Introduction & Evolution

1.1 OVERVIEW

In the modern economy, no company has redefined how products move from factories to consumers quite like Amazon. Once a modest online bookstore run out of Jeff Bezos’ garage in 1994, Amazon has evolved into a global behemoth that not only sells everything from toothpaste to televisions, but also orchestrates one of the most intricate supply chains ever devised.

Amazon’s logistics network is, in many ways, the backbone of the internet retail revolution. It is what enables a promise that has become almost mundane in the United States and other mature e-commerce markets: order today, receive tomorrow—or even in a matter of hours.

Yet this convenience masks an astonishing complexity. Hundreds of thousands of employees, millions of square feet of warehouse space, fleets of robots, planes, trucks, and last-mile delivery drivers all function in near-perfect synchronization to fulfill Amazon’s promise to customers.

To understand how this became possible—and how Amazon sustains it—requires exploring the company’s historical development, strategic pivots, investments in technology, and unrelenting focus on customer obsession.

1.2 The Early Years: 1994–2000

1994: The Beginning

When Jeff Bezos founded Amazon in Seattle in July 1994, he envisioned an online store that could offer far more selection than any physical retailer could ever dream of. The first product category was books, a deliberate choice: books are easy to catalog, ship, and store.

In these formative years, Amazon’s supply chain was rudimentary.

- Amazon did not own massive

- It operated a simple model: receive customer orders, relay them to book distributors, and then ship products once received.

- The process was slow, with delivery times of several days or even

- Inventory was largely dependent on partners’ stock

This “drop shipping” approach allowed Amazon to conserve cash but came with downsides:

- Lack of control over fulfillment

- Difficulty guaranteeing product

- Minimal differentiation from

1997–1998: Building First Fulfillment Centers

To solve these problems, Amazon began to invest in its own warehouses, which it called fulfillment centers (FCs).

By the end of the 1990s:

- Amazon operated several FCs across the United

- Inventory was stocked in-house, accelerating

- Warehouse operations were labor-intensive, relying on manual picking and

This foundational step was critical. It set the stage for Amazon’s philosophy:

Control the infrastructure to control the customer experience.

1.3 Expanding Product Lines and Geographic Reach

2000–2005: Product Explosion

In the early 2000s, Amazon began selling everything from DVDs to toys, electronics, and home goods. Each new category demanded changes to its supply chain:

- Different storage requirements (e.g., temperature control for some items).

- More sophisticated inventory

- Expanded warehouse

During this period:

- Amazon opened larger FCs with more advanced

- Implemented better barcode

- Began experimenting with predictive stocking, anticipating demand in

2005: The Launch of Amazon Prime

In 2005, Amazon launched Prime, which promised unlimited 2-day shipping for an annual fee. Prime was revolutionary for several reasons:

- It created a powerful loyalty

- It forced Amazon to reimagine its logistics

- It turned fast delivery from an occasional perk into a baseline

Internally, the Prime launch sparked massive investment in fulfillment and transportation:

- More regional

- Faster replenishment

- Closer relationships with

From this point forward, Amazon’s supply chain strategy would be defined by one overriding goal: Deliver faster than anyone else.

2006–2010: Fulfillment by Amazon (FBA) and Marketplace Growth

While Amazon’s own retail operations grew, it also transformed into a marketplace:

- Independent sellers listed products on

- With Fulfillment by Amazon (FBA), sellers could store inventory in Amazon

- Amazon handled picking, packing, and

FBA did three important things:

- Expanded Amazon’s selection

- Increased the volume of goods flowing through

- Raised complexity—warehouses now had to manage inventory ownership, fees, and processing rules for millions of SKUs.

By 2010, Amazon’s supply chain was no longer simply a retailer’s operation— it was a platform serving thousands of businesses.

1.4 Automation and Robotics: A New Era

2012: Acquisition of Kiva Systems

One of the most pivotal moments came in 2012 when Amazon acquired Kiva Systems, a robotics company specializing in warehouse automation.

Kiva robots:

- Moved entire shelves to human

- Reduced walking time in

- Improved picking speed and

After the acquisition:

- Amazon rapidly deployed Kiva robots in fulfillment

- By 2015, over 30,000 robots were working in Amazon

This was a watershed moment for warehouse logistics globally—Amazon demonstrated that automation wasn’t just possible at scale but could deliver significant cost and speed advantages.

2013–2017: Amazon Logistics and Delivery Infrastructure

During these years, Amazon invested heavily in building its own last-mile delivery network, rather than relying solely on UPS and USPS.

Key initiatives included:

- Amazon Logistics: A fleet of delivery vans operated by

- Amazon Flex: A gig-economy model allowing individuals to deliver packages in their

- Expansion of sortation centers, which pre-sorted packages by ZIP code before handing off to carriers or delivery drivers.

These moves reduced dependence on third parties, lowered costs, and improved control over delivery timelines.

1.5 The Same-Day Revolution and Prime Now

2014 Prime Now Launch:

- Amazon began offering 1–2 hour delivery in select

- Urban micro-fulfillment centers were established close to population

2015 Prime Day:

- The introduction of Prime Day created a massive spike in demand every

- Amazon had to build surge capacity into its supply

2015 Prime Day Highlights:

- Customers bought more items than on Black Friday 2014, our biggest Black Friday ever at the time.

- More than 4 million items were ordered across Prime-eligible countries, with 398 items ordered per second.

- Amazon sellers using Fulfillment by Amazon (FBA) enjoyed the biggest day ever with record-breaking unit sales growing nearly 300% worldwide.

Robotics Expansion:

- By 2017, over 100,000 robots were

- Automation extended beyond picking—robotic arms, automated packing, and advanced sortation systems were tested and implemented.

1.6 The COVID-19 Pandemic: A Real-Time Stress Test

2020–2022: Pandemic Hit

When the pandemic struck, Amazon’s supply chain was tested as never before.

Challenges:

- Unprecedented spikes in demand for home

- Labor shortages due to health and safety

- Transportation

Amazon’s Response:

- Hired over 400,000 new workers in

- Expanded delivery

- Prioritized essential

- Implemented safety protocols in

Despite immense challenges, Amazon sustained high service levels and grew sales dramatically—proof of its supply chain resilience.

1.7 The Present: Unmatched Scale and Sophistication

Today, Amazon’s supply chain includes:

- Over 1,100 active facilities worldwide, including:

- Fulfillment

- Sortation

- Delivery

- Air

- Over 520,000 robots working alongside human

- A private air fleet exceeding 100 cargo planes.

- A massive gig-economy and contractor-based delivery

- Proprietary AI predicting demand and optimizing inventory

It is a living, evolving system—one that continues to set the standard for global e-commerce logistics.

1.8 Evolution of Amazon Supply Chain

- Speed: Same-day and one-day delivery as a default

- Selection: Millions of SKUs, with inventory positioned close to

- Cost Efficiency: Automation, economies of scale, and optimized

- Resilience: Redundant facilities and diversified

- Sustainability: Ambition to reach net-zero carbon by

2. End TO End Order Journey

2.1 Overview

At the heart of Amazon’s operational excellence lies the end-to-end order journey—a finely tuned process that transforms a customer’s click into a delivered package, often within hours.

This journey is a showcase of advanced logistics, cutting-edge automation, and an obsession with eliminating friction.

This section details every step in the process, from order placement through delivery and returns, revealing how Amazon sets the benchmark for modern e-commerce fulfillment.

The lifecycle of an Amazon order typically includes:

- Customer Order Placement Order Routing and Allocation

Picking and Packing in Fulfillment Center

- Sortation and Transportation to Delivery Stations Last-Mile Delivery to the Customer

Returns Processing

Imagine you’re a Prime customer in Chicago. It’s 9:00 p.m., and you decide to order a portable phone charger. You click “Buy Now.”

Within seconds, a cascade of processes begins across Amazon’s digital and physical infrastructure. The next morning, the package is at your doorstep.

But how does that happen—so fast, so reliably, so invisibly?

2.2 Customer Order Placement

Process: A customer browses the Amazon website or app.Product availability and estimated delivery dates are displayed based on inventory and the customer’s ZIP code.

- At checkout, the system dynamically calculates:

- Optimal fulfillment

- Available shipping

- Delivery windows (Same-Day, One-Day, Two-Day, Standard).

Technology Enablers:

✅ Dynamic Inventory Visibility:Real-time data on stock levels in hundreds of facilities.

✅ Predictive Algorithms:Machine learning forecasts likely purchase patterns, pre-positioning inventory.

✅ Personalization:Recommendations and delivery promises tailored to browsing history and Prime membership status.

2.3 Order Routing and Allocation

Once the customer confirms the purchase, Amazon’s order management system determines how to fulfill it.

Routing Logic:

- Is the item in stock locally?

- Which facility can meet the delivery promise at the lowest cost?

- What are carrier capacity constraints?

- Are there batching opportunities with other orders to the same address?

Outcome:

The order is assigned to a specific Fulfillment Center (FC). A picking ticket is generated.

