift this way:

“Satya doesn’t shout. He doesn’t threaten. He listens. He asks questions. And because of that, people feel heard. They feel respected.”

3.7 Rebuilding Trust with Developers

Under Nadella’s leadership, Microsoft began to repair its strained relationship with the global developer community. For years, the company had been viewed as controlling and dismissive of open source. Nadella’s approach was the opposite: to meet developers where they were, to contribute rather than dictate.

He signaled this shift decisively by announcing that .NET would become open source—a radical departure from decades of proprietary licensing. The acquisition of GitHub further cemented Microsoft’s commitment to supporting developers on their terms. Internally, leaders were encouraged to think beyond Windows-centric strategies and focus on building tools that worked across platforms.

This openness wasn’t just symbolic. It created practical incentives for developers to trust Microsoft again. Azure adoption accelerated as more teams realized that Microsoft was serious about interoperability. The cultural shift was so pronounced that former critics began praising the company’s authenticity.

3.8 Decentralizing Decision-Making

One of Nadella’s core beliefs was that innovation happens closest to the customer. To enable faster learning, he pushed decision-making authority deeper into the organization.

He reorganized business units to reduce layers of hierarchy. He encouraged product teams to own their P&Ls, set their own roadmaps, and iterate without waiting for headquarters’ approval.

This decentralization not only sped up product development but also empowered employees to take ownership. Leaders were accountable for outcomes rather than simply executing centrally imposed plans.

3.9 Balancing Innovation and Discipline

While Nadella championed experimentation, he also believed in rigorous operational discipline. He emphasized that growth mindset was not an excuse for sloppy execution. Teams were expected to measure progress, learn from data, and be accountable for results.

This balance—between freedom to innovate and discipline to deliver—became a cornerstone of Microsoft’s resurgence. Product teams had room to test bold ideas, but with clear expectations about timelines, customer impact, and financial performance.

3.10 Evolving Leadership Development

As part of his cultural transformation, Nadella recognized that Microsoft needed to develop a new generation of leaders who could model the behaviors he championed. He introduced three simple leadership principles that became central to talent development across the company:

- Create Clarity – Leaders were expected to articulate clear goals and priorities so teams could focus their energy on what mattered most.

- Generate Energy – They needed to inspire and motivate teams, fostering a sense of purpose and

- Deliver Success – Leaders were accountable for achieving results and learning from

Microsoft invested in redesigned training programs, mentoring, and leadership coaching to embed these principles. Managers were encouraged to be more collaborative, empathetic, and open to feedback. The emphasis shifted away from positional authority and toward inclusive leadership that empowered teams to innovate.

This approach helped create a leadership culture aligned with the company’s new mission and mindset, ensuring that change would be sustained over the long term.

4. Strategic Shifts Under Nadella

4.1 From Cultural Renewal to Strategic Redirection

While Satya Nadella’s cultural transformation of Microsoft provided the philosophical and behavioral foundation for renewal, it was his bold strategic shifts that translated these values into enduring business outcomes. Leadership at scale requires not only shaping the internal narrative of a company but also redefining its position in the market. Nadella did both.

Under his leadership, Microsoft transitioned from a PC-centric software company to a cloud-first, platform- agnostic, developer-friendly ecosystem. It shifted from defending legacy franchises to building new growth engines. These shifts were not random or opportunistic; they reflected a deeply consistent vision of empowering customers and democratizing access to technology—whether through cloud infrastructure, productivity software, open-source contributions, or enterprise partnerships.

4.2 Pivot to Cloud: Azure as the Growth Engine

When Nadella took the helm, Amazon Web Services (AWS) was the undisputed leader in cloud infrastructure. Microsoft’s own cloud platform, Azure, existed but was trailing significantly in adoption, visibility, and capabilities. One of Nadella’s first—and most consequential—moves was to make Azure the centerpiece of Microsoft’s growth strategy.

Cloud-First Mindset

Nadella declared Microsoft a “cloud-first, mobile-first” company, signaling that all future product development would prioritize cloud scalability, integration, and services. This was not simply a branding change—it meant aligning sales incentives, engineering resources, marketing, and customer success efforts around Azure.Azure evolved from an experimental offering into a robust, global platform supporting enterprise workloads, hybrid deployments, AI services, and developer tools. Microsoft invested billions in expanding Azure data centers across continents, enabling it to meet latency, compliance, and redundancy requirements for governments and multinational corporations alike.

Shifting Revenue Models

The cloud strategy also marked a shift in Microsoft’s revenue model—from perpetual software licenses to recurring, subscription-based revenue. This offered predictable cash flows and deeper customer relationships. Products like Office 365 and Dynamics 365 were integrated with Azure to create comprehensive cloud-based ecosystems.By 2021, Microsoft’s Intelligent Cloud segment, anchored by Azure, had surpassed all others in revenue contribution, validating the strategic bet and fundamentally altering the company’s growth trajectory.

4.3 Embracing Open Source and Interoperability

Perhaps the most surprising—and symbolic—strategic shift under Nadella was Microsoft’s embrace of open- source software. For decades, the company had viewed open-source as a threat to its proprietary licensing model. Executives once famously referred to Linux as “a cancer.”

Nadella reversed this stance completely. His belief: “Microsoft loves Linux.” This was more than a marketing slogan—it reflected a genuine philosophical shift about where value resides in the modern software economy.

Tangible Commitments

- .NET Core was open-sourced, allowing developers to build cross-platform

- Microsoft became one of the top contributors to GitHub, eventually acquiring the platform for $7.5 billion in 2018.

- The Windows Subsystem for Linux (WSL) allowed developers to run Linux inside Windows environments natively.

- Azure embraced multi-cloud and hybrid cloud strategies, enabling customers to build and deploy open-source software seamlessly.

These moves won back developer trust and allowed Microsoft to compete effectively for the enterprise workloads driving cloud adoption.

