Mergers and Acquisitions as a Global Growth Strategy: A Case Study of Disney's Acquisition of 21st Century Fox

1. Introduction

1.1 Background to the Study

In the last two decades, the global media and entertainment industry has been transformed by rapid technology shifts, shifts in consumer behavior, and the advent of digital streaming platforms. Traditional broadcasting and cable television models are under pressure as audiences increasingly consume content on demand, over-the-top (OTT) services, and mobile devices. This structural disruption has pushed established media conglomerates to re-evaluate their strategic positioning, content portfolios, and distribution channels. Many firms have turned to mergers and acquisitions (M&A) as a critical tool for consolidating content libraries, scaling operations, capturing synergies, and entering new international markets.

M&A has become especially important in sectors where content, scale, and reach matter: the value of owning strong intellectual property (IP) and broad, deep libraries has soared in an era where content differentiation is a key competitive asset. Through acquisitions, media firms can rapidly amass content, consolidate production and distribution assets, and integrate operations across geographies. The capacity to deliver globally relevant content, while customizing it for local markets, is a central competitive battleground in the streaming era.

One of the most emblematic transactions in the media sector is Disney’s acquisition of 21st Century Fox. Announced in December 2017 and completed in March 2019, the deal was valued at approximately USD 71.3 billion and involved the transfer of major assets including 20th Century Fox film and television studios, FX Networks, National Geographic, Fox’s international channels, and a majority stake in Hulu. The transaction excluded certain assets (Fox Broadcasting, Fox News, sports channels), which were spun off into a separate Fox Corporation.

From Disney’s perspective, the strategic logic was multifaceted: deepen its content library, strengthen its direct-to-consumer (D2C) distribution (especially via Disney+), realize synergies in production/distribution, expand global footprint, and better compete with streaming giants like Netflix and Amazon Yet, such mega-mergers are inherently complex: blending cultures, integrating operations, managing regulatory scrutiny, and realizing projected synergies pose significant challenges.

More broadly, the Disney–Fox deal sits within a larger wave of consolidation in media. According to industry trackers, M&A and joint venture activity in the media and entertainment sector saw an 82% increase in the first half of 2024 relative to the prior half year, indicating renewed appetite for consolidation in response to competitive pressures, technological disruption, and the need to scale content and distribution assets. Thus, understanding whether and how such consolidation delivers value is a vital question for both scholars and managers.However, despite the frequency of such deals, empirical evidence is mixed: many acquisitions fail to deliver anticipated synergies or value enhancements due to flawed integration, culture clashes, overvaluation, or misalignment of strategic expectations. The Disney–Fox merger provides a high-visibility, information-rich case to examine these dynamics in a sector facing existential change.

Accordingly, this dissertation focuses on the Disney–Fox acquisition as a paradigmatic case to explore M&A as a global growth strategy in a disruptive industry, analyzing not only what motivated the deal, but how effectively it was integrated, what value was created (or destroyed), and what lessons can be drawn for large-scale, cross-border M&As in creative and digital industries.

1.2 Problem Statement

Mergers and acquisitions are widely used as instruments for growth, consolidation, and strategic repositioning. In theory, acquisitions should create synergies such that the combined entity is more valuable than the sum of its parts (i.e., 1 + 1 > 2). These synergies can stem from cost savings (economies of scale, shared services, elimination of redundancies), revenue enhancements (cross-selling, broader distribution, leveraging IP), and strategic gains (market power, entry into new geographies or segments).

Yet, empirical studies suggest that a significant proportion of M&A deals even well-publicized ones fail to fully realize these predicted gains. Common pitfalls include cultural clashes, inability to integrate operations, incompatible legacy systems, employee attrition, regulatory hurdles, delayed synergy realization, and overpayment at acquisition. In the media sector, these risks are magnified by intangible assets, creative cultures, and fast-evolving technological disruption.The Disney–Fox case is especially compelling because it is large scale, diverse, multi-jurisdictional, and occurred at a time when the media landscape was rapidly shifting toward streaming and digital consumption. While Disney has claimed success in leveraging the deal for its streaming ambitions, there is also debate and critique about whether all value was realized, whether cultural integration was well handled, and whether the acquisition has fully delivered on its promises.

Sub-questions implicit in this are: Which synergy levers delivered value, and which underperformed? How were cross-cultural and organizational integration challenges handled? To what extent did the acquisition strengthen Disney’s global competitive positioning? What lessons does this hold for similar global conglomerates pursuing M&A-driven growth?By focusing on this widely reported and richly documented case, this study aims to provide deep insights into value creation, integration execution, and strategic pitfalls in large-scale M&A in a digitally evolving industry.

1.3 Research Aim and Objectives

1.3.1 Research Aim: The central aim of this dissertation is to conduct a critical evaluation of The Walt Disney Company’s acquisition of 21st Century Fox as a global growth strategy. More specifically, the study seeks to explore the underlying strategic rationale for the deal, assess the financial structure and expected synergies, evaluate the challenges encountered in the post-merger integration phase, and examine the overall impact of the acquisition on Disney’s global competitive positioning within the entertainment and media sector.

By pursuing this aim, the dissertation will generate insights not only into the Disney–Fox transaction itself but also into the broader phenomenon of mega-mergers in industries undergoing digital disruption. The ultimate ambition is to produce theoretical contributions to the literature on M&A, strategic management, and international business, while also deriving practical lessons for multinational corporations (MNCs) contemplating large-scale acquisitions as a pathway to growth.

1.3.2 Research Objectives:

To achieve the stated aim, the dissertation is guided by six interrelated research objectives. Each objective is deliberately framed to move the study from analysis of motivation, through process and integration, to outcomes and lessons.

Objective 1: To examine the strategic rationale behind Disney’s decision to acquire 21st Century Fox, including content, distribution, scale, and competitive motivations.

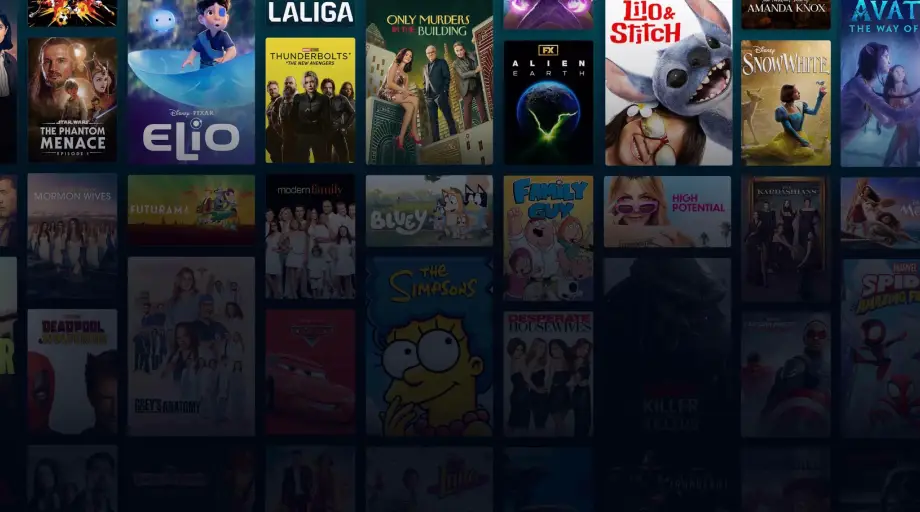

The first objective is foundational, as it addresses the question of why Disney pursued such a high-value and high-risk acquisition. In the era of streaming disruption, legacy media companies are under immense pressure to adapt. Disney’s strategic rationale included expanding its intellectual property portfolio (Marvel, Star Wars, Pixar, and now Fox assets such as Avatar, The Simpsons, and X-Men), gaining controlling stakes in Hulu, and leveraging Fox’s global distribution channels. By unpacking these motivations, this study situates the deal within broader industry dynamics and tests the extent to which strategic intent aligned with global growth imperatives.