Inventory is reserved in the warehouse.

Example:

A customer in Austin orders an iPhone case at 8:00 p.m.:Algorithm identifies a sortation center with late-night cutoff.Same-Day delivery window is offered.Picking begins within minutes.

2.4 Picking and Packing in Fulfillment Centers

Each Fulfillment Centers globally are Amazon’s operational nerve centers—massive facilities often exceeding 1 million square feet.

Zones:

- Receive: Inbound goods checked and

- Stow: Items placed in designated

- Pick: Robotic and human teams retrieve

- Pack: Orders consolidated, labeled, and

Automation:

✅ Robotics: Kiva robots bring entire shelves (pods) to human pickers which Reduces walking time & increases efficiency.

✅ Scanning and Weighing: Each item is scanned multiple times for accuracy & Packages are weighed to detect errors.

Packing Customization:

- Automated machines cut boxes to fit item

- Branded tape and recyclable materials

Output:Completed packages move to outbound staging.

2.5 Sortation and Transportation to Delivery Stations

After packing, packages enter the sortation phase:

Sortation Centers: Facilities that pre-sort packages by ZIP code.Conveyor belts and scanning systems organize the shipments.

- Labeled for next leg of journey:

- Amazon Air

- Regional delivery

- Third-party

Transportation:

Amazon Air:

- For expedited

- Over 80 aircraft in the

Linehaul Trucks & Third-Party Carriers:

- Move parcels between fulfillment centers and delivery

- Supplement capacity during peak

2.6 Last-Mile Delivery

The last mile is the most complex and costly part of the journey.

Amazon Logistics (AMZL) & Delivery Service Partners (DSPs):

- Proprietary delivery

- Drivers in branded

- Dynamic routing optimized

- Independent companies operating Amazon-branded

- Local coverage with Amazon

Flex Drivers & Third-Party Carriers:

- Gig-economy workers delivering packages with their

- Used for same-day and low-density

- UPS, USPS, FedEx used for rural and overflow

Customer Experience:

- Real-time tracking through the

- Photo proof of

- Notifications of delivery

2.7 Returns Processing

Amazon’s returns process is designed to be seamless.

Return Initiation:

- Drop-off at UPS

- Amazon

- Scheduled

Reverse Logistics: Returned items routed to:

- FC for

- Refurbishment

- Liquidation

- Donation

Automation:Scanning determines condition, thereafter automated sorters direct items to correct channel.

3. Supply Chain Architecture

3.1 Overview

Amazon’s supply chain architecture is perhaps the most formidable and studied example of logistics innovation in the 21st century. What began as a modest fulfillment system to ship books has evolved into a multi-tiered, technology-powered network capable of delivering almost any product to customers’ doorsteps within a single day. This architecture is the structural manifestation of Amazon’s “flywheel” strategy—one that combines vast selection, speed, and customer obsession to drive growth and loyalty.

Unlike traditional retailers that rely heavily on third-party carriers and distributors, Amazon has pursued an aggressive strategy of vertical integration. Over time, the company brought more elements of fulfillment and transportation under direct control. Today, Amazon’s supply chain is an intricate web of Fulfillment Centers (FCs), Sortation Centers, Delivery Stations, Air Hubs, and last-mile networks—orchestrated by proprietary software and real-time analytics.

This combination has created an ecosystem that few competitors can replicate.

3.2 Fulfillment Centers

The Engine of Amazon’s Logistics:

Fulfillment Centers are the foundation of Amazon’s ability to deliver at scale. These facilities are vast—some exceeding a million square feet—and strategically distributed near major metropolitan areas to shorten the distance between inventory and customers.

Each Fulfillment Center is subdivided into specialized zones. The Receive Area is where inbound inventory arrives, usually in pallets or cases from suppliers, import containers, or returns. Products are scanned, counted, and reconciled with purchase orders. Inbound shipments are then broken down into smaller units and assigned to stow locations.

Stow is a crucial process in which items are placed into storage bins or pods. Here, Amazon leverages advanced robotics: fleets of orange Kiva robots glide under mobile shelving units, lifting and transporting them to human workers stationed along the perimeter. This “goods-to- person” model dramatically reduces time spent walking aisles and increases picking productivity. Items are stored randomly, a concept known as “random stow,” where software remembers the exact bin locations. This approach optimizes space utilization and ensures fast retrieval.

When a customer order is placed, the system generates a pick ticket. Robots again retrieve the relevant shelves, which are brought to a picker who selects the correct item, scans it for accuracy, and places it in a tote. Totes containing individual picks move via conveyor to the Packing area, where associates or automated machines consolidate orders into shipping cartons, apply labels, and weigh each box to confirm accuracy. Finally, packages are sorted by carrier and delivery speed before leaving the Fulfillment Center.

3.3 Sortation Centers

Streamlining Regional Distribution

After fulfillment, packages enter the sortation phase. Sortation Centers are specialized facilities that pre-sort parcels by ZIP code or region, grouping them for efficient transfer to Delivery Stations or linehaul routes.

Sortation Centers typically operate massive conveyor systems and scanning infrastructure. Packages are inducted onto conveyor belts, scanned, and automatically routed to the appropriate chute corresponding to the final destination region. Sortation reduces costs by minimizing reliance on external hub-and-spoke networks and increasing density for last-mile delivery routes.

For example, if a Fulfillment Center in Pennsylvania ships thousands of orders destined for New York City, the Sortation Center consolidates them into trucks bound for NYC Delivery Stations. This pre-sorting is essential for enabling overnight and same-day delivery windows.

3.4 Delivery Stations

The Last Staging Point

Delivery Stations are smaller, hyper-local facilities that serve as the last point before packages reach the customer. Here, packages arrive in bulk from Sortation Centers or linehaul trucks.

They are scanned again and organized into delivery routes.

Delivery Stations typically support Amazon Logistics (AMZL), Delivery Service Partners (DSPs), and Amazon Flex drivers. Routes are optimized in real time using Amazon’s routing software, which factors in:

- Traffic

- Customer preferences (e.g., delivery windows).

- Density of

- Driver

Packages are loaded onto vans early in the morning for dispatch. In many markets, customers can receive real-time updates showing the van’s approach and estimated delivery times.

3.5 Amazon Air Hubs

The Strategic Air Network

Recognizing the limits of ground transportation alone, Amazon has invested heavily in its air freight network—known as Amazon Air. The company operates a fleet exceeding 80 aircraft, including Boeing 767 and 737 freighters, based at key air hubs.

The Cincinnati/Northern Kentucky International Airport (CVG) is Amazon Air’s primary hub, opened in 2021 after a $1.5 billion investment. This facility includes:

- A sorting center for hundreds of thousands of

- Parking for over 100

- Integration with ground transport and fulfillment

Amazon Air allows the company to guarantee overnight delivery between distant Fulfillment Centers and Delivery Stations. For example, a package ordered at 10 p.m. in Los Angeles can be airlifted overnight to New Jersey and delivered the next day.

3.6 Amazon Global Logistics

The International Supply Backbone

Amazon’s supply chain architecture also includes Amazon Global Logistics (AGL), responsible for managing imports from manufacturers abroad. AGL consolidates shipments in origin countries, books ocean freight, clears customs, and coordinates inland transport to Fulfillment Centers.

This function is critical because a substantial proportion of Amazon’s third-party marketplace sellers source inventory from Asia, especially China. AGL provides:

- Real-time container

- Customs

- Integrated warehousing

During COVID-19, AGL became essential in mitigating international supply chain disruption by securing priority capacity and rerouting shipments through less-congested ports.

3.7 Middle Mile

Connecting Fulfillment to Last Mile

The middle mile is the segment between Fulfillment Centers and Delivery Stations. Amazon relies on a mix of:

- Company-owned tractor-trailers (Amazon-branded blue trucks).

- Contracted linehaul

- Rail and intermodal

Middle mile operations focus on consolidating large volumes of packages, moving them overnight or during off-peak hours to maintain speed while controlling costs.

3.8 Last Mile Networks

Delivery Service Partners and Flex

Amazon’s last-mile network has evolved into a hybrid model:

✅ Delivery Service Partners (DSPs):

- Independent small businesses operating Amazon-branded

- Contracted to deliver packages exclusively for

✅ Amazon Flex:

- Gig-economy drivers who use their own

- Flexible scheduling to cover surges in

This model provides scalability and geographic reach while maintaining control over the customer experience.

3.9 Geographic Footprint

Amazon continues to invest aggressively in expanding its physical footprint:

North America:

- Hundreds of Fulfillment, Sortation, and Delivery

- Prime Now hubs in major metro

Europe:

- Dense networks in the UK, Germany, France, and

- Growing last-mile

Asia-Pacific:

- Fulfillment Centers in India, Japan, and

- Focus on localizing

This global reach enables Amazon to meet diverse customer expectations and regulatory environments.