4.4 Reimagining Office and Productivity

Another strategic transformation involved reimagining Office, Microsoft’s crown jewel, as a cloud-native productivity suite. Under Ballmer, Office had been sold as a licensed package. Nadella shifted the focus to Office 365, a subscription model that allowed continuous updates, mobility, collaboration, and integration with other tools.The transformation went beyond pricing:

- Office was redesigned for mobile, with native apps for iOS and

- Collaboration features like Teams, OneDrive, and SharePoint were deeply

- Microsoft introduced Power Platform (Power BI, Power Apps, Power Automate) to empower business users to create apps and dashboards without coding.

This modern, cloud-first Office suite drove recurring revenue, increased stickiness, and positioned Microsoft as a leader in workplace transformation—especially during the remote work surge of the COVID-19 pandemic.

4.5 The Rise of Microsoft Teams

Few products epitomize Nadella’s strategic instincts better than Microsoft Teams. Launched in 2017, Teams was initially seen as a response to Slack. But Nadella’s vision was broader: to create a centralized hub for teamwork, integrating chat, video conferencing, document collaboration, and business applications.

By embedding Teams deeply within Office 365 and Azure, Microsoft ensured rapid adoption. The product became central to remote work infrastructure, especially during the pandemic. Its tight integration with Microsoft’s broader ecosystem allowed Teams to displace Zoom and Slack in many enterprise settings.

By 2022, Teams had over 280 million monthly active users, making it one of Microsoft’s fastest-growing products and a linchpin of its productivity suite.

4.6 Strategic Acquisitions and Ecosystem Expansion

A hallmark of Satya Nadella’s leadership has been a thoughtful, long-term approach to acquisitions, designed to strengthen Microsoft’s ecosystem across productivity, cloud, gaming, and AI. Unlike previous eras, where acquisitions sometimes lacked clear integration or purpose, Nadella’s strategy emphasized coherence and alignment with the company’s mission: empowering every person and organization to achieve more.

Rather than merely accumulating assets, these deals were meant to fill capability gaps, accelerate growth in priority areas, and create enduring network effects. Each major acquisition built upon the cultural shift toward openness, collaboration, and learning.

LinkedIn (2016)

One of Nadella’s boldest moves was acquiring LinkedIn for $26.2 billion, Microsoft’s largest deal to date. While some questioned the price tag, Nadella envisioned LinkedIn as a way to connect Microsoft’s productivity software with the world’s largest professional network.

This integration allowed Microsoft to:

- Embed LinkedIn data into Office 365 and Dynamics

- Offer richer insights to enterprise

- Cross-sell advertising and subscription

Importantly, Nadella kept LinkedIn’s brand and culture largely intact, a sign of his respect for the platform’s autonomy and strengths.

GitHub (2018)

The $7.5 billion purchase of GitHub symbolized Microsoft’s cultural reinvention. GitHub was the world’s most popular platform for developers to share and collaborate on code, but it also embodied the open-source ethos that Microsoft had historically resisted.

Under Nadella, acquiring GitHub sent a clear signal: Microsoft was no longer an adversary to open source but a committed participant. The company pledged to keep GitHub independent and platform-neutral, reassuring developers and boosting trust.This strategic move strengthened Azure’s appeal to developers and demonstrated that Microsoft understood where innovation was happening.

Nuance Communications (2021)

Microsoft’s acquisition of Nuance for nearly $20 billion advanced its ambitions in AI, healthcare, and speech recognition. Nuance’s technology was already embedded in electronic health records and contact centers.By bringing Nuance into the fold, Microsoft gained:

- Industry-leading conversational AI

- Deep domain expertise in healthcare

- New opportunities to integrate speech services into Azure and

The deal positioned Microsoft to help hospitals digitize records, improve clinician productivity, and enable more natural user experiences across industries.

ZeniMax Media / Bethesda (2020)

In gaming, Microsoft acquired ZeniMax Media, parent of Bethesda Softworks, for $7.5 billion. This deal added blockbuster franchises such as The Elder Scrolls, Fallout, and Doom to the Xbox portfolio.

The acquisition was more than an IP grab. It supported:

- Strengthening Xbox Game Pass by offering exclusive

- Building a content moat against competitors like

- Expanding Microsoft’s footprint in gaming

With gaming increasingly seen as a pillar of consumer engagement and cloud services, Bethesda’s franchises enhanced both Xbox’s value proposition and Microsoft’s broader entertainment strategy.

Activision Blizzard (2023)

Perhaps the most ambitious move is Microsoft’s proposed $69 billion acquisition of Activision Blizzard, announced in 2022. If completed, it would be the largest gaming deal ever.Strategically, the acquisition aims to:

- Expand Microsoft’s reach in mobile gaming via Activision’s King division (Candy Crush).

- Strengthen franchises like Call of Duty and World of Warcraft.

- Accelerate Microsoft’s vision for the metaverse—immersive, interactive digital

While still under regulatory review, this deal underscores Nadella’s conviction that gaming is central to Microsoft’s future.

4.7 Windows and Hardware

While previous CEOs made Windows the centerpiece of Microsoft’s identity, Nadella took a pragmatic view. He recognized that mobile and cloud had eroded Windows’ strategic centrality.

Rather than trying to compete directly with Apple and Android in smartphones, Nadella shut down the Windows Phone business. He instead doubled down on integrating Microsoft services into other platforms— including releasing Office for iPad and Android, something previously considered unthinkable.

On the hardware side, Surface evolved from a niche experiment into a respected premium brand, but Nadella made clear it existed to showcase innovation, not to dominate market share.

This flexibility allowed Microsoft to redirect focus and resources toward platforms with more growth potential—especially Azure and Teams.

4.8 Gaming and the Future of Entertainment

Among all the strategic pivots Satya Nadella has overseen at Microsoft, few are as emblematic of the company’s long-term ambition—and willingness to reinvent itself—as its renewed focus on gaming and interactive entertainment. While gaming had long been a part of Microsoft’s consumer identity through Xbox, under Nadella it evolved into a core pillar of growth, innovation, and cultural relevance.This evolution was neither accidental nor incremental. Nadella recognized early that gaming was no longer a niche hobby but a powerful driver of technological adoption and community formation. He saw gaming as an arena where cloud computing, subscription models, hardware innovation, and content ecosystems could all converge—offering lessons for Microsoft’s broader platform strategy.