Objective 2: To analyze the financial structure and synergy expectations embedded in the deal.

The second objective focuses on the financial dimension of the transaction, which is often a decisive factor in determining long-term value creation. The Disney–Fox merger, valued at approximately $71.3 billion, involved both cash and stock elements and was subject to regulatory approvals in multiple jurisdictions. Analysts projected significant cost and revenue synergies, such as cost reductions through shared back-office functions and enhanced bargaining power with distributors, as well as revenue synergies from cross-selling content across platforms. This objective assesses the robustness of these assumptions, the structure of financing, and the alignment between projected synergies and the realities of execution.

Objective 3: To evaluate the post-merger integration process, with specific attention to cultural, operational, human resource, and technological integration challenges.

The third objective addresses integration, widely regarded in the M&A literature as the phase where most value is either realized or lost. Integrating 21st Century Fox into Disney posed formidable challenges: managing redundancies and layoffs, aligning corporate cultures (Fox’s more independent creative culture versus Disney’s brand-driven, family-oriented ethos), and consolidating technological systems and distribution networks. This objective evaluates how Disney approached integration, the barriers encountered, and the effectiveness of its strategies in overcoming them.

Objective 4: To assess the actual financial and market outcomes of the merger in the medium term.

While projected synergies and optimistic forecasts are common at deal announcement, the reality often diverges. This objective critically examines post-merger financial performance (e.g., revenue growth, profitability, debt load), market indicators (stock price, market capitalization), and strategic outcomes such as the successful launch and rapid scaling of Disney+. It also considers whether the deal enhanced Disney’s ability to compete against Netflix, Amazon, and newer entrants like Apple TV+ and HBO Max.

Objective 5: To examine the impact of the acquisition on Disney’s global competitive positioning, particularly in streaming, content markets, and international expansion.

The fifth objective shifts the focus from internal performance to external positioning. Disney’s acquisition of Fox was not just about scale but about reconfiguring its role in a new media landscape. The deal allowed Disney to expand internationally, control a greater share of premium content, and leverage economies of scope across film, television, and digital platforms. This objective evaluates the extent to which the acquisition has enhanced Disney’s global reach and competitive standing, especially in relation to international growth markets.

Objective 6: To derive recommendations and lessons for multinational corporations regarding governance, due diligence, integration, and value realization in mega M&A deals.

The final objective ensures the dissertation delivers practical contributions. By reflecting on the successes and shortcomings of the Disney–Fox merger, this objective seeks to distill generalizable insights for other MNCs. This includes the importance of cultural due diligence, integration planning, financing discipline, and post-merger monitoring. Lessons will be framed for senior managers, boards, and policymakers to guide the pursuit of M&A as a sustainable global growth strategy.

1.4 Justification of the Study

1.4.1 Academic Contribution

- Bridging strategy and integration literatures in a disruptive industry: Much M&A research is siloed — strategy studies focus on motives, competition, and value creation arguments; integration research focuses on cultural, process, and human issues. By making both dimensions central in one case, this study offers a richer, integrated perspective on how strategic intents align (or misalign) with integration execution in a dynamic, industry-shifting context.

- Mega-mergers in digital/creative industries: The media industry, especially in the streaming era, is underrepresented in classic M&A research despite being one of the most acquisition-intensive and disruption-prone sectors. The Disney–Fox case allows close examination of intangible assets, creative cultures, platform dynamics, and the interplay of content and distribution in value creation.

- Empirical insights on value realization: Many M&A studies are retrospective, generic, or rely on quantitative accounts. This dissertation will ground analysis in detailed secondary data (financials, performance metrics, industry reports) and integrate qualitative assessment of integration challenges and managerial choices, offering more nuanced insights.

- Generalizable lessons for global firms: Though the case is specific to media, the lessons around strategic alignment, cultural due diligence, integration sequencing, and value timelines can be applicable to mega-mergers in other technology-enabled and creative sectors.

1.4.2 Managerial Relevance

- Guidance for future mega deals: Senior executives and boards considering large-scale acquisitions in volatile industries can benefit from lessons about strategic clarity, integration planning, and pitfalls.

- Integration playbook insights: The case can illustrate best practices and cautionary tales in integrating diverse organizational units, creative cultures, legacy systems, and global operations.

- Investor and regulatory outlooks: Understanding how expectations align (or not) with outcomes helps investors, analysts, and regulators evaluate the efficacy and risks of large media M&As.

- Strategic posture in digital disruption: The media industry is a bellwether for how incumbents must transform in the face of technology-driven disruption. Lessons from Disney–Fox may inform strategic decision-making in comparable industries (e.g., publishing, telecommunications, gaming).

2. Literature Review

2.1 Theoretical Foundations of Mergers and Acquisitions

Mergers and acquisitions (M&A) have long been a focal point of corporate strategy research, serving as a vehicle for firms to achieve growth, diversify risk, and enhance competitiveness (Cartwright & Schoenberg, 2006). While M&A transactions are common across industries, the media and entertainment sector presents unique challenges and opportunities due to the intangible nature of its assets, the creative culture of its workforce, and the increasing dominance of digital platforms. The theoretical underpinnings of M&A are critical for understanding the rationale behind these complex transactions and evaluating their success.

2.1.1 Synergy Theory

Synergy theory posits that the combined value of two firms post-acquisition should exceed the sum of their standalone values (Sirower, 1997). Synergies are often categorized into operational, financial, and managerial types.

- Operational synergies occur when firms achieve cost savings or revenue enhancement through combined operations. In media M&A, operational synergies may include consolidation of production facilities, shared marketing and distribution networks, or integrated content development pipelines. For Disney, acquiring Fox’s assets allowed significant cost reductions by consolidating studio operations and optimizing production schedules. Moreover, Disney could leverage Fox’s content library to cross-promote films and series across Disney-owned networks and platforms, generating incremental revenues while lowering marginal costs. The operational synergy argument is particularly salient in industries where fixed costs are high, as is the case with film production and distribution.

- Financial synergies arise when the acquisition improves access to capital, enhances risk diversification, or generates tax efficiencies. Disney, with its strong balance sheet, was able to structure the Fox deal efficiently, combining cash and stock payments while taking advantage of low-cost debt financing. Tax planning opportunities were also significant, given Fox’s international holdings and Disney’s ability to offset certain revenues against tax liabilities. Financial synergies can enhance shareholder value if properly executed, but empirical studies suggest that anticipated financial gains are often overestimated, particularly in mega-mergers (Healy et al., 1992).

- Managerial synergies focus on the transfer and replication of superior management practices across the combined entity. Disney has been recognized for its expertise in brand management, intellectual property monetization, and franchise development. By acquiring Fox, Disney could apply these capabilities to Fox’s properties, potentially improving productivity, creative output, and market penetration. However, managerial synergy is highly contingent upon effective integration and leadership alignment, as misalignment can erode anticipated benefits (Haspeslagh & Jemison, 1991).

Despite the theoretical appeal of synergy, evidence suggests that many mergers fail to deliver on promised synergies. For example, a study of Fortune 500 acquisitions between 1990 and 2010 indicated that only 20–30% of M&A deals achieved the projected operational or financial gains within the first three years (Sirower, 1997). This emphasizes the importance of rigorous due diligence, integration planning, and monitoring to ensure that synergistic potential is not merely speculative.