4. Core Supply Chain Component & Technology

4.1 Overview

While Amazon’s global network of fulfillment and transportation facilities provides the physical foundation of its logistics empire, it is the technological infrastructure behind the scenes that truly differentiates the company. Unlike traditional retailers that bolt on technology as an afterthought, Amazon has always placed software and data at the core of every process—from predicting what you might buy next to determining the optimal route for your package.

This section explores in detail the essential technological components that power Amazon’s supply chain, including automation, robotics, forecasting algorithms, machine learning applications, and warehouse management systems. These capabilities enable Amazon to operate at a scale and speed that competitors struggle to match.

4.2 Robotic & Warehouse Automation

One of Amazon’s most significant strategic moves was the 2012 acquisition of Kiva Systems, a robotics company specializing in warehouse automation. This $775 million purchase would prove to be transformative, laying the foundation for a new generation of highly automated fulfillment centers.

Prior to Kiva, traditional fulfillment relied heavily on manual picking, where workers walked miles each day along aisles to retrieve items. Amazon recognized that this method was inefficient, slow, and increasingly unsustainable as order volumes soared. Kiva’s robots introduced a radically different approach known as “goods-to-person.” Instead of people going to products, robots brought the products to stationary pickers.

In Amazon’s modern fulfillment centers, thousands of Autonomous Mobile Robots (AMRs)— now rebranded as Amazon Robotics—glide across the warehouse floor in carefully choreographed movements. Each robot slides under a shelving pod, lifts it, and transports it to a workstation where an associate picks the required item. The robot then returns the pod to storage or moves on to the next location.

This system delivers multiple benefits:

- It reduces the average time required to retrieve

- It minimizes picker fatigue and improves

- It increases storage density by eliminating wide aisles between

Amazon has continued to innovate beyond the original Kiva robots. The company has deployed new types of automation, such as:

- Xanthus robots: Next-generation flat-topped vehicles capable of moving heavier

- Pegasus and Cardinal systems: Robotics that help sort and consolidate

- Automated bagging machines: Systems that automatically package certain categories of

Robotics do not replace humans but rather augment their productivity. One Amazon executive described this model as “human-centric automation,” where technology performs repetitive tasks while people handle more complex decisions.

4.3 Machine Learning & Forecasting Algorithm

Amazon’s supply chain is distinguished by the depth of its predictive analytics capabilities. Unlike many companies that plan inventory based on historical averages or seasonal trends, Amazon uses machine learning to forecast demand dynamically.

Demand Forecasting:

Amazon’s forecasting models analyze massive datasets, including:

- Search

- Page

- Price

- External signals (e.g., weather, news trends).

- Historical sales at granular regional

These models constantly update forecasts, enabling Amazon to pre-position inventory before orders are even placed. For example, during the holiday season, the system can anticipate which SKUs are likely to surge in a given city and allocate stock accordingly.

This capability is called anticipatory shipping, where products are moved closer to customers based on predicted demand, shortening delivery times and reducing shipping costs.

Replenishment Algorithms:

Amazon automates reordering from suppliers using replenishment models that factor in:

- Lead times from origin

- Production

- Safety stock

- Real-time inventory positions across Fulfillment

Pricing and Promotions:

Machine learning also influences dynamic pricing and promotions. When a product’s demand spikes, pricing algorithms adjust to balance inventory turnover with profitability. The system can

even automatically trigger promotional campaigns to accelerate inventory movement when needed.

4.4 Warehouse Management Systems(WMS)

Amazon’s Warehouse Management System (WMS) is a proprietary software platform known internally as Fulfillment Center Management System (FCMS). Unlike off-the-shelf solutions used by many retailers, Amazon built FCMS in-house to address the unique requirements of massive SKU variety, robotics integration, and same-day shipping windows.

Key Functions of FCMS:

- Real-time inventory tracking at the bin

- Allocation of pick paths and work

- Integration with robotics to coordinate pod

- Slotting optimization to position fast-moving SKUs closer to packing

- Exception management for damaged goods or mis-

The WMS interfaces directly with Amazon’s order management system, enabling tight synchronization between customer demand and fulfillment execution. For example, if a customer in Boston places an order for a popular laptop, the system can immediately locate the nearest Fulfillment Center with available inventory, assign a robot to retrieve the item, and prioritize it in the pick queue—all within seconds.

4.5 Transportation Management System(TMS)

Amazon’s scale demands sophisticated orchestration of transportation assets, from middle-mile linehaul to last-mile delivery vans. This is where the Transportation Management System (TMS) comes into play.

Functions of TMS:

- Planning linehaul routes between Fulfillment Centers, Sortation Centers, and Delivery

- Optimizing trailer loads to maximize capacity

- Scheduling dock

- Real-time tracking of shipments via GPS and

- Integrating with carrier partners and Amazon’s own

One of the notable innovations in Amazon’s TMS is its Dynamic Routing Engine, which recalculates delivery routes in near real time based on:

- Traffic

- Weather

- Driver

- Order cut-off

This dynamic approach allows Amazon to maintain delivery promises even when conditions change unexpectedly.

4.6 Vision Systems & AI in Fulfillment

Amazon deploys advanced computer vision systems throughout its warehouses to enhance speed and accuracy. These systems rely on cameras, sensors, and AI models to:

- Verify that pickers select the correct

- Ensure packing

- Detect damaged

- Guide robots safely through busy warehouse

For example, in the packing area, high-speed cameras capture images of each package. Machine learning models analyze the images to confirm that labels are correctly applied and the package matches the expected weight and dimensions.

In robotics-enabled fulfillment centers, computer vision guides robots to avoid collisions and maintain safe distances from associates.

4.7 IoTs & Real Time Visibility

Amazon’s warehouses are essentially vast networks of Internet of Things (IoT) devices. From conveyor belt sensors to pallet scanners, every component feeds data into centralized dashboards.

IoT provides:

- Location tracking for millions of

- Equipment performance monitoring (predictive maintenance).

- Environmental controls for temperature-sensitive

- Energy consumption

These insights allow managers to preempt equipment failures, rebalance workloads, and optimize operations minute by minute.

4.8 Amazon Web Service-AWS Integration

An often-overlooked pillar of Amazon’s supply chain technology is AWS, the company’s own cloud computing platform. AWS provides the infrastructure that enables scalability, redundancy, and security across all supply chain systems.

Examples of AWS Use:

- Data lakes storing petabytes of supply chain

- Machine learning models running on Elastic Compute Cloud (EC2).

- Real-time dashboards powered by AWS analytics

- IoT platform integrations with warehouse

AWS allows Amazon to deploy new capabilities quickly, experiment with optimization models, and ensure systems remain operational even during peak demand surges.

4.9 Reverse Logistics Technology

Returns are a significant challenge in e-commerce, often exceeding 15–20% of all orders. Amazon has invested heavily in reverse logistics technology to handle this volume efficiently.

Returns Workflow:

- Customer initiates return via the website or

- A return authorization and QR code are

- Items are dropped at a UPS Store, Kohl’s, or Amazon

- Packages are consolidated and routed to processing

At these facilities, computer vision and AI assess:

- Whether products are

- Whether they require

- Whether they should be liquidated or

This system allows Amazon to process returns faster and recapture value from returned inventory.

4.10 Culture of Continous Improving

Perhaps the most critical component is cultural. Amazon cultivates a mindset of continuous optimization, expressed through:

- Daily performance metrics visible to all

- “Kaizen” events (process improvement workshops).

- Regular experimentation with new automation and process

- Incentives for employees to suggest

This culture ensures that technology is not static but evolves in response to changing conditions and customer expectations.

5. Inventory Strategy & The Power of Prime

5.1 Overview

Amazon’s inventory strategy is not merely a matter of logistics—it is a central pillar of its business model. Unlike many retailers that treat inventory as a cost center, Amazon treats it as a strategic lever to drive growth, loyalty, and profitability. The company’s approach is anchored in two interlocking concepts:

- Proximity and Predictive Positioning: Stock must be held as close to the customer as possible, so delivery feels instant.

- Prime Membership: Inventory is optimized not just for profitability but to reinforce the Prime value proposition.

This section explores Amazon’s inventory management practices, including real-world examples of how decisions on stocking, replenishment, and allocation have enabled the company to outperform competitors in both normal times and crises like COVID-19.

5.2 Proximity

One of Amazon’s most radical departures from traditional retail was the idea that customers shouldn’t have to wait days for products that could be stored locally. In the 1990s and early 2000s, most e-commerce companies operated large, centralized warehouses. Orders were picked, packed, and shipped hundreds or even thousands of miles, resulting in long lead times.

Amazon decided early that proximity was power. This conviction led to the gradual development of regional Fulfillment Centers. For example, by the late 2000s, Amazon had built FCs near major population centers like Dallas, Chicago, and Los Angeles.

In the 2010s, the company began layering additional infrastructure: Sortation Centers and Delivery Stations, further breaking down inventory closer to the last mile.