Before Nadella became CEO, Microsoft’s gaming business had notable successes but also significant challenges. The original Xbox and Xbox 360 established a strong foothold in consoles, but the Xbox One era stumbled due to mixed messaging, an initial focus on TV integration over gaming, and a lack of exclusive titles compared to Sony’s PlayStation.This left Xbox in a vulnerable position. In many markets, PlayStation had clear dominance, and Nintendo retained powerful franchises that consistently captured consumer attention. At the same time, the rise of mobile gaming and free-to-play models disrupted traditional console economics.

When Nadella took over, there was speculation that Microsoft might divest or scale back its gaming ambitions. Instead, he chose to double down on gaming as a strategic bet—one that could unify cloud services, subscription revenue, and consumer engagement.

Gaming as a Strategic Growth Pillar: Nadella’s approach to gaming was based on several interlocking convictions:

Gaming drives hardware and cloud innovation:Cloud services like Azure could power multiplayer infrastructure, game streaming, and cross-device experiences.

Gaming communities are among the most loyal and engaged:Retaining gamers creates sticky ecosystems that drive recurring revenue.

Content is king:Exclusive franchises and beloved IP are essential to differentiation.

Subscription models are the future:Just as Office 365 transformed productivity software, recurring subscriptions could reshape how players access games.

Building Xbox Game Pass

One of Nadella’s most transformative initiatives was the launch of Xbox Game Pass in 2017. Instead of requiring players to buy individual titles, Game Pass offered access to a large, rotating library of games for a monthly fee.Game Pass was a bold bet for several reasons:

- It challenged traditional retail and digital purchase

- It required Microsoft to commit significant resources to licensing and developing a large

- It risked cannibalizing one-time

Yet Nadella and Xbox chief Phil Spencer believed subscription access could expand the gaming audience, smooth revenue, and reinforce loyalty.By 2023, Game Pass had surpassed 25 million subscribers, becoming a cornerstone of Xbox strategy. It demonstrated that subscription models could thrive even in markets long dominated by a la carte purchases.

Expanding Cloud Gaming

Complementing Game Pass was Microsoft’s investment in cloud gaming. The company launched Project xCloud, enabling players to stream console-quality games to smartphones, tablets, and PCs.

This initiative was rooted in several strategic objectives:

- Making Xbox content accessible to billions of devices, not just

- Reducing friction for new players who lack expensive

- Strengthening Azure as the infrastructure backbone of

Cloud gaming also anticipated shifts in consumer expectations—where on-demand access, portability, and instant play become the norm.

Strategic Acquisitions: Building a Content Moat

Under Nadella, Microsoft invested heavily in acquiring studios and content to fuel its gaming ambitions. The logic was clear: exclusive, high-quality content drives platform adoption.

Key acquisitions included:

- Mojang (Minecraft): While acquired before Nadella became CEO, Minecraft’s success validated the potential of cross-platform communities.

- ZeniMax Media / Bethesda (2020): This $7.5 billion deal brought iconic franchises like The Elder Scrolls, Fallout, and Doom into the Xbox ecosystem.

- Obsidian Entertainment, Playground Games, Ninja Theory, Double Fine: Smaller studios known for creative, critically acclaimed titles.

- Activision Blizzard (2023): The $69 billion bid—if completed—would be the largest gaming acquisition ever, adding Call of Duty, World of Warcraft, and Candy Crush to Microsoft’s

These acquisitions reflected Nadella’s recognition that owning premium content is the most defensible competitive advantage in gaming.

Strengthening Gaming Ecosystems

Nadella also supported initiatives to make Xbox a more inclusive and accessible platform:

- Backward Compatibility: Allowing players to access titles from older

- Cross-Platform Play: Breaking down barriers between Xbox, PC, and other

- Accessibility Features: Innovations like the Xbox Adaptive Controller demonstrated a commitment to serving all gamers.

These efforts enhanced Microsoft’s reputation and underscored its mission of empowerment.

The Metaverse and the Future of Interactive Entertainment

Looking forward, Nadella sees gaming as central to Microsoft’s ambitions in the metaverse—immersive digital environments where people work, play, and socialize.In earnings calls and interviews, he has described gaming as a precursor to the metaverse:

“When we think about our vision for what a metaverse can be, we see gaming as the most dynamic and exciting part.”

The Activision Blizzard acquisition is in part a metaverse bet—an investment in content, communities, and capabilities that will shape how people engage in virtual worlds.

Nadella’s approach to gaming exemplifies his broader philosophy: combining technology, content, and community to create platforms that empower and delight.Where others saw gaming as entertainment, Nadella saw an opportunity to redefine how people experience technology. By investing in subscriptions, cloud infrastructure, and inclusive design, he positioned Microsoft not just to compete in gaming but to help shape the future of digital interaction itself.

4.9 Security as a Strategic Differentiator

In the past decade, as cloud computing, remote work, and digital transformation have accelerated, cybersecurity has become one of the most critical concerns facing enterprises, governments, and consumers alike. Under Satya Nadella, Microsoft made security not just a feature of its products but a core strategic pillar—an area of investment, differentiation, and trust-building that has become essential to its competitive positioning.This focus on security reflects Nadella’s broader philosophy: that in an interconnected world, empowering customers requires more than delivering functionality—it requires protecting data, identities, and digital infrastructure against increasingly sophisticated threats.

When Nadella took over, Microsoft was already a major enterprise IT provider, but the security environment was becoming more complex every year:

- Cloud Adoption: As organizations moved workloads to the cloud, securing distributed systems became more difficult.

- Advanced Persistent Threats: State-sponsored actors, ransomware gangs, and organized cybercriminals were launching large-scale, targeted attacks.