2.1.2 Transaction Cost Economics (TCE)

Transaction Cost Economics (Coase, 1937; Williamson, 1975) provides a complementary lens for understanding M&A. TCE suggests that firms undertake acquisitions to internalize transactions that are costly, uncertain, or difficult to enforce in the market. In the media context, acquiring Fox allowed Disney to internalize control over critical IP, licensing agreements, and distribution channels, reducing dependency on external parties.TCE also explains the choice of governance structures. For instance, instead of negotiating complex multi-year content-sharing contracts with Fox, Disney internalized the relationship entirely, thereby minimizing potential opportunistic behavior and contractual risks. In cross-border M&A, TCE highlights additional transaction costs such as navigating regulatory environments, dealing with political risk, and managing institutional differences, all of which are relevant in global media consolidation (Hagedoorn & Hesen, 2007).Critics of TCE argue that while it explains the rationale for vertical integration, it may underemphasize strategic and cultural dimensions, which are often decisive in creative industries. Nevertheless, it provides a valuable economic framework for understanding why firms like Disney pursue large-scale acquisitions rather than relying solely on market transactions.

2.1.3 Resource-Based View (RBV)

The Resource-Based View (RBV) argues that firms acquire and combine unique, valuable, and inimitable resources to achieve competitive advantage (Barney, 1991; Wernerfelt, 1984). In the Disney–Fox case, Fox’s film and television library represented a strategic resource that could not easily be replicated. Owning such IP allowed Disney to expand its streaming offerings, enhance franchise development, and increase bargaining power with distributors.RBV also emphasizes the importance of complementary resources. Disney’s strengths in brand management, franchise monetization, and global distribution synergized with Fox’s creative assets, producing potential competitive advantage. However, RBV cautions that resource integration is not automatic: cultural misalignment, managerial conflicts, or incompatible organizational processes can prevent effective utilization (Prahalad & Hamel, 1990). This aligns with observations that media M&As often struggle during post-merger integration, particularly in aligning creative cultures.

2.1.4 Market Power and Diversification Theories

Market power theory suggests that firms pursue M&A to increase their control over market prices, distribution channels, and competitive positioning (Scherer & Ross, 1990). Disney’s acquisition of Fox allowed it to consolidate its market presence, expand globally, and gain bargaining power with streaming platforms, advertisers, and content distributors.

Diversification theory posits that firms engage in M&A to spread business risk across products, markets, or geographies (Markides & Williamson, 1996). The Disney–Fox deal diversified Disney’s content portfolio, including films targeted at adult audiences and international markets. However, over-diversification may dilute strategic focus, potentially undermining the core brand if not managed carefully (Montgomery, 1994).Overall, these theories collectively provide a robust framework for understanding M&A motivations, particularly in complex, global, and digital industries. Synergy, transaction cost efficiency, strategic resources, and market positioning all intersect to inform the rationale for mega-mergers like Disney–Fox.

2.2 Global Growth Strategies

M&A is an essential tool within the broader context of global growth strategies. Firms seeking to expand internationally face choices between organic growth—building capabilities internally—and inorganic growth—leveraging acquisitions, joint ventures, or alliances (Ansoff, 1965; Ghemawat, 2007).

2.2.1 Organic vs Inorganic Growth

Organic growth refers to internal expansion, such as investing in R&D, launching new products, or entering new markets gradually. Its advantages include control, cultural alignment, and gradual learning. However, organic growth can be slow, which is a disadvantage in fast-moving industries like media streaming, where competitors can quickly disrupt markets with new content or technology.Inorganic growth, particularly via M&A, enables firms to rapidly acquire market share, capabilities, and strategic assets. Mega-deals like Disney–Fox illustrate the strategic imperative of speed and scale: Disney could not organically amass Fox’s IP, distribution network, or Hulu stake quickly enough to remain competitive against Netflix and Amazon. Empirical studies indicate that firms pursuing high-growth sectors often rely on M&A to acquire capabilities not easily developed in-house, particularly in technology-intensive or creative industries (Hitt et al., 2001).

2.2.2 M&A as a Global Expansion Mechanism

Cross-border M&A allows firms to enter new geographic markets, acquire local expertise, and gain competitive scale. For Disney, Fox’s international channels and content libraries offered immediate market access in Europe, Asia, and Latin America. Such acquisitions reduce the time-to-market, mitigate first-mover disadvantages, and provide established customer bases.However, international M&A introduces complex integration challenges. Institutional differences, regulatory compliance, cultural alignment, and political risk can impede value creation (Shimizu et al., 2004). The Disney–Fox case demonstrates both the opportunities of rapid international growth and the complexities of integrating diverse operational and cultural systems.

The combination of these strategic theories demonstrates that M&A is not merely a financial transaction but a multidimensional strategy encompassing economic efficiency, resource accumulation, and global competitiveness. While theories like synergy and RBV provide strong rationale for mega-mergers, TCE and market power frameworks highlight the practical and economic justifications. The limitations of these theories particularly in addressing human and cultural dimensions underscore the importance of considering integration and post-merger management in evaluating the success of global acquisitions.

2.3 Integration Challenges in Mergers and Acquisitions

While strategic rationale and financial structure may justify an acquisition, the success of M&A ultimately hinges on the post-merger integration process (Haspeslagh & Jemison, 1991; Pablo, 1994). The integration phase involves combining operations, aligning cultures, coordinating HR and governance systems, and consolidating technology platforms. Research consistently demonstrates that a majority of M&A failures occur during this stage due to poor integration planning and execution (Cartwright & Cooper, 1993).

2.3.1 Cultural Differences and Leadership

Cultural integration is often the most underestimated challenge in M&A (Stahl & Voigt, 2008). Firms like Disney, with a highly brand-conscious and structured corporate culture, must integrate with Fox, which historically operated with greater autonomy and a more creative, decentralized culture. Cultural misalignment can lead to employee dissatisfaction, talent attrition, and conflicts in decision-making authority.

Leadership plays a pivotal role in navigating these challenges. Transformational leaders who communicate vision, set clear expectations, and demonstrate cultural sensitivity are more likely to succeed in integration (Marks & Mirvis, 2011). In Disney–Fox, the leadership challenge involved maintaining Disney’s brand ethos while preserving the creative freedom that allowed Fox to produce innovative, adult-oriented content. Case studies in media M&A suggest that failures to manage cultural fit, particularly in creative sectors, are a leading contributor to synergy loss (Weber & Camerer, 2003).

2.3.2 HR, Governance, and Structural Integration

Human resources, governance, and organizational structure are closely intertwined in integration. HR integration involves aligning compensation, benefits, and reporting structures while managing redundancies and workforce morale. Disney faced the delicate task of restructuring Fox without undermining its creative capabilities.Governance integration requires harmonizing board oversight, decision-making authority, and accountability mechanisms. Structural integration addresses overlapping departments, production units, and distribution channels. Research indicates that clear governance frameworks and well-sequenced structural integration are essential to achieve operational synergies (Angwin & Meadows, 2015).Moreover, technological integration is increasingly critical in media M&A. Consolidating digital platforms, content management systems, and analytics capabilities ensures that merged entities can capitalize on scale and data-driven decision-making. In the Disney–Fox merger, integrating Fox’s international streaming infrastructure and Disney+ required careful IT and operational planning to avoid service disruptions and data silos.

Despite extensive planning, post-merger integration remains inherently risky. Cultural clashes, legacy system incompatibilities, and human capital turnover can undermine the value of the deal. Scholars suggest that M&A success is less about deal size and more about integration capability (Weber, 1996). Hence, evaluating Disney–Fox must focus not only on strategic intent but also on how effectively the integration process preserved value, retained talent, and leveraged combined resources.

2.4 Performance Outcomes of Mergers and Acquisitions

2.4.1 Success vs Failure Rates in Mega Deals

Empirical studies suggest that M&A deals frequently fail to achieve projected goals. Research indicates that up to 70–90% of mega-mergers underperform relative to expectations (King et al., 2004; Cartwright & Schoenberg, 2006). Failure is often attributed to overvaluation, cultural incompatibility, poor integration, or unforeseen regulatory and market challenges.However, some studies highlight conditions under which mega-deals succeed:

- Strategic fit and complementary resources (Capron & Pistre, 2002)

- Strong leadership and clear integration plans (Haspeslagh & Jemison, 1991)

- Industry consolidation favoring scale and distribution efficiency (Healy et al., 1992)

The Disney–Fox deal provides a rare example of a high-profile mega-merger with strategic logic, yet its ultimate performance must be critically analyzed using both financial data and operational outcomes.