By 2019, Amazon launched Same-Day Fulfillment Centers—smaller, hyper-local warehouses stocked only with the fastest-moving SKUs. This allowed orders placed by noon to arrive by dinner time.

A vivid illustration of this came during the COVID-19 pandemic. As lockdowns were imposed in March 2020, e-commerce volumes surged. Competing retailers struggled to fulfill orders because their inventory was consolidated in a few hubs. Amazon’s distributed model allowed it to reroute shipments dynamically and keep delivery times relatively consistent. In a letter to shareholders, Jeff Bezos noted that the company had achieved “weeks’ worth of growth in a matter of days.”

5.3 Predictive Inventory Positioning

The engine behind this proximity is predictive positioning, an approach that uses massive data volumes to forecast demand and move products closer to where they will likely be ordered.

For example, Amazon’s machine learning models analyze:

- Search behavior (e.g., customers browsing for a specific model of headphones).

- Purchase trends in similar ZIP

- Seasonal buying

- Social media mentions and external news

When signals indicate rising demand for a product, Amazon pre-positions inventory in Fulfillment Centers nearest likely buyers—before a single order is placed. This practice is sometimes called anticipatory shipping, and Amazon filed a patent for it in 2013.

A notable incident occurred during the launch of the Echo Dot in 2016. Early marketing campaigns triggered a spike in searches and pre-orders. Amazon’s algorithms recognized this trend and began shipping units to Sortation Centers in anticipation of same-day orders. When customers in Boston and San Francisco placed orders on launch day, inventory was already sitting minutes away, allowing deliveries within hours.

5.4 Safety Stock & Service Level Target

While many companies optimize inventory to minimize carrying costs, Amazon emphasizes

service level targets—the probability that a product is in stock when a customer wants it.

The company’s internal benchmarks often exceed 99% in-stock rates for top-selling SKUs. Maintaining this requires holding significant safety stock, especially for items that are:

- High velocity (e.g., iPhone accessories).

- Critical to the Prime

- Seasonal (e.g., holiday decorations).

This approach was critical during COVID-19. As demand for essentials surged, many competitors ran out of stock. Amazon, while not immune to shortages, was able to maintain relatively higher availability due to pre-existing safety stock buffers. For example, during March and April 2020, the company prioritized inventory replenishment for household staples and medical supplies, suspending shipments of non-essential goods to keep FC capacity focused.

5.5 Replenishment & Vendor Managed Inventory

Amazon operates a highly automated replenishment engine. For many first-party products, the system:

- Monitors sales velocity in real

- Calculates reorder

- Places purchase orders automatically with

Additionally, Amazon uses Vendor Managed Inventory (VMI) relationships, where suppliers are responsible for maintaining agreed stock levels within Amazon’s facilities. This model improves responsiveness because suppliers can see their sell-through data and adjust shipments proactively.

For example, Procter & Gamble has VMI arrangements with Amazon. During the early pandemic phase, as demand for cleaning supplies spiked, P&G was able to accelerate replenishments because its teams had full visibility into Amazon’s stock levels and sales data.

5.6 Inventory Optimization

Amazon’s inventory strategy incorporates multi-echelon optimization, which means managing stock not only within a single warehouse but across the entire network.

This involves:

- Balancing inventory between regional

- Pre-staging in Sortation Centers and Delivery

- Accounting for lead times between

One illustrative case occurred during the 2017 hurricanes in Texas and Florida. Amazon dynamically rerouted inventory from unaffected regions to maintain service levels in the Southeast. By leveraging data from its Transportation Management System and predictive analytics, the company minimized disruption and quickly restored normal delivery speeds.

5.7 The Prime Imperative

If there is a single force shaping Amazon’s inventory strategy, it is Prime. Prime membership— launched in 2005—committed Amazon to free two-day delivery on millions of items, a radical promise at the time.

Over time, Prime evolved to offer one-day and same-day delivery, raising the bar for inventory positioning. In 2019, Amazon announced that it would invest $800 million in a single quarter to make one-day delivery the default for Prime customers in the U.S.

This shift required:

- Splitting inventory into smaller batches spread across dozens of

- Increasing inventory carrying

- Investing in faster replenishment

However, the payoff has been enormous. According to analysts, Prime members spend more than twice as much annually as non-Prime customers. Maintaining inventory close to the customer sustains this loyalty.

5.8 Covid19-Stress Test of The Inventory Model

The pandemic offered a rare real-time case study of Amazon’s inventory resilience. When lockdowns began:

- Demand for non-perishable food and household goods

- Fitness equipment and home office supplies

- Some SKUs saw sales increases of over 500%.

While many retailers rationed orders or posted out-of-stock notices, Amazon rapidly adjusted:

Prioritizing FC capacity for essentials.

- Temporarily restricting inbound shipments of low-priority

- Reallocating inventory between

Even so, the company faced unprecedented strain. Prime delivery times extended beyond two days for many products. Jeff Bezos warned customers in his shareholder letter that delays would persist as Amazon balanced employee safety with fulfillment volume.

This incident underscored the challenges of balancing cost efficiency, resilience, and customer expectations.

5.9 The Trade-Offs Of Proximity

While bringing inventory closer to customer’s yields faster delivery, it also introduces complexity and higher costs:

- More FCs require more stock

- Demand volatility increases the risk of misallocated

- Rebalancing stock between FCs incurs transportation

Amazon manages these trade-offs by continuously refining its forecasting algorithms and by maintaining flexible transportation capacity (e.g., Amazon Air).

5.10 Returns & Inventory Recovery

Returns represent a significant aspect of inventory management. Amazon has invested heavily in

reverse logistics to recapture value:

- Returned items are scanned and

- Resellable items are re-entered into active

- Damaged or used goods are refurbished or

- Donations are channeled through the FBA Donations

This system allows Amazon to maintain higher inventory efficiency despite high return volumes—especially in categories like apparel and electronics.

5.11 Inventory Visibility & Customer Experience

A crucial differentiator is inventory visibility for customers. When a buyer views a product page:

- The system shows delivery date estimates based on the exact inventory

- If inventory is low, the site displays messages like “Only 2 left in stock—order ”

- Real-time updates track fulfillment progress post-

This transparency builds trust and encourages faster purchasing decisions.

5.12 Real-Time Inventory Rebalancing in Crisis Scenarios

One of the most compelling aspects of Amazon’s inventory management is its ability to

rebalance inventory on the fly, particularly during disruptive events.

A notable example came during the 2015 West Coast port congestion, when a protracted labor dispute slowed the movement of shipping containers at the ports of Los Angeles and Long Beach. This crisis threatened to choke off inventory flow to Amazon Fulfillment Centers on the West Coast.

Rather than accept weeks-long delays, Amazon activated contingency plans:

- Redirecting inbound containers to Gulf Coast and East Coast

- Expediting cross-country intermodal

- Using air freight for high-velocity SKUs like consumer

These measures incurred higher transportation costs, but they kept Prime delivery promises intact for millions of customers. Even as competitors saw their stock outs balloon, Amazon maintained fulfillment rates above 95% for top-selling products.

This incident highlights a recurring theme: inventory proximity and resilience are expensive but can be decisive competitive advantages.

5.13 The Role of Third-Party Sellers and FBA Inventory Strategy

Another essential element is how Amazon manages inventory in partnership with its Fulfillment by Amazon (FBA) sellers.

FBA allows independent merchants to send their products into Amazon’s Fulfillment Centers, where inventory commingles with Amazon’s own stock and is eligible for Prime delivery. This model creates both benefits and challenges:

Benefits:

- Dramatically expands product selection without requiring Amazon to purchase

- Increases utilization of warehouse

- Enables faster scaling of new categories and

Challenges:

- Complexity in demand forecasting across millions of small

- Higher likelihood of overstocking slower-moving

- Need for real-time reconciliation of ownership and

To manage this, Amazon uses restock recommendations driven by predictive algorithms. Sellers see dashboards advising optimal inventory levels, timing, and replenishment quantities.

During COVID-19, Amazon temporarily suspended inbound shipments for FBA items not deemed essential. Many sellers were forced to pivot to Merchant Fulfilled Network (MFN) fulfillment or to redirect stock to alternative carriers. While controversial, this decision demonstrated Amazon’s willingness to prioritize core inventory categories critical to customer needs.

5.14 Seasonal Inventory Planning

Seasonality is a major factor in Amazon’s inventory model. The fourth quarter, encompassing Black Friday and the holiday peak, often generates as much as 30–40% of annual sales.

To prepare: Amazon begins inventory planning in Q2, working with suppliers to lock in production capacity.

- Safety stock levels are increased across all Fulfillment

- Sortation Centers expand operating

- Additional warehouse space is leased

- Delivery Service Partners and Flex drivers are recruited in

In 2020, amid the pandemic, holiday inventory planning was especially challenging. Global supply chains were still strained, but consumer demand was unpredictable. Amazon mitigated risks by:

- Diversifying suppliers for critical

- Chartering additional cargo

- Launching an early holiday sales event in October to flatten peak

This proactive approach allowed Amazon to sustain fulfillment performance while competitors were often overwhelmed.