- Identity Compromise: Password reuse and phishing created vulnerabilities across applications and

- Regulatory Pressure: GDPR, HIPAA, and other regulations increased compliance

- Remote Work: The pandemic forced rapid shifts to home offices, amplifying endpoint and network

In this context, Nadella saw an opportunity: if Microsoft could demonstrate leadership in security, it could earn the trust required to grow its cloud and productivity platforms.

Investing in Security Capabilities

To meet this challenge, Microsoft invested aggressively in security research, engineering, and acquisitions:

Annual Security Budget: The company committed over $1 billion annually to cybersecurity investments. Over time, this figure grew even larger as threats evolved.

Dedicated Security Teams: More than 8,500 security experts were tasked with defending Microsoft’s platforms and helping customers protect their environments.

Threat Intelligence: Microsoft created one of the largest security intelligence networks in the world, analyzing

24 trillion security signals daily from Windows, Azure, Office 365, Xbox, and partner ecosystems.

These investments allowed Microsoft to build a comprehensive, integrated security portfolio that went far beyond antivirus software.

From Products to Platforms

Under Nadella, security became a platform capability woven throughout the Microsoft ecosystem:

- Azure Security Center: Provided unified security management and threat protection across hybrid cloud workloads.

- Microsoft Defender: Evolved into an end-to-end suite protecting endpoints, identities, email, and cloud

- Azure Active Directory: Became the backbone of identity and access management, including multi- factor authentication and conditional access policies.

- Microsoft Information Protection: Helped organizations classify and protect sensitive

- Compliance Manager: Enabled automated assessments of regulatory

- SIEM and XDR: Microsoft launched Azure Sentinel (Security Information and Event Management) and extended detection and response (XDR) capabilities to integrate signals across environments.

This comprehensive approach was a marked departure from traditional point solutions. Instead of requiring customers to stitch together multiple vendors, Microsoft could offer a single, integrated security stack.

Zero Trust Architecture

As attacks became more sophisticated, Microsoft championed the concept of Zero Trust Security—a model based on the principle that no user or device should be inherently trusted, whether inside or outside the network perimeter. Nadella described Zero Trust as a “core mindset shift” and embedded its principles across product design:

- Verify Explicitly: Always authenticate and authorize based on all available data

- Use Least Privilege Access: Limit user permissions to minimize potential

- Assume Breach: Design systems to limit the blast radius when attackers

By aligning product roadmaps to Zero Trust, Microsoft positioned itself as a thought leader and practical enabler of next-generation security.

Security as a Competitive Advantage

Nadella recognized that trust would be a deciding factor in enterprise technology decisions. As more organizations moved critical workloads to the cloud, they needed assurance that their data and infrastructure

would remain secure.By embedding security into Azure, Office, Windows, and Dynamics, Microsoft differentiated itself from rivals:

- AWS: While dominant in cloud infrastructure, AWS was perceived as providing fewer out-of-the-box security integrations.

- Google Cloud: Had strong capabilities but lagged in enterprise adoption and ecosystem

- Specialist Vendors: While companies like CrowdStrike, Palo Alto Networks, and Okta offered powerful point solutions, Microsoft’s value proposition was holistic protection across identities, endpoints, data, and apps.

This integration resonated with CISOs seeking simplicity in an increasingly fragmented security landscape.

Customer Outcomes and Market Impact

Microsoft’s security focus has delivered tangible outcomes:

- Revenue Growth: By 2022, Microsoft’s security business surpassed $15 billion in annual revenue, making it the world’s largest security vendor by revenue.

- Customer Adoption: Over 400,000 customers, including most of the Fortune 500, used Microsoft security solutions.

- Innovation Leadership: Gartner, Forrester, and IDC consistently ranked Microsoft as a leader in multiple security categories.

This scale and credibility gave Microsoft unique leverage—security not only protected customers but also created lock-in across the broader Microsoft ecosystem.

Proactive Response to Incidents

Under Nadella, Microsoft also transformed its approach to security incidents. Rather than deflect blame, the company adopted a transparent, learning-oriented posture. For example:

- During the SolarWinds attack, Microsoft played a central role in analyzing and mitigating the supply chain compromise, sharing intelligence with the community.

- When vulnerabilities like PrintNightmare or Exchange Server flaws emerged, Microsoft rapidly released patches and guidance.

This responsiveness reinforced trust and underscored the company’s commitment to continuous improvement.

Customer Outcomes and Market Impact

Microsoft’s security focus has delivered tangible outcomes:

- Revenue Growth: By 2022, Microsoft’s security business surpassed $15 billion in annual revenue, making it the world’s largest security vendor by revenue.

- Customer Adoption: Over 400,000 customers, including most of the Fortune 500, used Microsoft security solutions.

- Innovation Leadership: Gartner, Forrester, and IDC consistently ranked Microsoft as a leader in multiple security categories.

This scale and credibility gave Microsoft unique leverage—security not only protected customers but also created lock-in across the broader Microsoft ecosystem.

Proactive Response to Incidents

Under Nadella, Microsoft also transformed its approach to security incidents. Rather than deflect blame, the company adopted a transparent, learning-oriented posture. For example:

- During the SolarWinds attack, Microsoft played a central role in analyzing and mitigating the supply chain compromise, sharing intelligence with the community.

- When vulnerabilities like PrintNightmare or Exchange Server flaws emerged, Microsoft rapidly released patches and guidance.

This responsiveness reinforced trust and underscored the company’s commitment to continuous improvement.

Security Culture

Internally, Nadella emphasized that security was everyone’s responsibility. Security awareness training became a core part of employee onboarding. Developers were trained in secure coding practices. Leadership reviews regularly included security metrics.Nadella described this cultural shift succinctly:

“You can’t separate security from innovation. They have to move together.” This mindset reframed security as an enabler—not an obstacle—to delivering new value. Security and the Future

Looking ahead, Nadella views security as central to Microsoft’s long-term strategy:

- Hybrid Work: As employees work from anywhere, security will increasingly depend on identity, device health, and continuous verification.