2.4.2 Metrics for Evaluating M&A Effectiveness

Scholars and practitioners employ multiple metrics to evaluate M&A performance:

- Financial Metrics – Stock price reaction, earnings per share (EPS), return on investment (ROI), and debt ratios (Gaughan, 2015). For Disney–Fox, analysts examined both short-term stock performance and medium-term revenue synergies from content monetization.

- Market Metrics – Market share, global reach, and competitive positioning. The acquisition allowed Disney to expand internationally and strengthen its market position in the streaming era.

- Innovation Metrics – Number of new franchises, content production quality, and platform engagement. Post-merger, Disney leveraged Fox’s IP to enhance Disney+, offering diverse content that attracted new subscriber segments.

Evaluation frameworks emphasize both financial and strategic outcomes. Overreliance on short-term stock performance may obscure long-term strategic gains, especially in creative industries where value realization can take several years (Hitt et al., 2001).

2.5 M&A in the Media and Entertainment Industry

The media and entertainment industry is characterized by rapid technological disruption, global competition, and high-value intangible assets. This context shapes both the rationale and challenges of M&A in this sector.

2.5.1 Digital Disruption and Content Wars

The rise of streaming platforms has disrupted traditional broadcasting and cable models, compelling legacy media firms to pursue consolidation. Disney–Fox is a prime example: by acquiring Fox’s content library and international networks, Disney gained the assets necessary to compete against Netflix, Amazon, and emerging global OTT platforms.Content wars drive M&A strategy by emphasizing the need for exclusive IP, scale, and global reach. Firms that fail to consolidate risk losing subscribers, licensing revenue, and market influence. Studies suggest that media M&A in the digital era is less about cost savings and more about securing strategic assets critical for future competitiveness (Doyle, 2013).

2.5.2 Role of Streaming in Shaping M&A Strategies

Streaming has transformed the valuation and strategic rationale of media assets. Content libraries, distribution networks, and subscriber bases have become central to firm value. The Disney–Fox deal illustrates how direct-to-consumer (D2C) strategies influence M&A: acquiring Fox not only expanded Disney’s IP portfolio but also strengthened its Hulu stake, enabling robust competition in streaming markets.Streaming considerations also affect post-merger integration, as digital infrastructure, platform interoperability, and content strategy must be aligned. Scholars note that firms with weak integration of digital assets often fail to capture anticipated value, underscoring the importance of combining strategic foresight with operational execution (Einhorn, 2020).

2.6 Research Gap

While M&A research is extensive, several gaps remain, particularly in the context of mega-mergers in digital, creative industries:

- Limited focus on post-merger integration in creative sectors – Most studies emphasize financial outcomes, underrepresenting cultural and operational integration challenges (Stahl & Voigt, 2008).

- Insufficient analysis of streaming-driven M&A strategies – Existing literature rarely addresses how digital transformation reshapes M&A rationale and success metrics.

- Lack of case-specific studies on Disney–Fox – Despite extensive media coverage, few academic studies provide a comprehensive analysis linking strategic intent, integration, and performance outcomes.

- Need for combined theoretical perspectives – Previous research often applies single frameworks (e.g., synergy theory or RBV). A multi-theoretical lens that integrates economic, strategic, and organizational perspectives can offer richer insights.

This dissertation seeks to address these gaps by combining strategic, financial, and cultural analyses to evaluate the Disney–Fox merger as a global growth strategy in a digital era. The study will also generate lessons for MNCs pursuing similar mega-mergers, particularly in industries where intangible assets and creative capabilities are central to competitive advantage.

3. Design DataCollection & Framework

3.1 Research Design

This dissertation adopts a qualitative case study research design, which is particularly suited for examining complex, contemporary phenomena within their real-life contexts (Yin, 2018). The Disney–Fox merger represents a high-profile, large-scale M&A that spans multiple geographies, content verticals, and digital platforms. By employing a qualitative case study approach, the research can explore both strategic intentions and operational realities, capturing the interplay of financial, organizational, and cultural factors.A qualitative design allows for in-depth analysis of non-quantifiable elements, such as cultural integration, leadership dynamics, and stakeholder responses. Unlike purely quantitative approaches, which focus on metrics and statistical correlations, qualitative case studies provide the flexibility to interpret context-specific insights, explore causal mechanisms, and examine the strategic rationale behind decisions (Eisenhardt, 1989).Furthermore, qualitative research enables triangulation of multiple data sources, enhancing the validity and reliability of findings. In the context of Disney–Fox, this design facilitates a nuanced understanding of how strategic intent translates into post-merger outcomes and how integration challenges influence synergy realization.

3.2 Case Study Justification: Disney–Fox

- Scale and Strategic Importance: Valued at approximately $71.3 billion, this acquisition is among the largest in the media industry. Its scale makes it an ideal case for studying mega-merger dynamics, including financial structuring, regulatory challenges, and integration strategies.

- Industry Disruption Context: The deal occurred amid digital disruption, where streaming services like Netflix and Amazon Prime reshaped consumer preferences and competitive dynamics. Studying Disney–Fox provides insights into how traditional media companies respond strategically to such disruptions.

- Availability of Rich Data: Extensive secondary data, including financial reports, press releases, industry analyses, media coverage, and scholarly commentary, is available. This richness allows for comprehensive triangulation and rigorous qualitative analysis.

- Global Relevance: The merger spans multiple markets, making it relevant for examining international growth strategies, cross-border integration, and global competitiveness. Insights from this case can inform strategic decision-making for multinational corporations considering large-scale acquisitions.

- Academic and Managerial Contribution: Disney–Fox serves as a valuable exemplar for exploring theoretical frameworks in practice, including synergy theory, transaction cost economics, and resource-based views. Findings have direct managerial relevance, particularly for firms navigating post-merger integration and digital transformation.

3.3 Data Collection

Data collection is a cornerstone of any research study, and in qualitative research, it encompasses gathering rich, detailed information to answer research questions rigorously. For this dissertation, secondary data has been identified as the primary source due to the public nature of the Disney–Fox merger and the availability of extensive financial, operational, and media coverage data.

3.3.1 Secondary Data Sources

- Financial Reports and Filings: Financial reports, including Disney’s and Fox’s annual reports, quarterly filings, and SEC disclosures, provide critical insights into pre- and post-merger financial performance. These documents include balance sheets, income statements, cash flow reports, and segment-wise revenue analysis, offering quantifiable data to assess:

- Deal structure and financing methods (cash, stock, debt instruments).

- Projected versus realized revenue and cost synergies.

- Financial ratios indicative of operational efficiency and market performance post-merger.

For example, Disney’s 2018 10-K filing detailed the Fox acquisition structure, including asset valuations, liabilities assumed, and anticipated synergies, providing a factual basis for evaluating financial outcomes.

- Press Releases and Industry Reports: Corporate press releases communicate strategic intentions, expected synergies, and integration plans. Industry reports from consulting firms like Deloitte, PwC, and McKinsey provide macroeconomic context, market trends, and benchmarking data that are critical for understanding the strategic rationale of the merger. For instance, Deloitte’s media M&A report highlights trends in content consolidation and direct-to-consumer strategies, framing Disney–Fox as part of a broader industry shift.

- Scholarly Articles and Academic Journals: Peer-reviewed literature offers theoretical and empirical grounding. Articles in journals such as the Strategic Management Journal, Journal of Business Strategy, and Harvard Business Review provide insights on:

- Factors influencing M&A success and failure.

- Post-merger integration challenges.

- Industry-specific trends in media M&A.

Integrating these studies allows the research to link empirical findings with theoretical frameworks, enhancing the academic contribution of the study.