5.15 SKU Rationalization and Inventory Discipline

Despite its vast selection, Amazon has learned that more SKUs do not always improve profitability. Low-velocity products consume warehouse space and create operational drag.

Over the years, Amazon has developed a sophisticated SKU rationalization process:

- Analyzing inventory turnover by region and

- Applying automated thresholds for delisting or deprioritizing

- Charging higher storage fees to FBA sellers for long-term

These measures encourage better inventory hygiene and ensure space is reserved for products that justify their footprint.For example, in 2019, Amazon increased monthly storage fees for items sitting longer than 365 days, reducing the volume of stale inventory by double digits.

5.16 Sustainability Considerations in Inventory Strategy

Inventory proximity has environmental implications. Holding stock closer to customers reduces last-mile delivery miles, lowering emissions per package.However, duplicating inventory across multiple Fulfillment Centers increases energy use and waste if products go unsold.

Amazon addresses this tension by:

- Using predictive algorithms to limit

- Investing in renewable energy to power

- Implementing automated systems to identify excess inventory early for donation or

In 2020, Amazon announced a commitment to reach net-zero carbon emissions by 2040, which will require further refinement of inventory practices to balance speed, cost, and sustainability.

5.17 Workforce Considerations in Inventory Management

Inventory strategy is not purely technological. Behind every stocking decision are thousands of associates responsible for:

- Receiving and stowing

- Picking, packing, and replenishing

- Managing returns and

During COVID-19, workforce health became a constraint on inventory throughput. Amazon invested over $4 billion in safety measures, including:

- Personal protective

- Enhanced cleaning

- Temporary pay

- Social distancing redesigns of warehouse

These measures protected operational capacity and maintained customer trust.

Amazon’s approach represents a paradigm shift. Where traditional retailers sought to minimize inventory costs and push inventory risk onto suppliers, Amazon embraced inventory as a strategic enabler. Its willingness to carry high service levels and tolerate short-term margin erosion reflects a profound commitment to customer satisfaction.

This mindset has forced the rest of the retail industry to reevaluate assumptions about where and how much inventory should be held. As e-commerce continues to grow, the lessons of Amazon’s inventory model will become increasingly relevant to all sectors seeking to meet rising consumer expectations.

6. Last Mile Delivery Revolution

6.1 Overview

Among all the innovations in Amazon’s supply chain, perhaps none has had as transformative an impact as its approach to last-mile delivery. Where traditional retailers relied almost exclusively on established parcel carriers, Amazon reimagined this critical step as a core competency—one that could set the company apart by enabling speed, reliability, and customer intimacy.

This section explores in detail how Amazon built its last-mile ecosystem, how it balances flexibility and control, and how it uses data, technology, and partnerships to achieve unparalleled delivery performance. We will also examine real-world examples of how the last-mile model evolved and how it positions Amazon for future growth.

6.2 The Strategic Importance of Last-Mile Delivery

The last mile refers to the final leg of the logistics journey: moving packages from a delivery station to the customer’s doorstep. Historically, this was outsourced to national carriers like UPS, FedEx, DHL, or the United States Postal Service.

While outsourcing made sense in the early years—when Amazon handled relatively low parcel volumes—it gradually became a constraint. As Prime accelerated customer expectations, Amazon realized that relying exclusively on third parties created bottlenecks and limited flexibility.

For example, during peak holiday periods, UPS and FedEx imposed volume caps to protect their own networks. This meant Amazon could not guarantee next-day delivery for all Prime orders.

In addition, the experience—tracking updates, delivery windows, package handling—was often inconsistent with Amazon’s customer obsession.

These challenges led Amazon to conclude that owning last-mile delivery was not just a cost issue but a strategic imperative to control the customer experience end-to-end.

6.3 The Strategic Importance of Last-Mile Delivery

In 2014, Amazon formally launched Amazon Logistics (AMZL), a dedicated internal delivery operation. Initially, AMZL started with a limited pilot in select cities. It combined:

- Company-owned Delivery Stations to sort packages

- Contracted drivers operating under Amazon’s

- Technology to optimize routes

This model proved successful in handling overflow volume, especially during holidays. Over time, Amazon expanded AMZL aggressively, building Delivery Stations near major metropolitan areas and recruiting thousands of drivers.

According to a 2020 Morgan Stanley analysis, Amazon surpassed FedEx in the total number of parcels delivered in the U.S.—a remarkable achievement in less than a decade. By 2022, Amazon Logistics was delivering nearly 2 billion packages annually, accounting for over half of the company’s shipments.

This growth reflects a deliberate strategy: integrate last-mile delivery as a core capability, giving Amazon unmatched flexibility to scale.

- Delivery Service Partner (DSP) Program

While Amazon Logistics created the blueprint, scaling last-mile delivery required a network of entrepreneurial partners who could operate with Amazon’s technology and standards. In 2018, Amazon launched the Delivery Service Partner (DSP) Program, inviting individuals to start small logistics companies delivering exclusively for Amazon.Here’s how it works:

- DSP owners lease or buy a fleet of Amazon-branded vans (often blue Mercedes Sprinters).

- They hire and manage

- Amazon provides training, route planning software, insurance, and

- The DSP receives per-package compensation and performance

By 2021, there were more than 2,500 DSP companies globally, employing over 150,000 drivers. This model enabled rapid capacity expansion without Amazon bearing all labor and asset costs.

Real-world examples abound. One notable case is a former military veteran who started a DSP in Atlanta with 20 vans and scaled to over 100 employees within two years. His story, featured in Amazon’s marketing materials, illustrates the dual benefit: entrepreneurship for local operators and scalable delivery capacity for Amazon.

The DSP model also creates operational consistency. Because all partners use Amazon’s routing systems and training standards, the customer experience remains predictable across regions.

6.5 Amazon Flex: The Gig Workforce

To complement DSPs and fill gaps in peak demand, Amazon built Flex, a gig-economy delivery platform launched in 2015. Flex drivers—independent contractors using their own vehicles— pick up packages from Delivery Stations or Prime Now hubs and deliver them along preassigned routes.

Flex offers:

- Flexible scheduling: drivers choose 2–4-hour delivery

- Dynamic routing through the Flex

- Real-time earnings

This approach has several advantages:

- Rapid scaling during holidays or promotional

- Coverage in lower-density suburban or rural

- Cost efficiency: Flex drivers are paid per delivery block without long-term

During Prime Day 2020—a period that coincided with COVID-related demand surges—Flex played a crucial role. Drivers in cities like Chicago and Dallas were able to supplement capacity when DSP and AMZL volumes maxed out.

6.6 Amazon Flex: The Gig Workforce

At the core of Amazon’s last-mile success is its logistics technology stack. The company leverages advanced software systems to orchestrate every detail, including:

✅ Routing Engine: Calculates optimal routes based on:

- Traffic

- Real-time

- Package

- Delivery

✅ Rabbit Device:

- A handheld scanner and navigation tool issued to

- Provides step-by-step instructions, turn-by-turn navigation, and proof-of-delivery

✅ Delivery App (Flex): For Flex drivers, this app assigns routes, tracks location, and collects signatures or photos of deliveries.

✅ Dynamic Reoptimization: If a driver falls behind schedule, the system can reassign packages to other drivers in real time.

✅ Data Analytics: Captures performance metrics:

- On-time delivery

- Customer

- Safety

- Delivery success

This ecosystem allows Amazon to maintain near-perfect visibility into every package from the moment it leaves a Fulfillment Center to final delivery.

6.7 Customer Experience: Transparency and Trust

Amazon understands that last-mile delivery is not just operational—it is the most visible part of the customer experience. That’s why the company invests in transparency tools:

✅ Real-Time Tracking:

- Customers can track a driver’s progress on a live

- Notifications include “10 stops away”

✅ Photo on Delivery:

- Drivers photograph the package at the delivery

- Customers receive the image in their app or

✅ Delivery Preferences:

- Customers can designate safe drop

- Options for “Do not ring doorbell” or “Deliver to ”

These features increase customer trust and reduce “Where is my order?” inquiries, improving operational efficiency.

6.8 Sustainability in Last-Mile Delivery

Amazon recognizes that the environmental impact of rapid delivery is substantial. In 2019, the company announced The Climate Pledge, committing to net-zero carbon emissions by 2040.

For last-mile delivery, sustainability strategies include:

✅ Electric Vehicles:

- Amazon ordered 100,000 electric delivery vans from Rivian, with thousands already

- These vans reduce emissions and operating

✅ Route Optimization:

- Algorithms that minimize total miles

- Grouping deliveries by density to reduce

✅ Consolidation Initiatives:

- Encouraging customers to group

- Offering incentives for no-rush

In 2021, Amazon reported that these efforts avoided millions of pounds of CO2 emissions.