- IoT and Edge: Securing billions of connected devices requires scalable, automated

- AI: Both a source of new defense capabilities and a potential threat

- Regulation: Data sovereignty, privacy laws, and compliance obligations will only

By building security into the foundation of its products, Microsoft aims to stay ahead of evolving risks—and continue earning customer trust.

Satya Nadella’s decision to make security a strategic differentiator was as much about values as it was about business. In a world where technology permeates every aspect of life, trust is the ultimate competitive advantage.By investing in comprehensive protection, pioneering Zero Trust principles, and fostering a culture of accountability, Nadella transformed security from a defensive necessity into a proactive driver of innovation, differentiation, and growth.

5. Cultural Transformation

When Satya Nadella assumed the CEO role in 2014, Microsoft was in the midst of an identity crisis. It had the cash reserves, the market presence, and an army of skilled engineers, but something fundamental was broken: the company’s culture.Under previous leadership, Microsoft’s culture had often been described as combative, hierarchical, and internally competitive to the point of dysfunction. The famous “stack ranking” system pitted colleagues against each other, creating fear and resentment. Innovation was hampered by silos, and talented people left rather than fight endless battles over turf and credit.Nadella recognized that no strategy—no matter how brilliant—would succeed without first addressing this cultural decay. He believed that culture is not one aspect of the game; it is the game.The cultural transformation he led was not about slogans or perks. It was about replacing old habits of fear and rivalry with new habits of learning, empathy, and collaboration.

5.1 Diagnosing the Problem:

In his early listening tours, Nadella heard a consistent refrain: talented employees felt demoralized by the infighting and blame-shifting. Many teams operated as isolated kingdoms. People measured their success by how much they could control rather than how much they contributed.Microsoft’s culture had become risk- averse. The company clung to Windows and Office as the only proven playbooks, even as the market shifted to mobile and cloud.Nadella summed up the mindset this way:

“We were a know-it-all culture. We needed to become a learn-it-all culture.”

This diagnosis was candid and powerful. By naming the problem, he created space to address it.

5.2 A New Leadership Tone

From day one, Nadella modeled vulnerability and humility. He didn’t pretend to have all the answers. In executive meetings, he asked open-ended questions instead of delivering monologues. He listened before making decisions.

This tone was transformative. For employees used to fear-based management, seeing the CEO openly admit what he didn’t know was liberating.

One senior leader later said:

“Satya changed the conversation. Suddenly, it was okay to say, ‘I’m still learning.’”

Nadella also brought empathy to the forefront. His personal experience raising a son with disabilities taught him to see the world through others’ eyes. He believed empathy was not only a personal value but a professional strength—key to designing products people truly needed.

5.3 Embracing Growth Mindset

To reorient the company around learning, Nadella introduced the concept of growth mindset, inspired by psychologist Carol Dweck’s work.Growth mindset teaches that skills and intelligence are not fixed but can be developed through effort, feedback, and curiosity. In contrast, a fixed mindset treats abilities as static and resists risk for fear of failure.

Nadella wanted employees to embrace experimentation. Failure was to be treated not as proof of inadequacy but as data to improve.

To embed this mindset, Microsoft:

- Redesigned performance reviews to reward collaboration and

- Replaced stack ranking with more holistic

- Trained managers to coach instead of

- Publicly celebrated examples of teams that learned from

This shift was foundational. It encouraged people to ask better questions, take smart risks, and share knowledge across teams.

5.4 Breaking Down Silos

One of the most visible legacies of Microsoft’s old culture was the rivalry between divisions. For example, Windows and Office often acted as separate empires. Teams would duplicate work or sabotage each other to protect their budgets.

Nadella was determined to break these silos. He restructured the leadership team, placing collaborative leaders in key roles. He created shared goals that required different product groups to work together.

Under his watch, the Windows team began working more closely with Azure. Office was reimagined as part of a broader productivity cloud. Even Xbox, once treated as an outlier, became a proving ground for innovation that benefitted the entire company.

5.5 Leadership Development and Accountability

Empowering a New Generation of Leaders at Microsoft

One of the most profound shifts Satya Nadella initiated after becoming CEO was a complete rethinking of what it meant to be a leader at Microsoft. Culture could not be transformed through words alone; it required new models of leadership and a systematic approach to developing individuals who could carry and reinforce the company’s evolving values. Nadella understood that leaders are the cultural carriers of an organization. If Microsoft was to change from within, the change had to begin at the top—and be sustained at every level of management.At the time of Nadella’s appointment, Microsoft’s leadership ranks were heavily shaped by legacy systems of evaluation that rewarded technical expertise and individual accomplishment—often at the expense of emotional intelligence, collaboration, and employee development. The combative “stack ranking” culture had fostered a climate in which leaders competed rather than collaborated, often managing through fear rather than trust. This led to siloed decision-making, low morale, and disjointed execution.

Nadella’s vision required a complete reversal of this mindset. He believed that leaders should empower others to succeed, create psychological safety, and act as stewards of long-term growth. He set out to redefine Microsoft’s leadership model from one based on control and performance metrics to one based on coaching, clarity, and compassion.

Shifting Leadership Values: The Three Core Principles

To embed this transformation, Nadella introduced a new leadership framework centered around three deceptively simple but deeply powerful principles:

- Create Clarity

- Generate Energy

- Deliver Success

These principles became the foundation for how leaders were selected, promoted, trained, and evaluated.

- Create Clarity emphasized that leaders must cut through complexity and help teams focus on what matters In a massive organization like Microsoft, ambiguity was common, and leaders were now expected to act as signal-beacons—not noise amplifiers.

- Generate Energy recognized that leadership was not about commanding attention but about inspiring teams. It meant showing up with passion, recognizing contributions, and creating an environment where others could thrive.

- Deliver Success reinforced that leaders are accountable for outcomes—but not at any Success needed to be sustainable, ethical, and aligned with Microsoft’s mission to empower people and organizations.

These principles were more than motivational posters. They were operationalized across Microsoft’s HR and talent systems—from recruitment to development, from 360-degree feedback to executive coaching.