- Media Coverage and Expert Commentary: Reputable media sources, including The Wall Street Journal, Variety, and Deadline, provide real-time reporting on merger announcements, regulatory approvals, and post-merger developments. Expert commentary and analysis highlight:

- Stakeholder perspectives, including investors, analysts, and employees.

- Market reactions and competitive implications.

- Cultural and operational integration challenges.

For instance, media reports documented leadership changes, layoffs, and cultural integration efforts at Disney post-acquisition, offering qualitative evidence of post-merger dynamics.

3.3.2 Rationale for Secondary Data

The use of secondary data is justified by multiple factors:

- Accessibility and comprehensiveness: High-quality, publicly available data enables thorough analysis without the constraints of primary data collection.

- Triangulation: Cross-referencing financial reports, press releases, media coverage, and academic literature ensures reliability and validity.

- Historical depth: Data spans the pre-merger announcement, execution, and post-merger periods, allowing longitudinal analysis of strategic and financial outcomes.

- Feasibility: Access to primary data in high-profile corporate mergers is limited; secondary sources provide a practical and ethical solution.

While secondary data is rich and informative, the research acknowledges limitations:

- Potential bias in media reporting may influence the interpretation of cultural and operational integration issues.

- Retrospective analysis is constrained by available information; some internal decision-making processes remain opaque.

- Data gaps exist for qualitative metrics such as employee satisfaction, creativity retention, and managerial decision-making nuances.

These limitations are mitigated by cross-validating data from multiple sources and triangulating findings across financial, operational, and strategic dimensions.

3.4 Analytical Frameworks

Analytical frameworks provide structured approaches to evaluate the merger, ensuring that findings are systematic, rigorous, and theoretically grounded. The research applies a multi-framework approach, combining pre-merger environmental analysis, post-merger performance assessment, and competitive positioning evaluation.

3.4.1 PESTLE and SWOT Analyses

PESTLE analysis examines macro-environmental factors that influence corporate strategy:

- Political: Regulatory scrutiny from antitrust authorities, particularly in the U.S. and EU, shaped the merger’s structure.

- Economic: Global economic conditions, currency fluctuations, and investment climate affected deal valuation and financing.

- Social: Consumer preferences, demographic trends, and cultural factors informed content strategy and international expansion.

- Technological: Rapid digitalization and streaming technology adoption created urgency for consolidation.

- Legal: Compliance with intellectual property laws, employment law, and media regulations impacted integration planning.

- Environmental: Sustainability practices in production and corporate responsibility considerations influenced operational decisions.

SWOT analysis complements PESTLE by evaluating internal and external factors:

- Strengths: Disney’s brand equity, Fox’s content library, international reach.

- Weaknesses: Integration complexity, potential cultural clashes.

- Opportunities: Streaming market expansion, cross-platform content monetization.

- Threats: Emerging competitors, changing consumer habits, regulatory hurdles.

These analyses provide a foundation for understanding strategic fit and potential risks, informing the assessment of synergy potential and integration planning.

3.4.2 Synergy Realization Framework

The synergy realization framework evaluates whether projected value from the merger is achieved (Sirower, 1997). It assesses:

- Operational synergies: Cost reductions, economies of scale, streamlined distribution.

- Revenue synergies: Incremental earnings from new content utilization and market expansion.

- Managerial synergies: Knowledge transfer, improved decision-making, and organizational learning.

By applying this framework, the research systematically links pre-merger projections with post-merger outcomes, highlighting areas of over- or underperformance.

3.4.3 Post-Merger Integration (PMI) Models

PMI models evaluate integration strategies and their effectiveness (Haspeslagh & Jemison, 1991; Weber et al., 2011). Key dimensions include:

- Cultural integration: Alignment of values, norms, and creative processes.

- HR and governance integration: Consolidation of reporting structures, compensation, and decision-making authority.

- Operational and technological integration: Harmonization of IT systems, production workflows, and distribution channels.

PMI models facilitate understanding of why integration succeeds or fails, offering insights into the mechanisms driving synergy realization and long-term value creation.

3.4.4 Porter’s Five Forces (Competitive Positioning)

Porter’s Five Forces framework assesses industry attractiveness and competitive pressure:

- Threat of new entrants: Emerging streaming platforms increasing market competition.

- Bargaining power of suppliers: Content creators and talent agencies influencing production costs.

- Bargaining power of buyers: Consumer leverage over subscription choices and content demand.

- Threat of substitutes: Alternative entertainment options such as gaming, social media, and user-generated content.

- Competitive rivalry: Intense competition among legacy studios, global streaming services, and digital entrants.

This analysis demonstrates how the merger affected Disney’s strategic positioning, helping to evaluate whether the acquisition strengthened competitive advantage in the evolving media landscape.

3.4.5 Critical Reflection

The use of multiple analytical frameworks in this study serves a dual purpose: it allows for a structured evaluation of the Disney–Fox merger while also providing flexibility to explore nuanced, context-specific insights. Each framework offers a unique lens, capturing different dimensions of the merger process, yet no single framework can fully encapsulate the complexity of a mega-merger in a dynamic industry such as media and entertainment. This recognition underscores the need for a triangulated analytical approach that combines strategic, financial, operational, and competitive perspectives.

The PESTLE and SWOT analyses, for instance, provide a macro- and micro-level understanding of the pre-merger environment, highlighting how external factors such as regulatory scrutiny, technological disruption, and consumer behavior intersected with internal strengths and weaknesses to shape Disney’s strategic rationale. These frameworks are descriptive and exploratory, offering a foundation for interpreting the merger’s context and potential risks. However, they do not directly measure outcomes or the effectiveness of integration strategies.In contrast, the synergy realization and post-merger integration (PMI) frameworks move the focus from planning to execution, enabling a critical assessment of whether projected operational and financial synergies materialized. These models emphasize the importance of organizational, cultural, and human factors in achieving value creation. In the case of Disney–Fox, the PMI lens reveals how leadership alignment, structural integration, and talent retention influenced the success of the merger beyond mere financial metrics. This analytical depth highlights that strategic intent alone is insufficient; the realization of synergies depends heavily on meticulous planning and adaptive management during integration.

Finally, Porter’s Five Forces situates the merger within the broader competitive landscape, offering insight into how the acquisition reshaped Disney’s market position and industry dynamics. This framework helps explain the strategic motivation for the merger, particularly in terms of strengthening competitive advantage, responding to emerging threats from digital streaming platforms, and leveraging the acquired content portfolio. While Porter’s analysis does not address internal operational challenges, it is invaluable for linking the merger to industry-level pressures and strategic imperatives.The combined application of these frameworks enables a multi-dimensional understanding of the merger, allowing the research to bridge theory and practice. Importantly, this approach also illuminates the interdependencies between external environment, internal capabilities, strategic intent, and operational execution. While each framework has inherent limitations—for example, PESTLE and SWOT may oversimplify complex dynamics, and PMI models may not fully capture intangible cultural factors—their integration creates a complementary analytical system. Through this triangulation, the study achieves both breadth and depth, providing a rich narrative that captures the financial, strategic, and human elements of the Disney–Fox merger.

In essence, the critical reflection emphasizes that mega-mergers are multi-faceted, high-stakes endeavors. The success of such transactions cannot be understood through a single lens; it requires a nuanced, layered approach that accounts for market forces, organizational complexities, and strategic objectives. By narratively linking the insights from these frameworks, this research establishes a robust foundation for analyzing the pre-merger rationale, post-merger integration, and overall performance outcomes of the Disney Fox acquisition.

3.5 Limitations and Ethical Considerations

While this study is designed to provide a rigorous and comprehensive analysis of the Disney–Fox merger, it is important to acknowledge its inherent limitations and the ethical considerations that guide its execution. Recognizing these aspects ensures that the research maintains transparency, credibility, and academic integrity.