6.9 Pandemic Response: Resilience Under Pressure

COVID-19 presented an unprecedented test for last-mile operations. Demand surged while health protocols restricted workforce availability. Amazon responded by:

- Hiring over 175,000 temporary workers.

- Expanding Flex

- Installing sanitation stations in Delivery

- Reconfiguring vehicle loading processes for social

- Offering hazard pay and

Despite these challenges, Amazon maintained high service levels. In many metro areas, same- day and one-day delivery continued, reinforcing customer loyalty during a period when competitors were overwhelmed.

6.9 Global Expansion of Last-Mile Capabilities

Although Amazon Logistics started in the U.S., the model has expanded internationally:

- UK: Amazon Logistics operates hundreds of Delivery Stations, supplementing Royal

- Germany: DSPs and Flex programs support dense delivery

- India: Last-mile delivery integrates local carriers and Amazon’s own

Each market is adapted to local infrastructure and regulatory requirements but retains core elements of the Amazon approach: technology-driven routing, branded vehicles, and end-to-end visibility.

6.11 Real-World Example: Holiday Peak Season

In Q4 2021, Amazon prepared for its busiest holiday season ever. Forecasts projected record e- commerce volumes and logistics constraints across the industry.

Amazon’s last-mile strategy included:

- Doubling Delivery Station capacity in key

- Recruiting thousands of new DSP

- Offering Flex incentives up to 2× normal pay

- Launching temporary pop-up Delivery

- Adding thousands of Rivian electric

During Black Friday week, Amazon delivered over 1 billion items globally, most through its own network. This performance demonstrated the maturity and scalability of its last-mile architecture.

6.12 The Economics of Last Mile

Last-mile delivery is the most expensive segment of fulfillment, often accounting for more than 50% of total logistics costs. Amazon mitigates these expenses through:

✅ High-density routing: Reduces cost per package as stops increase.

✅ Automation in Delivery Stations: Lowers labor costs per parcel.

✅ Vertical integration: Captures margin otherwise paid to third-party carriers.

Although expensive, the control and loyalty benefits are strategic. Analysts estimate that Amazon spends billions annually on last-mile delivery but sees outsized returns through increased Prime membership and higher customer lifetime value.

Amazon’s last-mile strategy transformed e-commerce fulfillment. By combining technology, entrepreneurial partnerships, and relentless focus on the customer, the company created an ecosystem that redefined convenience.

As Amazon continues to invest in electric fleets, automation, and global expansion, its last-mile capabilities will remain a central pillar of its supply chain advantage.

7. Sustainability Financials & Covid19 Response

1.1 Overview

Amazon’s supply chain is remarkable not only for its speed and scale but also for the unprecedented challenges it faces. In the last decade, the company has confronted what we might call a triple challenge:

Sustainability: Customers, regulators, and investors increasingly demand lower emissions, better packaging, and more responsible sourcing.

Financial Viability: Shipping millions of parcels overnight is expensive, and Amazon must manage profitability while maintaining low prices.

Resilience: Events like COVID-19 revealed how fragile even the most sophisticated supply chains can be when global systems seize up.

1.2 Sustainability as a Strategic Priority

While many companies treat sustainability as a compliance obligation, Amazon has repositioned it as a strategic pillar of supply chain innovation. In 2019, Amazon announced The Climate Pledge, committing to reach net-zero carbon emissions by 2040, a decade ahead of the Paris Agreement goals.

This pledge transformed the company’s logistics strategy in several areas:

- Renewable energy investments powering Fulfillment

- Electrification of last-mile

- Packaging reduction and

- Carbon accounting and

1.3 Renewable Energy in Fulfillment

Amazon operates more than 400 facilities globally, including Fulfillment Centers, Sortation Centers, Delivery Stations, and data centers. These facilities consume vast quantities of electricity for:

- Conveyor systems and

- Climate control and

- High-performance computing for

To decarbonize this footprint, Amazon committed to power operations with 100% renewable energy by 2025. As of 2023, the company had reached about 85% renewable energy usage.

- Real-World Examples:

Wind and Solar Investments:

Amazon has become the world’s largest corporate buyer of renewable energy. It funds dozens of utility-scale solar farms and wind projects in the U.S., Europe, and Asia.

For example: The Amazon Wind Farm Texas generates over 1 million MWh annually.

- In 2022, Amazon announced 37 new renewable energy projects, totaling 5 GW of capacity.

Onsite Solar: Many Fulfillment Centers now feature rooftop solar installations. In California, FCs routinely generate a significant portion of daytime electricity from onsite systems.

Energy Efficiency: Beyond renewable generation, Amazon invests in:

- LED

- High-efficiency HVAC

- Automated building

These measures lower operational costs and emissions in tandem.

7.4 Electric Vehicles in Last-Mile Delivery

Last-mile delivery is among the most carbon-intensive segments of e-commerce logistics. Each delivery van produces emissions per mile driven, multiplied across hundreds of millions of packages annually.

In 2019, Amazon made headlines by ordering 100,000 custom electric delivery vans from Rivian, representing one of the largest commercial EV deployments in history.

Details and Impact:

- The first Rivian vans began service in

- By 2023, over 10,000 were deployed in S. cities.

- Each van reduces annual CO2 emissions by about 4 metric tons compared to diesel

- Amazon plans to have the full fleet operational by

Additionally, Amazon is testing electric cargo bikes in dense urban areas like New York and London. These micro-mobility solutions allow zero-emission deliveries in congested zones.

7.5 Packaging Innovation and Waste Reduction

One of the more visible aspects of sustainability is packaging. Amazon ships billions of boxes each year, creating mountains of cardboard, plastic, and filler material.

To address this, Amazon launched the Frustration-Free Packaging (FFP) program, aimed at reducing waste and improving recyclability.

Key Initiatives:

Box Reduction Algorithms: Machine learning determines the smallest possible box for each order, reducing void space.

Ship in Own Container (SIOC): Products are sent without over-boxing when the manufacturer’s packaging is sufficient.

Material Innovation: Experimentation with recyclable mailers and paper-based cushioning instead of plastic air pillows.

Incentives for Vendors: Brands enrolled in FFP receive incentives to design packaging that requires no additional shipping materials.

Real-World Example: In 2021, Amazon eliminated over 60,000 tons of plastic packaging, illustrating incremental gains at massive scale.

7.6 Carbon Accounting and Offsets

Amazon developed detailed carbon accounting systems to measure emissions across the supply chain, including:

- Manufacturing emissions (Scope 3).

- Transportation emissions (air, sea, road).

- Facility energy

Where emissions cannot yet be eliminated, Amazon funds credible offset programs, such as reforestation and renewable energy credits. However, the company emphasizes that offsets are a last resort, not a substitute for systemic reduction.