Embedding Coaching into the Leadership Fabric

One of the most radical changes was the shift from “manager-as-boss” to “manager-as-coach.” Microsoft invested heavily in leadership development programs that trained managers to listen, ask powerful questions, give constructive feedback, and remove roadblocks rather than dictate action.

The company partnered with leading thinkers in organizational psychology and coaching to build immersive experiences for senior and mid-level managers. These programs emphasized:

- Empathetic listening

- Unbiased performance conversations

- Feedback loops grounded in trust

- Growth mindset reinforcement

Managers learned to hold space for failure, helping teams treat setbacks as learning opportunities rather than performance failures. These behaviors were essential for building the risk-taking and innovation culture that Nadella envisioned.

Accountability without Fear

Importantly, Nadella did not eliminate accountability—he redefined it. Under his leadership, accountability meant being responsible for both outcomes and the way those outcomes were achieved. Leaders were not just measured by results but by how they delivered those results.

- Did they build collaborative relationships?

- Did they enable learning within their teams?

- Did they elevate the voices of others?

This subtle but powerful reframing shifted incentives. Toxic high-performers were no longer tolerated. Leaders who made teams worse—no matter their results—were removed or redirected. Those who modeled humility, encouraged diversity of thought, and built inclusive environments were recognized and promoted.

This also created a psychologically safe culture—one where employees felt secure in speaking up, experimenting, and questioning assumptions. Psychological safety, according to research by Amy Edmondson and Google’s Project Aristotle, is one of the key predictors of high-performing teams. Nadella’s leadership embraced this insight and baked it into Microsoft’s DNA.

Performance Management Overhaul

Microsoft retired its infamous stack ranking system, which had long forced managers to label a fixed percentage of employees as low performers. This system had promoted internal politics and fear-based motivation.

Under Nadella, performance management was reimagined to emphasize impact, learning, and collaboration. New review systems asked questions like:

- How did you help others grow?

- How did you seek feedback?

- What did you learn this year?

- How did you contribute to the success of the whole organization?

This new review process encouraged reflection, self-awareness, and forward-looking growth—essential elements of a truly transformed culture.

Promoting Inclusive Leadership

Another major focus was building diverse and inclusive leadership pipelines. Nadella pushed for better gender representation, greater ethnic diversity, and more inclusive hiring practices. He encouraged leaders to build teams that reflected the global audiences Microsoft served.

Inclusion became a core leadership expectation, not a side initiative. Microsoft tied parts of executive compensation to diversity goals. Leaders who failed to support DEI (Diversity, Equity & Inclusion) initiatives risked being sidelined.

Moreover, inclusive leadership training was integrated into all levels of management development. Leaders learned how to identify unconscious bias, how to lead across cultures, and how to amplify underrepresented voices in meetings and projects.

A Ripple Effect: Scaling Leadership Globally

With over 220,000 employees globally, Microsoft couldn’t rely solely on top-down leadership to drive culture. Nadella’s model depended on scaling leadership at every level—from team leads to VPs to regional heads.

The company launched internal platforms for storytelling, knowledge-sharing, and recognition. Managers were encouraged to share success stories about learning, vulnerability, and transformation, creating a ripple effect of positive change.

A New Generation of Empowering Leaders

The shift in leadership development produced measurable and visible results:

- Internal promotion rates improved, with more diverse candidates moving into senior

- Employee engagement scores increased, particularly around trust in leadership and opportunities for

- Retention of top talent improved, especially among women and underrepresented

- Microsoft began to be recognized globally for its inclusive, purpose-driven leadership style— becoming a model for others in the tech industry.

Perhaps most importantly, leadership at Microsoft became a force for culture, not a barrier to it. Managers began to act not just as deliverers of business outcomes, but as enablers of purpose, trust, and innovation.

In transforming Microsoft, Nadella didn’t just change how the company built software—he changed how it built leaders. By embedding values like empathy, curiosity, and accountability into the heart of leadership development, he ensured that culture would scale across the enterprise.

6. Embracing Open Source

If you had told developers in the early 2000s that Microsoft would one day become the largest contributor to open-source projects on GitHub, most would have laughed—or recoiled in disbelief.For decades, Microsoft’s identity was rooted in proprietary software, protected intellectual property, and the conviction that its dominance depended on control over platforms and code. In fact, in 2001, then-CEO Steve Ballmer famously

described Linux—an open-source operating system—as a “cancer” that threatened to “attach itself in an intellectual property sense to everything it touches.”

This combative stance reflected not only a business model but a cultural ethos: the belief that openness diluted value, that free software was inherently unsustainable, and that winning meant defending proprietary standards at all costs.When Satya Nadella became CEO in 2014, the world had changed, but many parts of Microsoft had not. Open-source ecosystems had become the engines of modern software innovation—powering everything from mobile apps to cloud infrastructure. Startups, enterprises, and even governments expected vendors to support and integrate with open-source tools.

Nadella understood that if Microsoft failed to adapt, it would risk irrelevance among developers and lose credibility as a partner in the new era of software development.His approach to open source was neither a superficial marketing ploy nor a reluctant concession. It was a strategic and cultural transformation that reframed openness as a catalyst for innovation and a foundation for growth.

6.1 The Historical Antagonism

To appreciate the scale of this transformation, it is important to understand how deep Microsoft’s antagonism toward open source had run.

Windows and the Wintel Monopoly

Throughout the 1990s and early 2000s, Microsoft’s dominance of the PC market was anchored in the “Wintel” alliance—Windows operating systems on Intel processors. The Windows platform became a fortress of proprietary APIs and interfaces. Developers were incentivized—sometimes compelled—to build exclusively for Windows, reinforcing the ecosystem’s strength and fending off competitive encroachment.

Open-source alternatives such as Linux, Apache, MySQL, and PHP were dismissed as fringe technologies or threats to be neutralized. Microsoft invested heavily in proprietary frameworks like .NET, and internal culture treated open source with suspicion or outright hostility.

The Legal Wars

Microsoft’s antagonism extended beyond rhetoric. The company engaged in protracted legal and lobbying efforts against open-source adoption in government contracts and enterprise procurement. Patent litigation became a tool to assert control and dissuade adoption of competing technologies.