3.5.1 Limitations

One of the primary limitations of this research arises from its reliance on secondary data sources. While these sources—including financial reports, press releases, industry analyses, media coverage, and scholarly articles provide extensive information, they may not fully capture internal decision-making processes or the nuanced perspectives of executives and employees. Certain strategic deliberations, integration challenges, and cultural dynamics remain proprietary, limiting the study’s ability to offer first-hand insights into organizational behavior. Another limitation is the retrospective nature of the analysis. The study examines the Disney–Fox merger after its announcement, execution, and partial integration, which may introduce hindsight bias. Interpretations of the merger’s strategic rationale and the success of post-merger integration may be influenced by knowledge of outcomes, potentially skewing objective assessment. To mitigate this, the research triangulates multiple sources and applies analytical frameworks systematically to maintain methodological rigor.

Additionally, the generalizability of findings is limited. The Disney–Fox case represents a unique mega-merger in the media and entertainment industry, characterized by specific cultural, financial, and strategic contexts. While the insights derived may inform broader M&A practices, caution is needed in applying conclusions to industries with different competitive dynamics, regulatory environments, or organizational cultures. The study is therefore best understood as providing in-depth, context-specific insights rather than universally applicable prescriptions. Finally, while analytical frameworks such as PESTLE, SWOT, synergy realization, PMI models, and Porter’s Five Forces offer structured evaluation, each has inherent limitations. For example, SWOT and PESTLE analyses are largely descriptive and may oversimplify complex interactions, whereas synergy and PMI frameworks rely on accurate reporting of financial and operational outcomes. Despite these constraints, the combined use of multiple frameworks allows for complementary insights and strengthens the robustness of the analysis.

3.5.2 Ethical Considerations

Ethical considerations are central to the credibility and integrity of this research. Firstly, the study adheres to the principle of data integrity. Only publicly available, credible sources have been utilized, including verified financial statements, official press releases, reputable media reports, and peer-reviewed literature. This approach ensures that all data used is accurate, traceable, and verifiable, reducing the risk of misrepresentation or misinformation.Secondly, the research maintains academic honesty and proper attribution. All sources are cited appropriately following accepted academic standards, preventing plagiarism and giving due credit to original authors. Quotations, paraphrases, and data are carefully referenced to uphold transparency and intellectual property rights.

Thirdly, the study emphasizes objectivity and neutrality. Analyses and interpretations are presented without speculation or bias, focusing on factual evidence and systematic evaluation. Stakeholder actions, corporate strategies, and post-merger outcomes are discussed analytically rather than judgmentally, ensuring a balanced perspective.Finally, the research addresses confidentiality and sensitivity. Although the study relies on publicly available data, discussions involving leadership decisions, employee impacts, and cultural integration challenges are presented respectfully, avoiding undue attribution of motives or private organizational matters. This consideration ensures ethical representation of all parties involved.

3.5.3 Narrative Integration of Limitations and Ethics

Taken together, acknowledging limitations and ethical considerations strengthens the trustworthiness and validity of this study. Limitations highlight the boundaries of analysis, providing context for interpreting findings and framing conclusions responsibly. Ethical considerations ensure that the research is conducted with integrity, credibility, and respect for both academic standards and the organizations under study. By transparently addressing these aspects, the dissertation establishes a methodologically sound foundation, enabling subsequent chapters to present findings and analyses confidently and responsibly.

4. Pre & Post Merger Analysis

4.1 Pre-Merger Analysis

4.1.1 Strategic Rationale

The Disney–Fox merger represented a landmark consolidation in the media and entertainment industry, driven by a combination of strategic imperatives and market pressures. Central to Disney’s decision to pursue Fox was the acquisition of its extensive content library, which included iconic franchises, film and television assets, and international channels. These assets provided Disney with immediate intellectual property (IP) expansion, enhancing its capability to leverage content across multiple platforms, including theatrical releases, television, and digital streaming services.A critical strategic driver was the competitive threat posed by streaming platforms. By 2017–2018, Netflix, Amazon Prime Video, and Hulu had begun reshaping consumer viewing habits, eroding traditional television and cinema audiences. Disney recognized the urgency of vertical integration in the digital space, seeking to combine Fox’s content with its own to bolster its direct-to-consumer offerings, culminating in the launch of Disney+. The merger thus provided a defensive and offensive strategic posture, enabling Disney to retain market relevance while positioning itself as a dominant player in the streaming wars.Moreover, Disney pursued global reach and diversification. Fox’s international channels and regional production facilities offered Disney a broader footprint, particularly in emerging markets where direct-to-consumer penetration was still developing. The strategic rationale was, therefore, multi-dimensional: increasing content ownership, strengthening competitive positioning against digital disruptors, and achieving geographical diversification to reduce dependence on domestic revenue streams.

4.1.2 Deal Structure

The Disney–Fox deal, valued at approximately $71.3 billion, was structured as a combination of cash and stock consideration, financed through internal cash reserves and debt instruments. Key components of the transaction included:

- Assets Acquired: Disney gained Fox’s 20th Century Fox film and television studios, FX Networks, National Geographic channels, and Fox’s 30% stake in Hulu. Notably, Disney did not acquire Fox News, Fox Broadcasting Company, or Fox Sports, which were spun off into a separate entity.

- Regulatory Approvals: The transaction underwent rigorous scrutiny from U.S. and international regulators due to antitrust concerns. Approval conditions required divestments and commitments to maintain competitive market conditions, particularly in film distribution and streaming markets.

- Financial Considerations: The mix of cash and stock minimized immediate dilution for Disney shareholders while enabling Fox shareholders to participate in Disney’s future growth, reflecting careful financial engineering to balance stakeholder interests.

The deal structure reflected Disney’s strategic prudence, ensuring regulatory compliance while maximizing the value of acquired assets. It also set the stage for complex post-merger integration, as the company absorbed a wide array of operations, talent, and international holdings.

4.1.3 Industry Context

The pre-merger industry landscape in which Disney and Fox operated was characterized by rapid disruption, intense competition, and shifting consumer preferences. Traditional media and entertainment companies were facing structural challenges, primarily due to the rise of digital streaming platforms. Services such as Netflix, Amazon Prime Video, and Hulu were redefining how audiences consumed content, moving away from linear television schedules and theatrical releases toward on-demand, personalized viewing experiences. This shift placed considerable pressure on legacy media firms, which had historically relied on predictable cable subscriptions, box office revenues, and syndicated content distribution. In addition to digital disruption, the industry was experiencing consolidation trends, with competitors pursuing mergers, acquisitions, and strategic partnerships to gain scale, secure content libraries, and expand global reach. For example, AT&T’s acquisition of Time Warner reflected a broader strategy of integrating content production with distribution capabilities, mirroring Disney’s objectives in the Fox deal. Warner Bros., Sony, and Comcast also engaged in content aggregation and international expansion to remain competitive against digital entrants. These trends underscored the strategic importance of scale, IP ownership, and multi-platform distribution as drivers of long-term competitiveness.

Consumer behavior was another critical factor shaping the industry context. The demand for original, high-quality content was increasing globally, particularly among younger audiences who favored streaming platforms. This shift influenced both pricing models and content strategies, compelling traditional media companies to diversify their offerings, invest in original programming, and develop direct-to-consumer channels. Disney’s acquisition of Fox was a direct response to these pressures, as Fox’s content assets including franchises, television networks, and regional studios enhanced Disney’s ability to meet evolving consumer expectations.