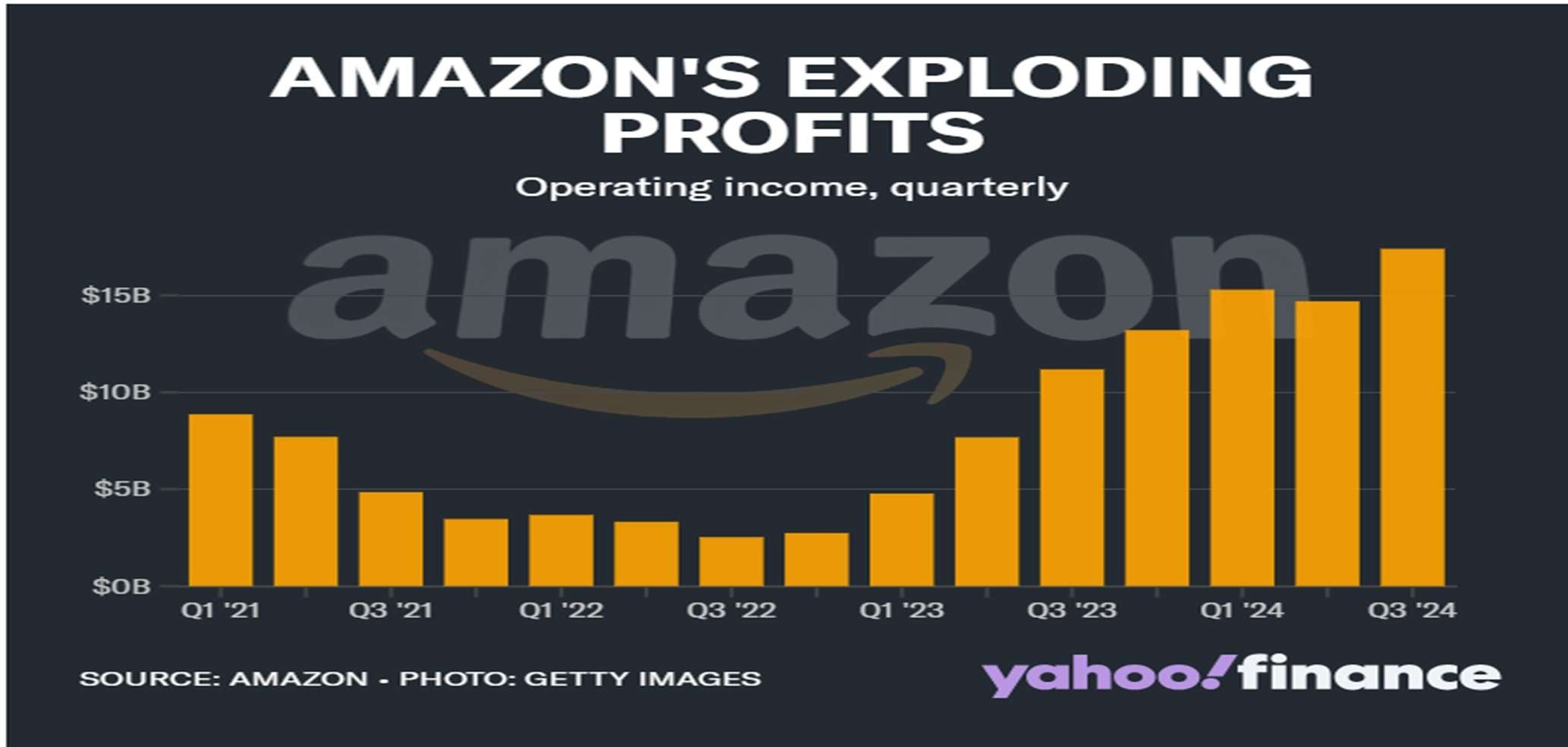

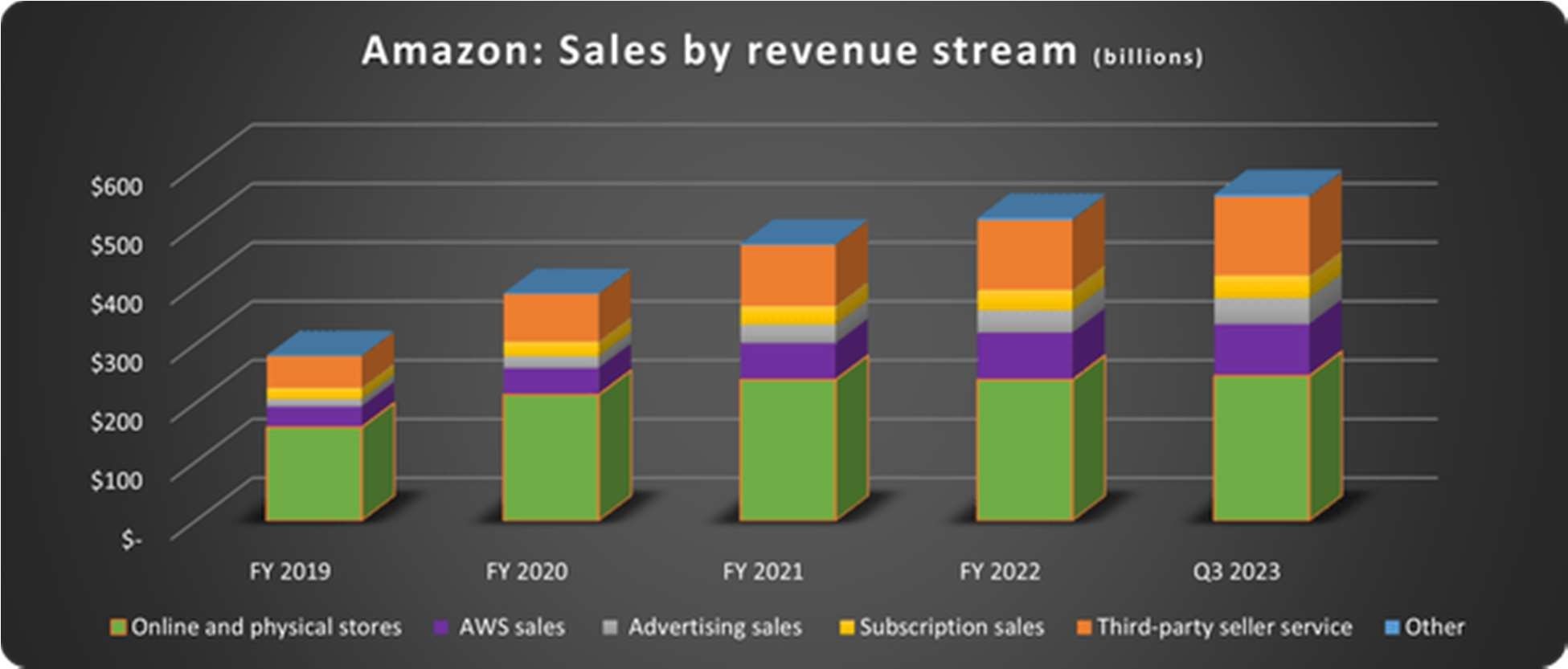

7.7 The Financial Model of Amazon’s SC

Amazon’s supply chain is frequently admired for its scale and speed, but less often do observers appreciate the enormous financial complexity and discipline required to operate it. Unlike traditional retailers whose distribution models were built over decades, Amazon had to invent its own approach, blending e-commerce fulfillment, wholesale logistics, and parcel delivery. This hybrid structure required not only capital expenditure on infrastructure but also continuous operational spending that, at times, suppressed short-term profitability.

At a high level, Amazon’s logistics spending falls into four major categories: fulfillment operations, transportation costs, technology and data infrastructure, and packaging and reverse logistics. Each category has unique cost drivers and strategic implications.

7.7.1 Fulfillment Operations

Fulfillment costs are the largest single expense in Amazon’s supply chain. According to company filings, these costs encompass:

- Wages and benefits for hundreds of thousands of warehouse

- Depreciation and amortization on robotic equipment and conveyance

- Utilities, property taxes, insurance, and facility

The company’s Fulfillment Centers are among the most automated in the world, but contrary to popular belief, labor remains a substantial portion of the expense. While Kiva and other robotics systems significantly boost throughput per square foot, the human workforce is essential for tasks like quality control, exceptions handling, and returns processing.

Example:

In Q4 2020, when e-commerce demand surged during the holidays, Amazon hired over 175,000 temporary workers to keep up. This led to a noticeable uptick in fulfillment costs as a percentage of revenue, demonstrating that even automation has limits in absorbing sudden demand shocks.

Amazon also incurs significant depreciation expense as it continues to build new Fulfillment Centers. Unlike many competitors that lease facilities or rely on third-party operators, Amazon often owns its warehouses outright or builds them to bespoke specifications. This requires higher upfront capital expenditures but creates long-term cost advantages through control and efficiency.

7.7.2 Transportation Costs

Transportation is the second-largest bucket of supply chain expenses and includes:

- Line haul trucking between Fulfillment Centers, Sortation Centers, and Delivery

- Last-mile delivery via Amazon Logistics, Delivery Service Partners (DSPs), and Amazon

- Air cargo transport through Amazon

- Contracted services from UPS, FedEx, USPS, and regional

A unique aspect of Amazon’s transportation strategy is its multi-modal blend of owned and contracted assets. While this provides flexibility, it also increases complexity in managing capacity and cost.

Cost Dynamics:

- Last-mile delivery is the most expensive segment per According to industry analysts, it can account for up to 50% of Amazon’s total shipping expense.

- Air freight is faster but substantially more costly than ground transport. Operating Amazon Air allows for predictable capacity but requires massive capital and operational

- Flex drivers and DSPs provide scalable labor, but incentives, insurance, and routing systems add overhead.

The company has accepted high transportation costs as the necessary price of its customer value proposition: fast, free shipping. Over time, Amazon believes volume growth and density will improve efficiency.

7.7.3 Technology and Data Infrastructure

Many companies view supply chain software as a support function. Amazon sees it as a core competitive asset, investing billions in proprietary systems that power:

- Real-time inventory

- Demand

- Routing and

- Robotics

- Customer delivery

These investments are expensed through ongoing development and maintenance costs, but also through significant capitalized software expenditures.

Example:

In 2019, Amazon spent over $35 billion on technology and content, which includes AWS infrastructure but also supply chain systems. Although not broken out precisely, logistics technology represents a large share of these expenses.

Amazon believes that technology spending creates a virtuous cycle: better forecasting reduces inventory holding costs, better routing lowers delivery expenses, and customer-facing tools improve retention, which in turn justifies further investment.

7.7.4 Packaging and Reverse Logistics

While less discussed, packaging and returns are meaningful cost centers:

Billions of boxes, labels, and protective materials purchased annually.

Investments in sustainable packaging, like recyclable mailers.

Systems to sort, refurbish, resell, or donate returned merchandise.

Amazon’s generous return policies create customer loyalty but add cost pressures, especially in categories with high return rates like fashion and electronics.

During COVID-19, returns processing became even more expensive as facilities implemented safety protocols and extended windows for customer returns.

7.7.5 Prime as a Catalyst and a Cost Center

Prime membership fundamentally reshapes Amazon’s financial model:

- On the revenue side, annual subscription fees generate billions in high-margin

- On the cost side, free one-day and same-day shipping significantly increase fulfillment and transportation expenses.