This combative approach damaged Microsoft’s reputation among developers and open-source communities, who saw the company as an aggressor more interested in control than collaboration.

6.2 The Strategic Imperative to Change

By the early 2010s, the ground had shifted decisively:

- Cloud platforms like AWS and Google Cloud embraced open-source tools to attract

- Linux emerged as the dominant operating system for cloud

- Enterprises began demanding interoperability and openness in vendor

- The startup ecosystem built on open-source frameworks began outpacing traditional enterprise software vendors in innovation.

In parallel, Microsoft’s dependence on Windows was eroding. Mobile, cloud, and platform-agnostic services were reshaping how businesses consumed technology.

When Nadella took over, he saw that open source was no longer a fringe movement—it was the default mode of innovation.

He also understood that reengaging developers would be critical to Microsoft’s growth in cloud computing and subscription-based services. Rebuilding trust meant acknowledging past mistakes, demonstrating genuine commitment, and rethinking Microsoft’s role in the software ecosystem.

6.3 Declaring a New Philosophy

One of Nadella’s most striking early statements was simple but symbolic:

“Microsoft loves Linux.”

These words, delivered during a keynote announcing expanded Linux support on Azure, were more than a headline—they were an olive branch. Nadella recognized that the first step in rebuilding credibility was signaling respect for developers’ choices.

This philosophy was embedded into product strategy, partnerships, and the company’s cultural narrative:

- Choice and interoperability became guiding

- Windows would no longer be the sole center of

- Azure would support any workload, not just Microsoft-native

- Developer happiness became a priority

Internally, this shift challenged deep-seated assumptions. Some long-time employees struggled to reconcile decades of hostility with the new embrace of openness. But Nadella was consistent: if Microsoft was to lead again, it had to be the best platform for every developer—not just Windows loyalists.

6.4 Azure and Linux: A Pragmatic Embrace

Perhaps the clearest signal that Nadella’s Microsoft was serious about open source came from its deep integration of Linux within Azure, Microsoft’s cloud platform. Traditionally, Linux and Windows were viewed as rivals, especially in enterprise infrastructure. But Nadella and his cloud leadership team recognized that if Azure was to compete with AWS and Google Cloud, it had to welcome Linux, not fight it.

Within a few years, Microsoft went from opposing Linux to supporting and optimizing it across nearly every layer of Azure:

- More than 50% of Azure workloads now run on Linux, not

- Microsoft partnered with Linux distributions such as Red Hat, SUSE, and Ubuntu to ensure seamless performance on Azure.

- It developed its own Linux kernel for Azure Sphere, a security-focused IoT

- Azure Kubernetes Service (AKS) became one of the most robust managed container services on the market, supporting open-source tools like Docker, Helm, and Prometheus.

This wasn’t just symbolic. It was practical. Microsoft’s enterprise customers were demanding Linux-based solutions for flexibility, scalability, and performance. Instead of trying to convert them to Windows, Nadella’s Microsoft met them where they were.By treating Linux not as a threat but as an equal citizen in its ecosystem, Microsoft showed developers and CIOs alike that it was serious about interoperability and cloud neutrality.

6.5 Open-Sourcing .NET and Other Key Projects

For Microsoft to fully embrace open source, it had to go beyond using community tools—it had to release its own crown jewels. Under Nadella, Microsoft began open-sourcing core components of its developer stack, including:

- .NET Core: The open-source, cross-platform version of Microsoft’s core development framework. It allowed developers to build and deploy on Windows, Linux, and macOS with no licensing

- PowerShell: Microsoft’s scripting and automation language, now available on Linux and

- Visual Studio Code (VS Code): A lightweight, open-source code editor that quickly became one of the most popular developer tools in the world.

- TypeScript: A superset of JavaScript developed by Microsoft and released as open source, now widely used in modern web development.

Each of these moves reflected a profound cultural shift. Instead of hoarding innovation behind paywalls or platform lock-in, Microsoft chose to contribute value to the broader developer community—and let trust drive adoption.

This approach also allowed Microsoft to build credibility with younger developers, many of whom had never used Windows professionally but now encountered Microsoft through GitHub, VS Code, or TypeScript.

6.6 Developer Ecosystem Rebirth

Nadella’s open-source strategy wasn’t just about symbolic moves or major acquisitions. It was about rebuilding relationships with a community that had long felt alienated. Microsoft began sponsoring major open-source conferences, contributing to popular projects like Kubernetes and Python, and joining key foundations:

- Joined the Linux Foundation as a Platinum

- Became a founding member of the .NET Foundation to oversee open

- Contributed to and adopted Kubernetes, OpenTelemetry, GraphQL, and many

- Released documentation and learning content under open

More importantly, Microsoft encouraged its own engineers to become open-source contributors—not as side projects, but as part of their jobs. GitHub activity from Microsoft employees surged, and the company consistently ranked among the top contributors to open-source projects globally.The company also launched Microsoft Learn, a free, open-access learning platform that made it easier for developers worldwide to build skills across Azure, .NET, and open-source stacks.

By changing its posture—from gatekeeper to collaborator—Microsoft rebuilt its credibility and helped create an ecosystem where developers came back willingly.

6.7 Open Source and Business Strategy

For Satya Nadella, embracing open source was never merely a goodwill gesture—it was also a deliberate strategic lever to accelerate Microsoft’s transformation into a cloud-first, developer-centric company.By making Azure the most open cloud platform, Microsoft could attract workloads from every ecosystem, not just Windows. For example:

- Enterprises running Linux-based databases (PostgreSQL, MySQL, MariaDB) could move them to Azure without rewriting applications.

- Developers who built apps with js, Python, or Java—once considered competitors to Microsoft’s proprietary tools—found first-class support.

- Containers and microservices orchestrated with Kubernetes were integrated seamlessly into Azure Kubernetes Service.

This openness also allowed Microsoft to:

- Win developer trust, encouraging them to adopt Azure over

- Differentiate itself from legacy enterprise software rivals (e.g., Oracle).