Technological advancements also played a transformative role. Innovations in cloud computing, content delivery networks, and data analytics enabled streaming services to provide personalized recommendations, seamless multi-device access, and localized content. Disney needed to integrate Fox’s operations and digital capabilities to capitalize on these technologies and maintain a competitive edge in a rapidly evolving technological environment.Regulatory and global market dynamics further influenced the industry context. The merger required approval from multiple jurisdictions, including the U.S. Department of Justice and international antitrust authorities. These regulatory considerations affected the scope of assets acquired and the strategies for post-merger integration, reflecting the increasingly globalized nature of media M&A. Fox’s international channels and production facilities provided Disney with a foothold in markets with high growth potential, while also introducing complexities related to local regulations, labor laws, and content standards.Finally, competitive rivalry in the industry was intensifying, with both traditional studios and digital-first platforms investing heavily in original content, global expansion, and subscriber acquisition strategies. Netflix, for instance, had established itself as a formidable competitor with a large international subscriber base and a strong reputation for original programming. Amazon Prime Video leveraged e-commerce integration to create a holistic entertainment ecosystem. Hulu, partially owned by Disney and Fox, represented a strategic joint venture in streaming. Against this backdrop, Disney’s acquisition of Fox allowed it to consolidate content libraries, reduce competitive pressures, and enhance its ability to compete across multiple platforms and regions.

4.2 Post-Merger Analysis

4.2.1 Integration Issues

The post-merger phase revealed significant integration challenges, particularly in human resources, leadership, and operational restructuring. Disney undertook consolidation of overlapping departments, resulting in redundancies in production, administrative functions, and regional operations. Leadership alignment was critical, as executives from both companies needed to adapt to Disney’s centralized decision-making structures while preserving Fox’s creative autonomy.Operational integration extended to technology platforms, distribution systems, and production pipelines, requiring careful coordination to avoid disruptions. Disney implemented structured project management and cross-functional teams to oversee integration, yet some inefficiencies persisted due to differences in organizational culture and workflows.

4.2.2 Cultural Challenges

Cultural integration posed one of the most significant hurdles. Disney’s brand identity, centered on family-friendly content and strong corporate governance, contrasted with Fox’s reputation for diverse, sometimes edgy content aimed at broader demographics. Aligning creative teams, reconciling content strategies, and maintaining morale during restructuring required sensitive leadership and clear communication.Strategies to address cultural challenges included:

- Retention of key creative talent from Fox to ensure continuity of high-profile projects.

- Blended corporate culture initiatives, combining Disney’s operational discipline with Fox’s creative flexibility.

- Structured integration workshops and leadership forums to foster collaboration and shared vision.

Despite these measures, some tensions persisted, particularly in areas involving creative decision-making, branding strategies, and employee expectations. Cultural alignment, therefore, emerged as a critical determinant of the merger’s overall success.

4.2.3 Financial Outcomes

The financial implications of the Disney–Fox merger were central to evaluating its success, both from a shareholder perspective and in terms of achieving strategic synergies. The acquisition, valued at approximately $71.3 billion, had immediate and long-term effects on Disney’s balance sheet, stock performance, and cash flow management. Analyzing these outcomes provides insights into whether the merger fulfilled its financial objectives and how the combined entity navigated the complexities of a high-stakes integration.

Stock Price Movements and Market Reactions

Market reaction to the merger announcement was characterized by initial volatility, reflecting investor uncertainty regarding the size, complexity, and strategic rationale of the deal. Disney’s stock experienced short-term fluctuations as analysts and investors evaluated potential risks, including integration difficulties, regulatory approvals, and debt financing. Over time, as clarity emerged regarding the transaction structure, asset allocation, and anticipated synergies, stock performance stabilized, with positive market sentiment driven by the strategic value of the acquired content portfolio and potential growth in streaming revenues.

The market also responded to broader industry pressures, such as competition from Netflix and Amazon Prime, which contextualized investor expectations. Analysts noted that while the merger increased Disney’s leverage temporarily, it also positioned the company to capture long-term revenue growth and strengthen its competitive advantage, particularly in the streaming segment through Disney+.

Debt Structure and Financing Considerations

The acquisition increased Disney’s debt levels, necessitating careful financial management. To fund the transaction, Disney utilized a combination of cash reserves and debt instruments, balancing immediate liquidity needs with long-term financial sustainability. While leverage temporarily increased, Disney’s strong cash flows and robust operating performance provided confidence in its ability to service debt while investing in strategic initiatives.

Debt financing also allowed Disney to maximize shareholder value by minimizing immediate dilution of stock ownership. The combination of cash and stock consideration for Fox shareholders ensured that both companies’ stakeholders participated in the anticipated upside from content monetization, streaming growth, and international market expansion.

Synergy Realization: Expected vs. Realized

A central component of the financial analysis involves comparing expected versus realized synergies. Disney projected that the merger would generate significant cost savings and revenue enhancements, including:

- Operational synergies: Streamlining administrative functions, consolidating production facilities, and achieving economies of scale across content creation and distribution.

- Revenue synergies: Cross-leveraging Fox’s content across Disney’s platforms, including theatrical releases, broadcast, cable networks, and direct-to-consumer streaming.

- Managerial and strategic synergies: Improved decision-making through the integration of leadership talent and intellectual property management.

Post-merger reports indicate that while some operational synergies, such as consolidated back-office functions and supply chain optimization, were realized relatively quickly, others—particularly revenue synergies dependent on international market penetration and Disney+ subscriber growth—required longer timelines. The realization of these synergies was influenced by factors such as market acceptance of Disney+, integration of Fox’s creative teams, and the competitive pressures from digital-first platforms.

Financial Metrics and Performance Indicators

Financial outcomes are further evaluated using key performance indicators (KPIs):

- Revenue Growth: The merger contributed to increased overall revenue through expanded content offerings, higher distribution capabilities, and entry into new international markets.

- Profit Margins: Cost synergies improved operating efficiency, though integration expenses and amortization of intangible assets temporarily constrained net margins.

- Return on Investment (ROI): While the full ROI depends on long-term synergy realization, early assessments suggested that strategic content acquisition and streaming expansion created a foundation for sustained profitability.

- Shareholder Value: Disney’s stock performance over the medium term indicated market confidence in the merger’s long-term value creation potential, despite short-term volatility.

Financial outcomes reveal the inherent complexity of mega-mergers. While the Disney–Fox acquisition achieved significant strategic and financial milestones, including content consolidation and enhanced market positioning, it also underscores the challenges of translating projected synergies into realized value. Debt management, operational integration, and international market execution were critical determinants of financial performance. Furthermore, timing played a crucial role, as some revenue synergies depended on the successful launch and adoption of Disney+, which unfolded over several years following the merger.

The financial analysis highlights that the Disney–Fox merger was strategically and financially significant, producing measurable benefits while also illustrating the temporal and operational challenges of large-scale integration. Understanding these financial outcomes provides a foundation for assessing the merger’s effectiveness in relation to its strategic objectives and offers valuable lessons for future global media acquisitions.

4.2.4 Market Positioning

The Disney–Fox merger significantly reshaped Disney’s market positioning, reinforcing its dominance in the global media and entertainment industry and strategically preparing the company to compete in an increasingly digital and fragmented marketplace. By acquiring Fox’s extensive portfolio of film and television assets, international channels, and stakes in streaming services, Disney was able to enhance its intellectual property (IP) arsenal, diversify its content offerings, and expand its global footprint.

Streaming and Direct-to-Consumer Strategy

A critical component of post-merger market positioning was the launch and expansion of Disney+, Disney’s flagship direct-to-consumer streaming platform. The integration of Fox’s content library provided immediate scale and differentiation, allowing Disney+ to offer a more extensive and diverse content portfolio than it could achieve organically. This included popular franchises such as Avatar, The Simpsons, and Deadpool, which complemented Disney’s pre-existing IP, including Marvel, Star Wars, and Pixar.

The combination of Disney’s family-friendly brand and Fox’s broader, sometimes edgier content enabled the platform to appeal to a wider demographic spectrum, enhancing subscriber acquisition and retention. This strategic positioning directly addressed competitive pressures from Netflix, Amazon Prime Video, and Hulu, while providing Disney with a unique value proposition in content depth, variety, and brand recognition. The merger also facilitated cross-promotion and bundling opportunities, allowing Disney to integrate Hulu and ESPN+ offerings into a broader streaming ecosystem, increasing both engagement and monetization potential.