A critical dynamic is that Prime accelerates purchase frequency and basket size, creating economies of scale in fulfillment and delivery. This density helps amortize fixed costs and improves the unit economics of each shipment.

However, the pressure to maintain consistently fast delivery across millions of SKUs also forces Amazon to:

- Pre-position more inventory in regional

- Invest in additional last-mile

- Tolerate lower margins in certain

Analysts estimate that Prime members spend 2–3 times more than non-Prime customers annually, justifying these investments over the customer lifecycle.

7.7.6 Economies of Scale and the Flywheel Effect

Jeff Bezos often described Amazon’s business model as a flywheel, where lower prices and faster delivery attract more customers, increasing order volume and seller participation. This in turn enables:

- More Fulfillment Centers closer to

- Better carrier contract

- Higher delivery density per

Each additional order improves utilization of fixed assets like robotics, Delivery Stations, and air hubs. In this sense, Amazon’s logistics expenses are not purely variable but have significant economies of scale as volume grows.

This flywheel also acts as a defensive moat: competitors struggle to match the combination of low prices, broad selection, and rapid delivery without similarly massive infrastructure investments.

7.7.7 Trade-offs Between Efficiency and Resilience

Before COVID-19, Amazon had spent years driving down per-unit logistics costs. However, the pandemic demonstrated that efficiency alone was insufficient. Resilience became equally important:

- Safety stock levels increased, raising carrying

- Additional warehouse capacity was brought online, even if not fully

- Air freight usage surged, driving up

The lesson for Amazon and the broader industry is clear: cost optimization must be balanced with the capacity to absorb shocks.

7.7.8 Cash Flow Considerations

One often-overlooked advantage in Amazon’s financial model is its cash conversion cycle. Because Amazon receives payment from customers before paying suppliers, it generates positive working capital, which helps fund ongoing investments in logistics infrastructure.

This dynamic creates a self-reinforcing loop:

- Faster delivery increases

- Sales generate

- Cash funds more Fulfillment Centers and

- Enhanced logistics further improve the customer

This cycle has allowed Amazon to outspend competitors in logistics while maintaining liquidity.

7.7.9 Real-World Illustration: Prime Day Economics

Prime Day offers a clear window into Amazon’s financial strategy. During the 48-hour sale, order volumes surge by millions of units, creating enormous logistical challenges and expenses.

Amazon plans for Prime Day months in advance:

- Rebalancing inventory across

- Securing additional air and trucking

- Scheduling Flex drivers and

Although margins on individual items may be thin or negative due to promotions and free shipping, the event strengthens Prime’s value proposition and drives long-term loyalty. In subsequent quarters, increased purchase frequency and Prime renewals help offset short-term logistics costs.

This illustrates how Amazon uses its supply chain not simply as an operational function but as a

strategic lever to deepen customer engagement.

The financial model underpinning Amazon’s supply chain is as complex and ambitious as its physical network. From massive fulfillment investments and last-mile innovations to technology development and cash flow optimization, every element is carefully orchestrated to support growth, loyalty, and competitive advantage.

While these investments suppress short-term profits, they build long-term resilience and scale that competitors find difficult to replicate. As e-commerce continues to expand, Amazon’s willingness to treat logistics as a strategic asset rather than a cost center will likely remain a defining element of its success.

7.8 Profitability Trade-Offs & Long-Term Investments

One of the most distinctive elements of Amazon’s supply chain philosophy is its willingness to accept short-term profitability trade-offs in pursuit of long-term strategic positioning. In many traditional companies, logistics is managed primarily as a cost center—something to be minimized and kept lean to maximize quarterly earnings. Amazon has consistently challenged this orthodoxy, treating supply chain investments as a source of durable competitive advantage, even when that means suppressing operating margins for years.

This approach originates in Jeff Bezos’s early shareholder letters, where he wrote that “we will make investment decisions in light of long-term market leadership considerations rather than short-term profitability considerations.” This mindset became a cultural principle embedded in every major logistics decision.

7.8.1 Infrastructure Ahead of Demand

Amazon has also demonstrated a remarkable tolerance for building infrastructure ahead of observable demand. This strategy often appears inefficient in the short term, as new Fulfillment Centers and Delivery Stations operate under capacity during their early months.

For example, between 2017 and 2019, Amazon embarked on an ambitious program to double the square footage of its logistics footprint in North America. This included:

- Dozens of new regional Fulfillment Centers designed to enable next-day

- Expansion of sortation centers to pre-stage packages closer to

- The scaling of Amazon Air hubs and dedicated air

While some analysts criticized these moves as overly aggressive capital expenditures that compressed operating margins, Amazon’s leadership argued that only by “overbuilding” capacity could the company reliably meet demand surges and elevate customer expectations.

Indeed, when the COVID-19 pandemic struck in 2020, this excess capacity proved invaluable. Competitors without spare warehouse space struggled to keep pace, while Amazon was able to absorb massive volume spikes by activating underutilized facilities.

7.8.2 Technology Investments Without Immediate ROI

Amazon’s long-term view also extends to technology. The company spends billions annually developing proprietary software and robotics. Systems such as:

- The Fulfillment Center Management System (FCMS): Orchestrates inventory storage, picking, and packing.

- Transportation Management Systems (TMS): Optimizes linehaul and last- mile routing.

- Forecasting Algorithms: Predict demand at the SKU and ZIP-code

These systems require immense upfront investments in engineering talent and computing infrastructure, yet their financial benefits are only realized gradually through reduced error rates, faster fulfillment, and incremental cost savings.

Example:

Amazon’s acquisition of Kiva Systems (now Amazon Robotics) in 2012 for $775 million was a watershed moment in automation. While the initial deployment of robots was costly and time- consuming, over time these systems have:

- Increased pick

- Reduced labor

- Improved warehouse

It took several years for the return on investment to become evident, but today robotics are foundational to Amazon’s logistics efficiency.

This patient approach to technology spending is often at odds with investors focused on short-term earnings but aligns with Amazon’s commitment to scale and resilience.

7.8.3 Balancing Cash Flow and Capital Expenditures

Amazon has also demonstrated sophistication in balancing cash flow discipline with aggressive capital investment. The company’s business model generates positive working capital because customers pay upon ordering while suppliers often receive payment weeks later. This cash float provides liquidity to fund logistics expansion without relying heavily on debt.

In essence, Amazon’s supply chain is financed in part by its own operational cash flows, reducing the need for external capital and allowing for sustained investments even in periods of low reported margins.

Real-World Example: The One-Day Shipping Transformation

In 2019, Amazon announced it would make one-day delivery the new standard for Prime members in the U.S. This initiative required:

- Reconfiguring Fulfillment Center inventory

- Adding more regional

- Increasing air freight

- Expanding last-mile delivery

The financial impact was significant—logistics costs surged as a percentage of net sales. Critics questioned whether the strategy was sustainable. But Amazon remained committed, arguing that compressing delivery times would create a loyalty moat too wide for competitors to cross.

This bet has largely paid off: Prime membership growth remained robust, and customer expectations recalibrated in Amazon’s favor.

7.9 Covid-19 Response – The Demand Shock

The COVID-19 pandemic in 2020 was the most severe operational disruption Amazon had faced in its history. Practically overnight, it created a paradox: soaring demand coupled with severe constraints on labor and infrastructure. Whereas natural disasters or localized crises impact regions or product categories, COVID-19 disrupted the entire global system. Even Amazon’s vast infrastructure, technology, and financial resources were tested to the brink. In March 2020, when lockdowns were imposed across Europe and North America, consumer behavior changed in days rather than years:

- Online orders for household staples, sanitizers, and pantry goods spiked 3–5X normal

- Categories such as exercise equipment, webcams, and small appliances saw triple-digit

- Non-essential discretionary categories plummeted, including luggage and formal

Amazon had always anticipated seasonal spikes—like Prime Day or the holidays—but nothing prepared the company for sustained pandemic-level volumes.

In early April 2020, Amazon had to temporarily stop accepting non-essential inbound shipments from sellers to reserve warehouse space for essentials. This move was unprecedented in scale and indicative of the strain the network was under.

7.10 Transportation and Supply Chain Constraints

The pandemic disrupted global logistics flows:

- Air cargo capacity collapsed as passenger flights were

- Ocean freight delays worsened due to port closures and container

- Trucking capacity tightened as drivers faced

Amazon used multiple strategies to cope:

Air Freight:

Amazon Air became a lifeline. The company’s fleet of 80+ aircraft transported critical inventory when commercial air networks were largely inactive.

Import Diversification:

Where feasible, Amazon shifted imports from West Coast ports to Gulf and East Coast alternatives.

Inventory Rebalancing:

Real-time demand signals allowed stock to be rerouted from low-demand to high-demand regions.

These adaptations highlight Amazon’s ability to control more of its transportation network than most competitors.