- Reinforce a culture of innovation that thrived on contributions and feedback

Nadella understood that open ecosystems create larger markets—and that Microsoft’s success no longer required forcing customers into proprietary silos.

6.8 Market Impact and Growth

Microsoft’s embrace of open source produced tangible results, both cultural and financial.

Azure Growth: Azure became the fastest-growing major cloud platform, capturing workloads that previously defaulted to Linux-first providers. By 2023, more than 60% of Azure workloads ran on Linux or open-source stacks.

Developer Sentiment: Surveys from Stack Overflow, GitHub, and Forrester showed steadily improving perceptions of Microsoft as a developer-friendly company. VS Code, TypeScript, and GitHub emerged as essential tools in modern development workflows.

Enterprise Adoption: Large organizations previously hesitant to trust Microsoft embraced Azure as a hybrid cloud platform precisely because of its commitment to openness.

Recruiting and Talent: By championing open source, Microsoft attracted and retained top engineering talent who wanted to build with modern tools and transparent practices.

Community Leadership: The company became a top contributor to Kubernetes, Linux kernel improvements, and hundreds of smaller projects—cementing its role as a leader in the open-source ecosystem.

Financial Performance: Azure’s openness fueled subscription growth, pushing Microsoft’s Intelligent Cloud business past $75 billion in annual revenue.

7. Strategic Acquisitions Under Satya Nadella

When Satya Nadella became CEO in 2014, he inherited a company that had often struggled to integrate the acquisitions it made. Microsoft’s acquisition history was checkered: there were moments of great success (such as acquiring Skype) but also high-profile failures (like the Nokia handset business).Part of this struggle stemmed from a culture that saw acquisitions either as defensive moves to protect Windows or as short-term market-share grabs rather than as strategic levers to reinvent the business.Nadella approached acquisitions differently. Rather than treating them as isolated transactions, he embedded them into a coherent strategy designed to accelerate Microsoft’s transformation into a cloud-first, AI-driven, and developer-centric company.

His approach reflected three guiding principles:

- Acquire to build ecosystems, not

- Buy companies that extend the mission to empower every person and

- Focus on cultural fit to avoid stalling

7.1 LinkedIn: The Professional Graph

In 2016, Microsoft announced the $26.2 billion acquisition of LinkedIn—its largest deal ever at the time.

On the surface, this move surprised analysts. Microsoft had little experience operating a consumer-like social network, and the acquisition price was steep. But Nadella saw LinkedIn as a strategic asset capable of transforming Microsoft’s productivity offerings and providing new data-driven insights for enterprises.

Strategic Rationale

- Data Synergy: LinkedIn owned the world’s most complete professional graph—profiles, connections, and career histories. This data could enrich Microsoft’s Dynamics CRM and Office 365 platforms.

- Engagement: With over 400 million members at acquisition (and 930 million by 2023), LinkedIn represented a sticky platform that would diversify Microsoft’s revenue away from Windows and

- Advertising: LinkedIn’s growing advertising business would help Microsoft expand beyond search ads into B2B marketing.

- Cultural Alignment: LinkedIn’s mission—“to connect the world’s professionals to make them more productive and successful”—resonated with Microsoft’s focus on empowerment.

Integration Strategy

Nadella decided LinkedIn would remain an independent brand with its own CEO, Jeff Weiner. Unlike prior acquisitions that were tightly folded into Microsoft, this approach protected LinkedIn’s culture and innovation tempo.

Integration focused on key synergies:

- Embedding LinkedIn data into Office 365 (e.g., profile cards in Outlook).

- Bringing LinkedIn Learning into Microsoft’s education and enterprise

- Connecting Dynamics CRM with LinkedIn Sales

By 2023, LinkedIn contributed over $15 billion annually, up from $3 billion pre-acquisition. The platform strengthened Microsoft’s engagement with professionals and positioned it as a credible player in enterprise social networking.

6.2 GitHub: Winning Back Developers

Perhaps no acquisition better symbolized Microsoft’s cultural reinvention than its $7.5 billion purchase of GitHub in 2018.

Historical Context

For years, GitHub was the world’s largest developer collaboration platform—and a symbol of open-source culture. Microsoft, by contrast, had been seen as an antagonist to open source.

Buying GitHub was therefore a declaration: the new Microsoft would put developers first.

Strategic Rationale

- Developer Trust: Owning GitHub would give Microsoft unparalleled visibility and influence in the developer ecosystem.

- Azure Adoption: GitHub could become a gateway for developers to deploy workloads on

- Tooling Integration: Combining GitHub with Visual Studio Code and Azure DevOps would create a seamless development lifecycle.

Integration Philosophy

Nadella emphasized continuity and trust:

- GitHub remained platform-

- Nat Friedman, a respected open-source leader, became

- No forced integrations with Windows or

By 2022, GitHub had doubled its users and introduced innovative products like:

- GitHub Actions (CI/CD automation).

- GitHub Copilot (AI-powered coding assistance).

- GitHub Codespaces (cloud development environments).

Microsoft’s reputation with developers improved dramatically, and GitHub became a growth engine rather than a defensive acquisition.

7.3 Nuance Communications: The Healthcare Bet

In 2021, Microsoft acquired Nuance for $19.7 billion, the second-largest acquisition under Nadella.

Strategic Rationale

- Healthcare Cloud: Nuance was the leader in AI-powered clinical transcription, with deep relationships in the healthcare sector.

- Voice Recognition: Nuance’s natural language processing capabilities enhanced Microsoft’s AI

- Industry Differentiation: The acquisition reinforced Microsoft’s focus on industry-specific cloud

Integration Approach

Nuance operated semi-independently but leveraged Azure for AI training and cloud hosting.

6.4 ZeniMax Media: Gaming Content

In 2020, Microsoft purchased ZeniMax Media for $7.5 billion, acquiring blockbuster franchises like The Elder Scrolls and Fallout.

Strategic Rationale

- Game Pass Growth: Exclusive content would drive