International Expansion and Market Penetration

Fox’s extensive international channels and regional production facilities offered Disney a ready-made infrastructure for global expansion. In markets where Disney had limited reach, particularly in Asia, Latin America, and Europe, Fox’s assets provided distribution networks, licensing agreements, and localized content production capabilities. This accelerated Disney’s international growth strategy, enabling faster penetration into emerging markets and tailoring content to regional tastes while leveraging established brand recognition. Furthermore, the acquisition allowed Disney to mitigate risks associated with single-market dependence, diversifying revenue streams across multiple territories and reducing vulnerability to domestic market fluctuations. By combining Disney’s operational expertise with Fox’s international experience, the company strengthened its competitive positioning in both mature and emerging markets, ensuring long-term strategic resilience.

Strengthened Intellectual Property Portfolio

One of the most significant outcomes of the merger was the enhancement of Disney’s IP portfolio, which is central to its market power and long-term profitability. The addition of Fox’s franchises and television series expanded Disney’s licensing, merchandising, and theatrical distribution opportunities, while enabling cross-platform content utilization across Disney+, theatrical releases, and theme parks.This strengthened IP base also allowed Disney to consolidate industry influence, leveraging its franchises for synergy creation across multiple business units. For example, Fox’s characters and storylines could be integrated into theme parks, consumer products, and marketing campaigns, amplifying brand loyalty and reinforcing Disney’s position as a global entertainment powerhouse.

Competitive Advantage and Strategic Differentiation

From a strategic perspective, the merger enhanced Disney’s ability to compete with digital-native companies and traditional media conglomerates simultaneously. By owning a vast and diverse content library, Disney could differentiate itself in a market where content exclusivity, brand equity, and audience engagement are decisive factors. Moreover, the merger provided operational scale, enabling cost efficiencies in content production, marketing, and distribution, which further strengthened competitive advantage.The Disney–Fox acquisition also improved bargaining power with advertisers, talent agencies, and technology partners, as the combined entity could offer broader reach and more attractive content deals. This reinforced Disney’s position in negotiations and partnerships, allowing it to influence market standards and secure favorable terms in licensing and distribution agreements.

Critical Assessment

While the merger strengthened Disney’s market positioning, it also introduced challenges. Managing a more complex, diverse content portfolio required careful brand management and audience segmentation to ensure that the distinct identities of Disney and Fox content were preserved without diluting core brand values. Additionally, integrating international operations involved navigating local regulations, cultural preferences, and competitive dynamics, requiring sophisticated market intelligence and adaptive management strategies. Overall, the Disney–Fox merger enhanced market positioning through strategic content acquisition, global expansion, and direct-to-consumer platform growth, positioning Disney as a leading force in the rapidly evolving media landscape. The combined assets, operational scale, and IP portfolio provide a strong foundation for sustainable competitive advantage, enabling Disney to respond proactively to industry disruption, technological change, and global consumer trends.

5. DISCUSSION

5.1 Comparison with Literature

The Disney–Fox merger provides a compelling case to evaluate how theoretical perspectives on mergers and acquisitions (M&A), synergies, and global growth strategies manifest in practice. Existing literature emphasizes that M&A success hinges on strategic fit, operational and financial synergies, and effective integration (Sirower, 1997; Haspeslagh & Jemison, 1991). In the context of mega-mergers, especially in the media and entertainment industry, the realization of projected synergies often proves challenging due to cultural complexity, technological disruption, and market volatility (Gaughan, 2015; King et al., 2004).From a synergy perspective, the Disney–Fox merger largely aligns with theoretical expectations. Synergy theory posits that combining complementary assets and capabilities should generate value exceeding the sum of individual entities (Damodaran, 2005). Disney’s acquisition of Fox brought together two content-rich portfolios, creating opportunities for operational efficiencies, revenue enhancement, and cross-platform content utilization. For example, Fox’s IP Avatar, Deadpool, and The Simpsons which complemented Disney’s existing franchises, enabling integrated content strategies across theatrical releases, streaming platforms, and merchandising. This exemplifies the operational and revenue synergies outlined in the literature, highlighting the role of asset complementarity in value creation.

From the perspective of global strategy theory, Disney’s move illustrates a deliberate inorganic growth mechanism for international expansion (Barney, 1991; Johnson et al., 2017). Fox’s global channels and regional production facilities provided Disney with immediate access to new markets, aligning with the resource-based view (RBV), which emphasizes leveraging unique resources for sustainable competitive advantage. The merger demonstrates how global firms can accelerate growth by acquiring strategic assets rather than relying solely on organic expansion, a point reinforced in studies on media M&A (Bower, 2001; Palepu, 1985).

However, the outcomes also partially diverge from theoretical expectations. Literature on M&A cautions that synergy realization is often delayed due to integration challenges, and mega-mergers frequently fail to meet projected financial targets (Cartwright & Schoenberg, 2006). In Disney–Fox, while operational synergies were realized relatively quickly through cost consolidation, revenue synergies dependent on international streaming adoption and content monetization unfolded more gradually. This aligns with the dynamic and iterative nature of value creation in complex mergers, emphasizing that theoretical models may overstate the speed of synergy realization in practice.

5.2 Strategic Effectiveness

The merger’s strategic effectiveness can be assessed through its impact on Disney’s competitive positioning, market power, and long-term growth prospects.First, the acquisition strengthened Disney’s content leadership, providing a diversified and globally recognized IP portfolio. By integrating Fox’s franchises with Disney’s established brands, the company achieved market differentiation that competitors—including Netflix and Warner Bros.—struggled to replicate. The enriched portfolio allowed Disney to maximize cross-platform exploitation, including Disney+, theatrical releases, theme parks, and merchandise, enhancing overall shareholder value.

Second, Disney’s global competitiveness was significantly enhanced. Fox’s international channels and production capabilities enabled rapid market penetration in Europe, Latin America, and Asia. This international footprint mitigated reliance on domestic markets and reduced exposure to regional market volatility, aligning with global expansion theories that emphasize the strategic benefits of geographic diversification (Bartlett & Ghoshal, 2002). The merger also increased Disney’s bargaining power with distributors, advertisers, and content partners, further reinforcing its industry influence and strategic leverage.

Third, the merger positioned Disney to respond proactively to digital disruption and streaming competition. The combined assets allowed for a differentiated offering on Disney+, blending family-oriented content with broader entertainment options from Fox. This strategic alignment addressed the evolving preferences of consumers, particularly the younger, digitally native demographic, and positioned Disney to compete effectively in the on-demand, multi-platform content market.

While the strategic effectiveness is evident, it is tempered by the complexities of integration. Operational and cultural alignment challenges introduced delays in full synergy realization. Thus, strategic gains were substantial but dependent on meticulous post-merger execution, reinforcing the literature’s assertion that M&A strategy alone does not guarantee success; execution and integration capabilities are critical (Weber et al., 2011).

5.3 Challenges vs. Successes

The Disney–Fox merger exemplifies the dual nature of mega-mergers, where strategic opportunities coexist with operational, cultural, and financial challenges. A critical examination of these dimensions provides insight into why the deal succeeded in delivering value while also revealing the complexities that accompanied integration.

5.3.1 Integration Challenges

- Human Resources and Leadership Alignment: Merging two large organizations required harmonizing leadership structures and reporting hierarchies. Disney had to integrate executives and management teams from Fox while preserving Fox’s creative autonomy, particularly in film and television production. This involved realigning decision-making processes, managing redundancies, and retaining high-value talent, all of which posed significant challenges. Delays or mismanagement in HR integration could have risked losing key creative personnel, potentially compromising content quality and production timelines.